Global: Attitudes towards savings accounts

Savings accounts are sometimes seen as less exciting than options such as stocks and shares – with some arguing that they’re vulnerable to inflation, and others holding that it’s better to diversify your finances across different kinds of investments.

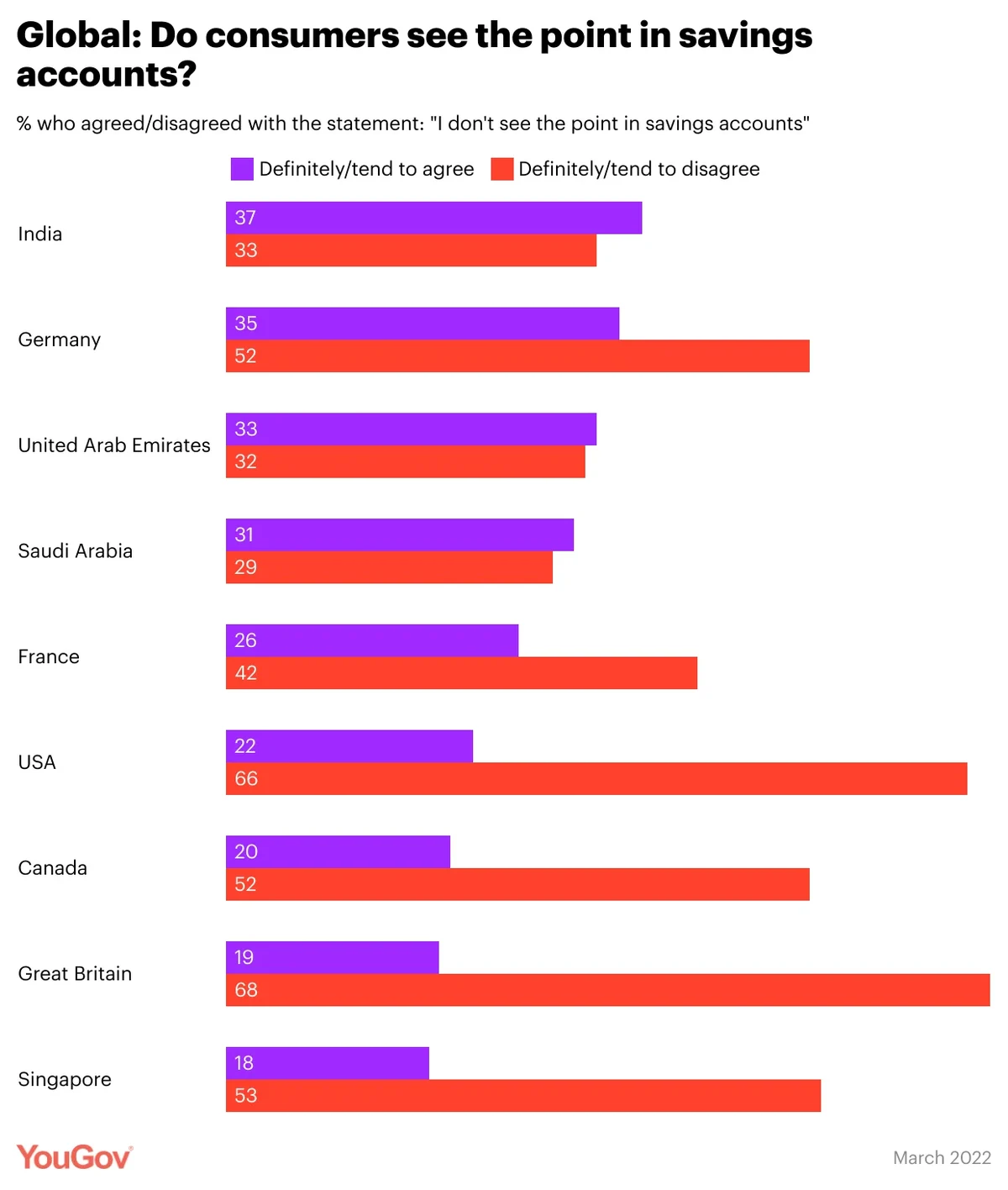

Ask the public, and you’ll see a range of opinions depending on where you are. Global YouGov data shows that, in markets such as India (37% agree; 33% disagree); Saudi Arabia (31% agree; 29% disagree); and the UAE (33% agree; 32% disagree) consumers are more likely to agree that they don’t see the point in savings accounts.

In other markets, it’s a different story. If you’re an American, you’re three times more likely to disagree than agree (22% agree; 66% disagree) – suggesting that traditional savings accounts have a powerful hold on the financial imagination of the public. It’s a similar, albeit less dramatic story in nearby Canada (20% vs. 52%).

Singaporeans are also significantly more likely to see the point in savings accounts (18% agree; 53% disagree), as are the European nations in our study. Alongside the Germans, French consumers (26% vs. 42%) are substantially more likely to see the merits of these accounts, as are Britons (19% vs. 68%). For banks looking to roll out these products, there are clearly markets that are more receptive; for banks looking to roll out alternatives, there may be markets where consumers are hungry for something different. YouGov Profiles can help you figure out which is which.

YouGov Profiles is based on continuously collected data and rolling surveys, rather than from a single limited questionnaire. Profiles data is nationally representative and weighted by age, gender, education, region, and race. Learn more about Profiles.