YouGov Finance Framework: Ethical investors

“Ethical” investment – where investors focus on companies that are perceived to meet certain moral criteria – has risen to prominence in recent years, as has the sub-category of “eco-investing”, which focuses more on the environment and sustainability.

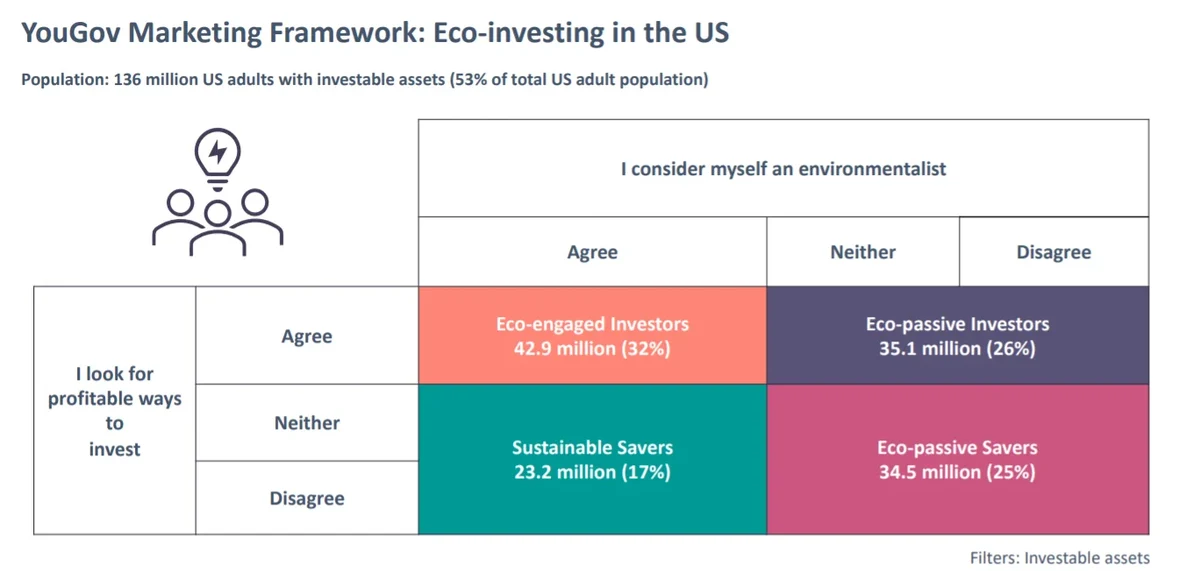

But which Americans are driving this kind of investment? YouGov’s new framework study examines four categories of eco-investor.

Eco-engaged investors

Eco-engaged investors account for 32% of the US population with investable assets. They consider themselves environmentalists and are actively looking to find profitable avenues for investing their assets – in other words, looking to do good and turn a buck at the same time.

In terms of their demographics, eco-engaged investors are disproportionately likely to belong to the younger, 25-34 year old cohort (30% vs. 15% nat rep) and to report a monthly household disposable income of $1,000 to $7500 (42% vs. 26%). This group are significantly more likely to have made a stock trade online in the past year (33% vs. 16%), and to say they like to take risks on the stock market (53% vs. 20%).

Eco-engaged investors are uncommonly informed: 78% say they consider news about finance and the economy before making a major investment, while 39% say they currently work with financial advisors or planners for info and advice on investment products and services, compared to 20% of the general public

Eco-passive investors

Eco-passive investors are less concerned with the environment, and more concerned with investing. They make up about 26% of the population with investable assets. This group are more likely to be over 55 (48% vs. 42%), more likely to be male (65% vs. 53%), and more likely to have stocks (67% vs. 45%) and hold retirement accounts (49% vs. 38%). They have excellent credit (44% vs. 32%), are more likely to have investment accounts (39% vs. 21%), and to have traded between 1-24 stocks online in the past year (29% vs. 18%).

Overall, they are also more likely to believe they “manage their finances well” (82% vs. 74%). This group may be willing to invest in eco-friendly companies, but it may not be a primary motivation.

Sustainable savers

Sustainable savers are environmentalists with investable assets at their disposal – but they’re not necessarily interested in investing them. They’re more likely to be women (52% vs. 42%), over 55 (47% vs. 40%) with a monthly disposable income below $249 (42% vs. 33%). They account for nearly a fifth (17%) of the population with investable assets. They’re also quite risk averse: 63% say investing in stocks and shares seems too risky vs. 48% of the general public.

While they don’t have the net worth of other eco-investment groups, they may be worth targeting for the simple fact that they’re very positive about sustainability: 89% say green energy is the future vs. 66% of the public, so investments in – for example – renewables that have low fees and a low barrier to entry may be appealing.

Eco-passive savers

Eco-passive savers are neither environmentalists nor especially interested in investing. The segment has therefore not been profiled for this framework.