The UK is £3.5 billion overdrawn

Just this week, Barclays wrote to several customers to inform them that it would be withdrawing their arranged overdrafts within a month’s notice – sparking a panicked response among the recipients. While these facilities been considered a “rip off” and a debt trap among certain consumers, others regard them as a vital financial safety net – and with energy bills rising quickly and inflation recently hitting a 40-year high, they’re a line of credit some would prefer not to lose.

But how many Britons regularly use overdrafts, and to what extent?

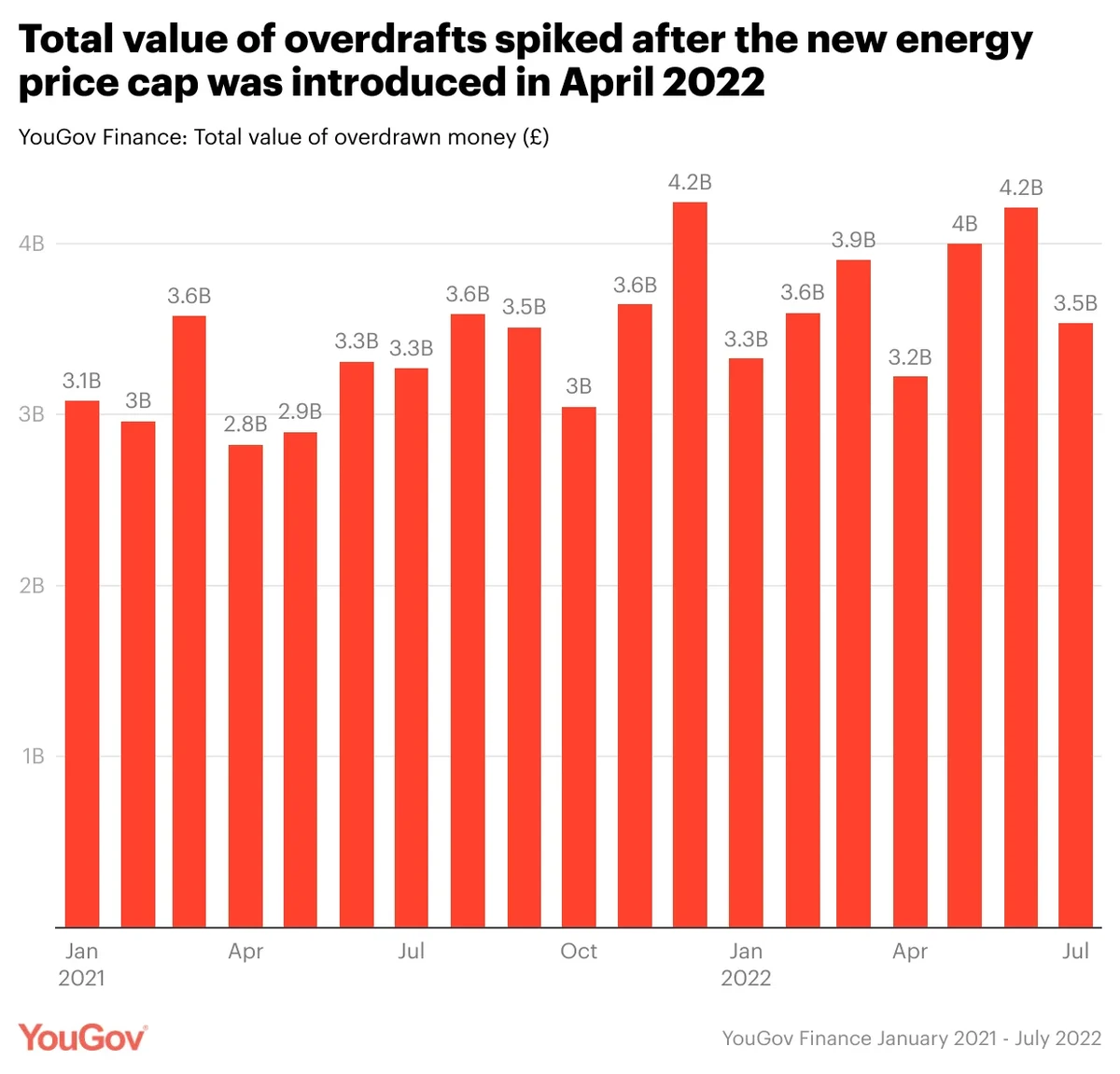

New research from YouGov Finance, which aggregates transaction data from thousands of UK consumers, allows us to delve a little deeper into overdrafts and how they are used. Looking at the total value of overdrawn funds shows that, as of the end of July 2022, the nation was overdrawn to the tune of £3.5 billion. But examining this metric since January 2021 shows some notable spikes.

In December 2021, for example, we can see that the total value of consumer overdrafts hit £4.2 billion. We could attribute this to festive spending; data from last year’s Christmas period showed that nearly one in six Brits expected the financial strain of Christmas to increase their level of debt (14%).

But our data also shows spikes at the end of May (when the value hit £4bn) and June (£4.2bn); the first billable months after the new energy price cap was introduced. It could well be that more people dipped into their overdrafts to cope with dramatically increased energy bills. By the end of July, the nation was less overdrawn by around £500m – after the government delivered the first cost of living payments to lower-income households across the country.

Falling into the safety net: 30% of Britons dipped into their overdraft last month

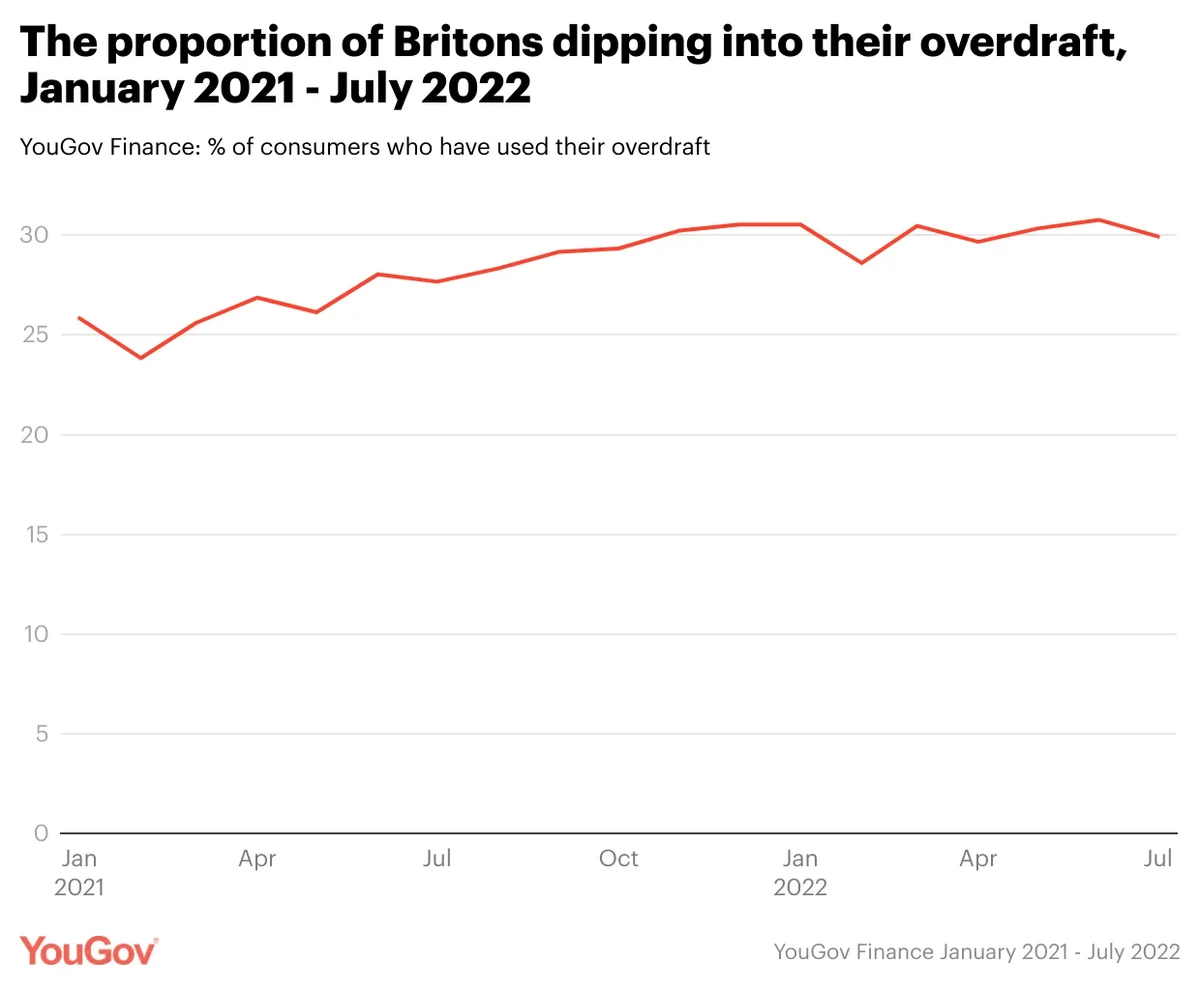

Looking further into the data, we can see that, by the end of July 2022, some three in ten Britons (30%) had used their overdraft during the previous month. This represents a slight increase (28%) compared to this time last year. Overall, the proportion of people who have dipped into their overdraft has ticked upwards since January 2021.

And this group are not necessarily using it as a last resort. In July 2022, the first day Britons used their overdraft was, on average, the eighth day of the month; the same was true in July 2021. This metric remains relatively static, with some (less than dramatic) exceptions. For instance, the data shows that people were most likely to dip into their overdrafts a little earlier in February 2022 and February 2021 (in both cases, on the seventh day of the month).

This isn’t to say people remain overdrawn all month. The most recent transaction data shows that consumers used this facility for 10% of July (and every month of 2022 before that). Broadly, overdrafts are used for a couple of days before consumers restore a positive bank balance – perhaps bridging a gap before payday arrives and after bills are due.

YouGov Finance can also explore overdraft users (among other things) by age, gender, region, employment status, income bracket, and other demographic data.

About YouGov Finance

YouGov Finance aggregates transactions from thousands of consumers in the UK and US, creating a rich, verified, connected dataset to unlock understanding of consumer spending habits and market trends with an unparalleled level of accuracy. Data was weighted by age, gender, and education.