Most Australians sceptical about current housing market: six in ten say it is a bad time to buy

Proximity premium still prevalent, with more bullish attitudes towards housing in inner and middle suburban areas of Australia’s major cities

While the Australian economy is doing well by many measures, inflation is also high, with potential for further rate increases by the Reserve Bank of Australia. Partially as a result, between May and October 2020, house prices declined nationally by 6 percent, and in Sydney by 10 percent.

The old adage is that the best time to buy is when prices are falling. How has all of this impacted on Australians’ attitudes towards real estate, and do they see opportunities in the current market?

To understand how this may have influenced perceptions of the housing market in different parts of country, YouGov used a methodology called MRP (methodology below) to estimate the share of Australians who believed now was a good time to buy in 88 regions of Australia.

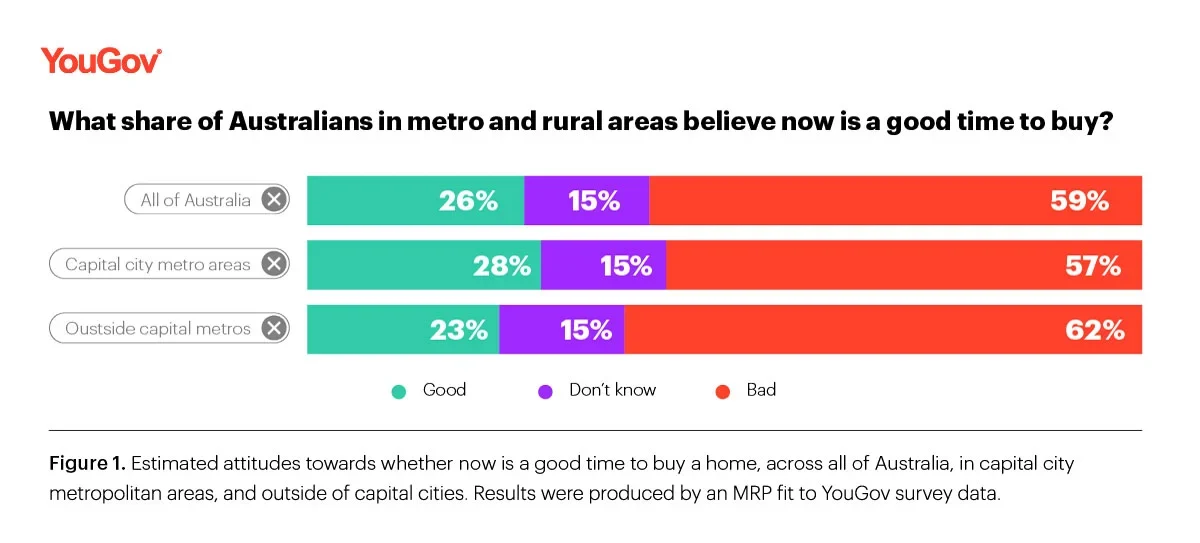

The results of the YouGov MRP on housing indicate that the majority of Australians are sceptical, with close to six in ten saying now is a bad time to purchase property now (59%). This compares to a fewer quarter who think it is a good time to buy (26%).

Comparing the capital city metropolitan areas with parts outside the metros, residents of the former are slightly more optimistic about now being a good time to buy real estate, with almost three in ten saying so (28%), compared with just under a quarter of those outside the state capitals who say the same (23%). Fewer metropolitan residents also think it is a bad time to enter the housing market (57%) compared to those living outside them (62%).

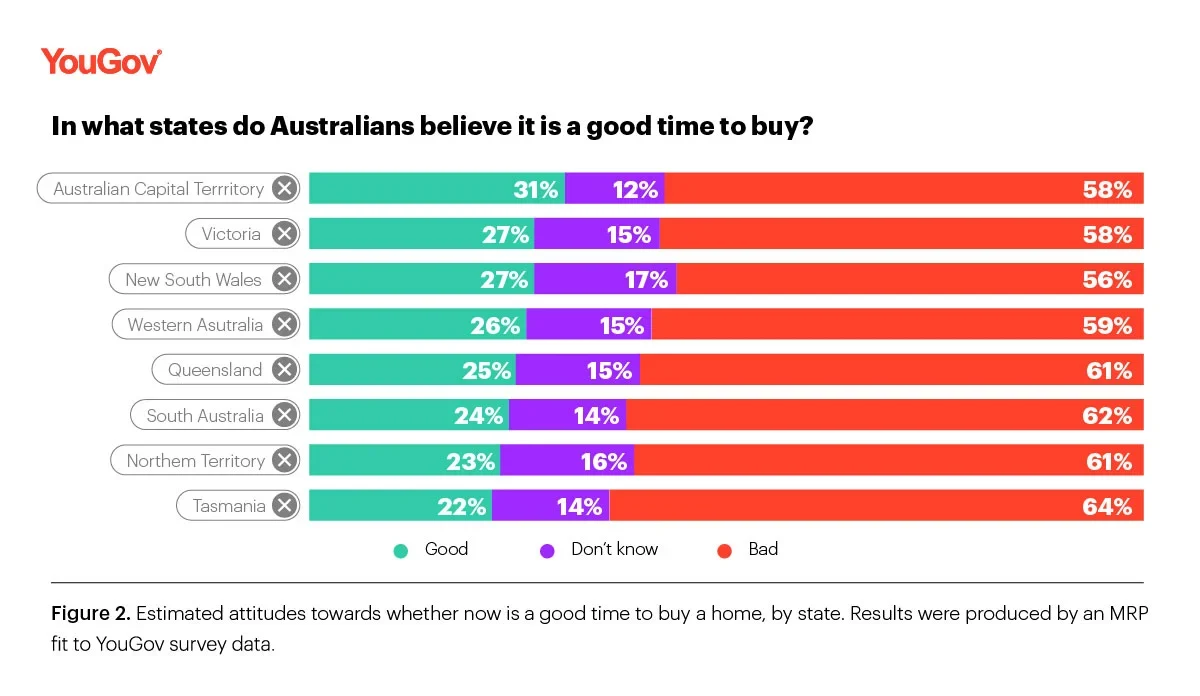

Within capital city metropolitan areas, inner city areas tended to have the highest share of people who think now is a good time to buy, with Sydney’s North Shore and Eastern Suburbs having the highest rates.

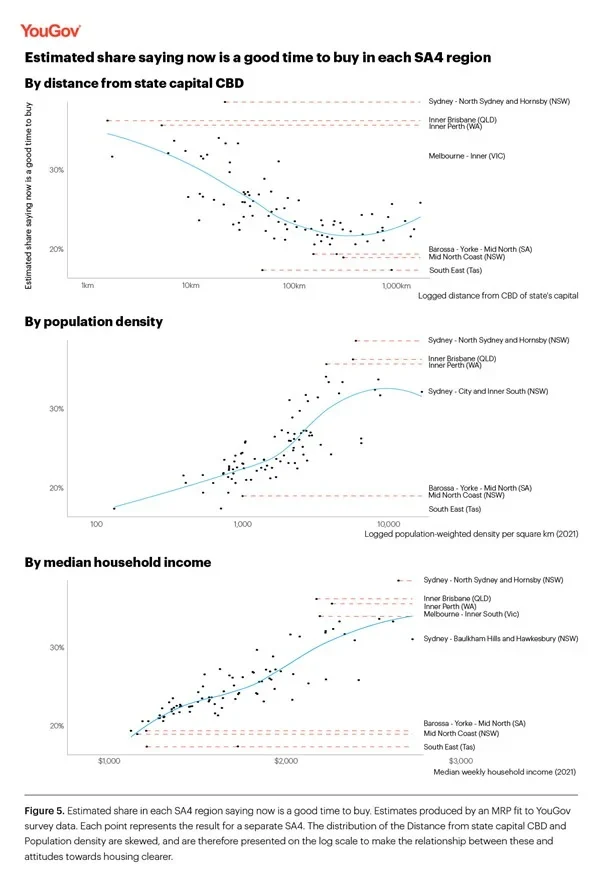

YouGov’s Director of Data Science, Dr Shaun Ratcliff, said that according to the MRP, perceptions of the housing market tended to be more positive in higher income, higher density areas closer to state capitals. These also tend to be correlated with one another: areas close to state capitals tend to be higher income and have higher population densities.

“All areas with the highest estimated share of residents saying now is a good time to buy were closer to their state capital CBD, said Dr Ratcliff.

“Those with the least positive residents tend to be more than 100km from their capital’s CBD and outside capital metropolitan areas.

“This appears to be a reverse trend to the ‘spatial shock’ that hit many markets during the COVID-19 pandemic, with many people moving back to major cities and driving demand for inner and middle suburban real estate.”

For more information, analysis and a full methodology, download the full report here.

Methodology:

To better understand the geography of the Australian Dream, YouGov conducted a large survey of 10,047 Australians from 30th August - 5th October 2022. The survey was carried out online.

In addition to basic demographic variables, the following question was asked: Is now a good time or a bad time to be doing each of the following? Leaving your job and starting another one; Investing in Australian shares; Buying a house; Buying a car; Booking a holiday overseas.

The method used to produce the estimates of attitudes towards home buying for this report was a model assisted approach called multilevel regression with poststratification (MRP). This is a statistical technique used to predict results for small areas by combining survey data with regional-level information (such as population density and average incomes) from the Census.

The data collected for this survey was used not only to obtain a snapshot of current attitudes, but also to model attitudes across different parts of Australia, to understand regional variation in attitudes towards the housing market.