Global supply chain: In which sectors are consumers noting shortages?

The COVID-19 pandemic and the international shortage of semiconductor chips – used to make games consoles, cars, computers, and more – has made it harder for some consumers to get their preferred products as and when they want them.

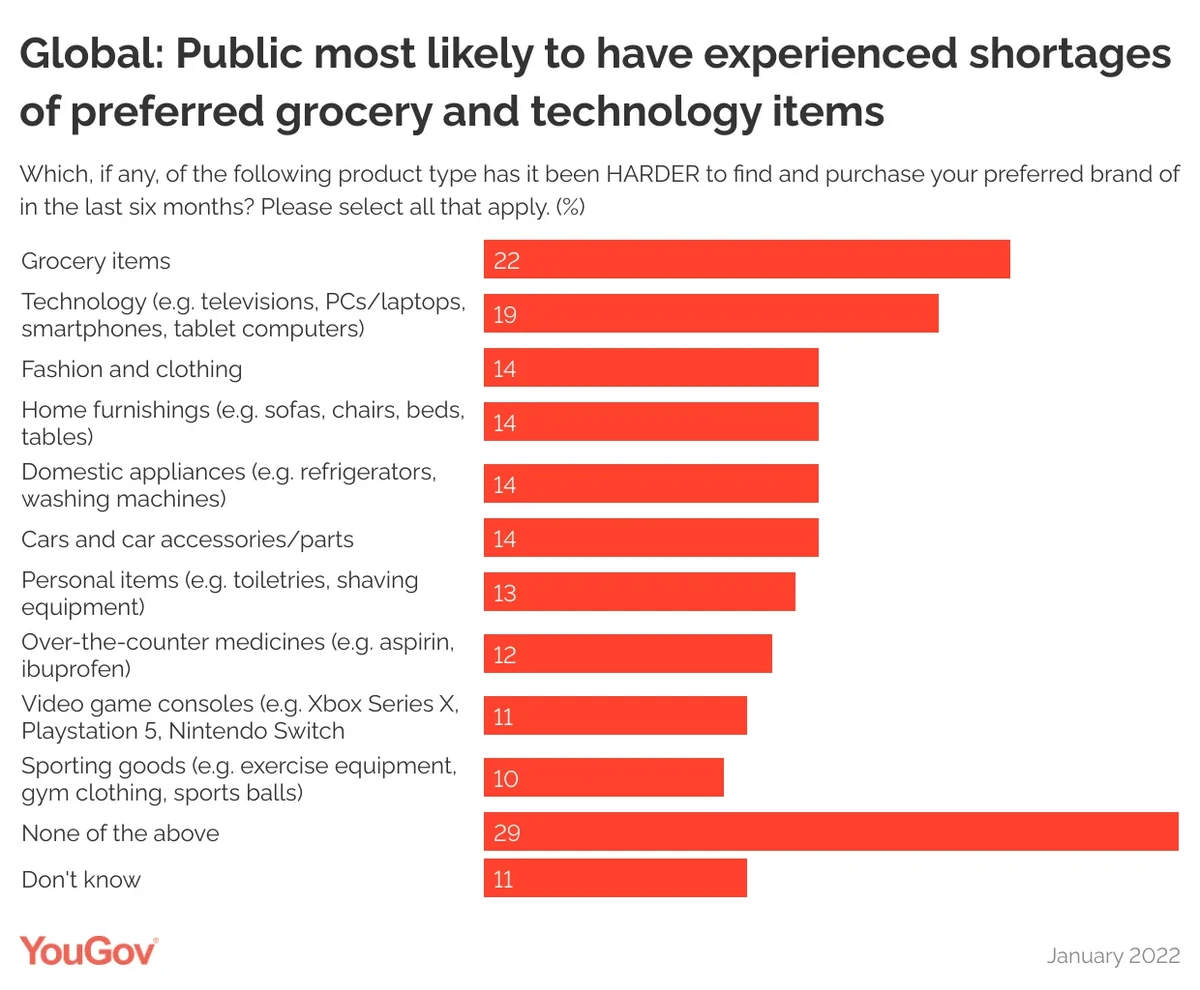

New YouGov data highlights the extent of the problem in some industries. Across 17 markets, consumers are most likely to report being unable to buy their preferred brands of groceries (22%) or technology items (19%), with fashion, home furnishings, domestic appliances, and cars (14% for all) joint-third in terms of difficulty to buy. Just three in ten (29%) say they have experienced no shortages of their favoured brands at all but this is something which varies between product categories and markets.

Groceries and retail

The countries most likely to report grocery shortages is the US - half of American consumers say they’ve found it harder to buy their preferred brands (49%). In Australia, more than two in five say the same (43%), and in Britain approaching two in five (37%) haven’t been able to find what they need from the supermarket or corner shop.

On the other end of the scale, European countries – and particularly those in the Nordics – are less likely to report difficulty. Fewer than one in ten Swedish (9%), Danish (8%), Italian (8%), and French (6%) consumers say they’ve experienced shortages of preferred groceries.

Home furnishing shortages are most likely in India (29%) and Indonesia (27%) – where our samples represent the online, rather than general public – Mexico (19%), and Singapore (16%). As the ancestral homeland of flatpack furniture, it is perhaps to be expected that Sweden (8%) and neighbouring Denmark (8%) are least likely to experience home furnishing shortages.

Fashion and clothing wise, consumers in India (34%) Hong Kong (25%) and Mexico (21%) were most likely to say they found it hard to buy their preferred items.

Technology, appliances, and gaming

Shortages of items such as TVs and laptops were most likely to affect consumers in Indonesia (40%) and India (39%) – though again, both samples are online representative rather than nationally representative. The public in the UAE (34%), Mexico (29%), and China (27%) were also likely to have had trouble securing their preferred products. Britons (7%) were the least likely to have had difficulty buying technology products, with Swedish (11%), German (11%), and Danish (12%) consumers also among the lesser-affected.

Domestic appliances were also in shortest supply in India (28%) and Indonesia (27%) as well as the UAE (27%). Mexican and Polish (17%) consumers also reported that it was harder to find their preferred brands.

Indonesians are far ahead of the rest when it comes to PlayStation, Xbox, and other games console shortages (29%), with the UAE (20%) and India (17%) a distant second and third respectively.

Health and fitness

In terms of health and fitness, the Mexican and Chinese public (22%) are equally likely to have experienced shortages of preferred over-the-counter medicines, with consumers in the UAE (18%) not far behind. The European experience varies, but they are generally less likely to say they’ve found it hard to find medicines – particularly in the Nordics, where 7% of Swedes and 5% of Danes report difficulty accessing these products. Germans (6%) Italians (8%) and French consumers all hover around the same level, with Spanish (14%) Polish (12%) and British (11%) consumers more likely to have experienced shortages.

On the fitness side of things, Indians (22%), Indonesians (21%), and people in the UAE (20%) are most likely to say it’s been difficult to purchase sporting goods and gym equipment.

Cars and car parts

Finally, the automotive industry – which has, in some markets, seen people buying second hand cars in greater numbers – has seen especially high levels of shortage in Indonesia (36%), the UAE (28%), and India (24%). Britain (6%), Germany (6%), Denmark (6%) Hong Kong (7%) and Sweden (7%) are among the least affected.

The data is based on the interviews of adults aged 18 and over in 18 markets. All interviews were conducted online in February 2022. Data from each market uses a nationally representative sample apart from Mexico and India, which use urban representative samples, and Indonesia and Hong Kong, which use online representative samples.