Lidl benefits from a cut-price Christmas

The German supermarket chain Lidl recently reported that it saw an influx of 1.3m customers over the Christmas period. The retailer claimed that it had seen a cost of living boost as consumers limited their Xmas spending.

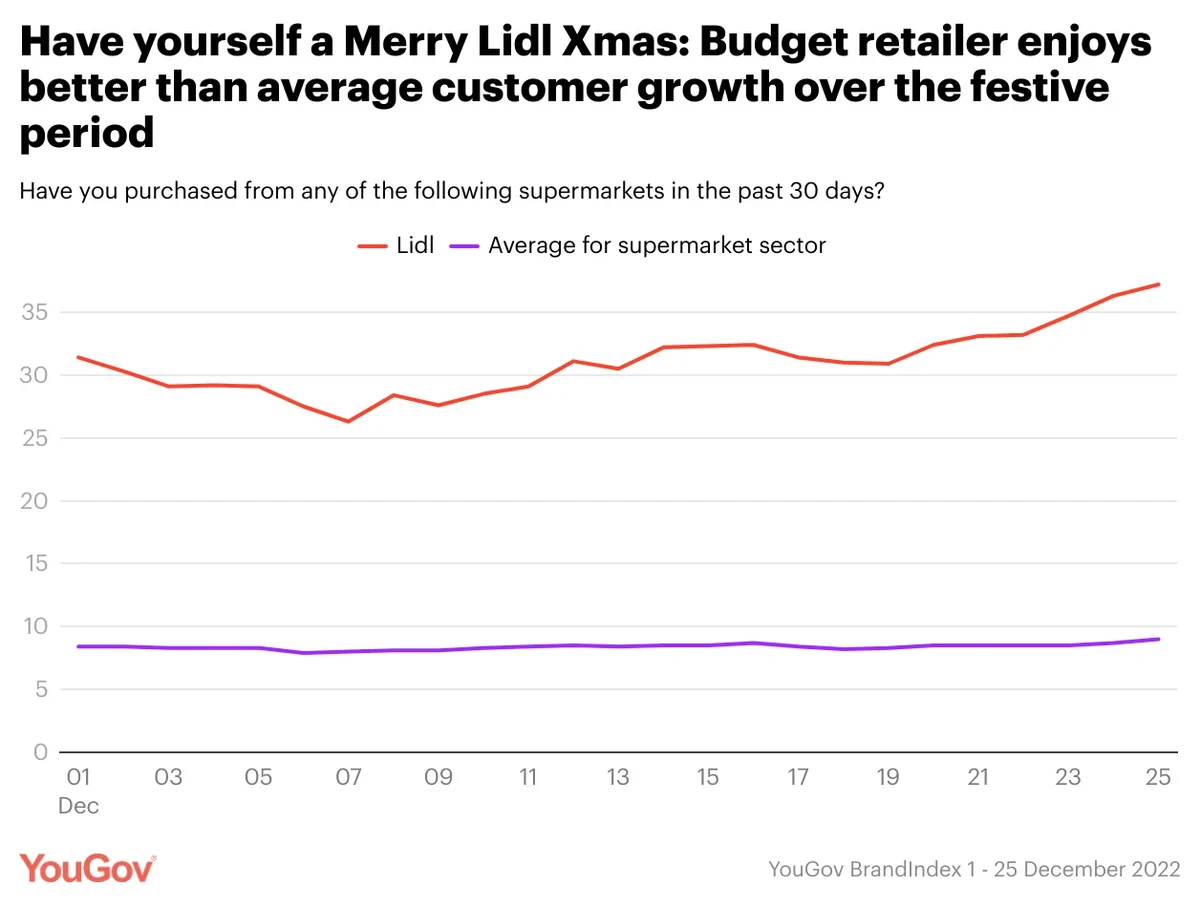

Data from YouGov BrandIndex UK shows that, over this period, the chain outperformed the industry average in a few different respects. Current Customer scores (which ask whether members of the public have recently bought anything from a retailer in the past 30 days) for supermarkets in general rose from 8.4 to 9.0 (+0.6) between 1 – 25 December. But over the same period, Lidl saw these scores jump 5.8 points from 31.4 to 37.2. Compare scores from Christmas day 2021 (23.3) and you have an increase of 13.9 points.

Beyond customer growth, shoppers developed a more positive opinion of Lidl in other areas. Impression, a measure of general good or bad sentiment towards a brand, climbed from 41.6 to 45.1 (+3.5) in the leadup to Christmas, compared to a slight decline from 10.7 to 9.5 for the supermarket sector on average (-1.2) – which may indicate that a discount brand may have more appeal at a time when consumers are tightening their belts.

It's a similar story with Purchase Intent, which asks the public which brands out of a list they would be most likely to buy from. Lidl’s scores improved from 12.8 to 15.2 (+2.4) while the industry average only moved from 3.0 to 3.1.

YouGov polling conducted just before Christmas found that 55% of consumers said they would spend less on the holiday this year, with 32% saying they intended to spend less on food. Against this backdrop, Lidl was well-positioned to benefit compared to its more mid-market and upmarket competitors; whether this success is sustained may depend on whether or not the public get back into old spending habits next Christmas.

This article originally appeared in City A.M.