YouGov Framework – Retail Loyalty Program Subscribers in the United States

Loyalty programs play an important role in driving customer engagement and can be an ethical and effective way to collect first-party data in the current privacy climate.

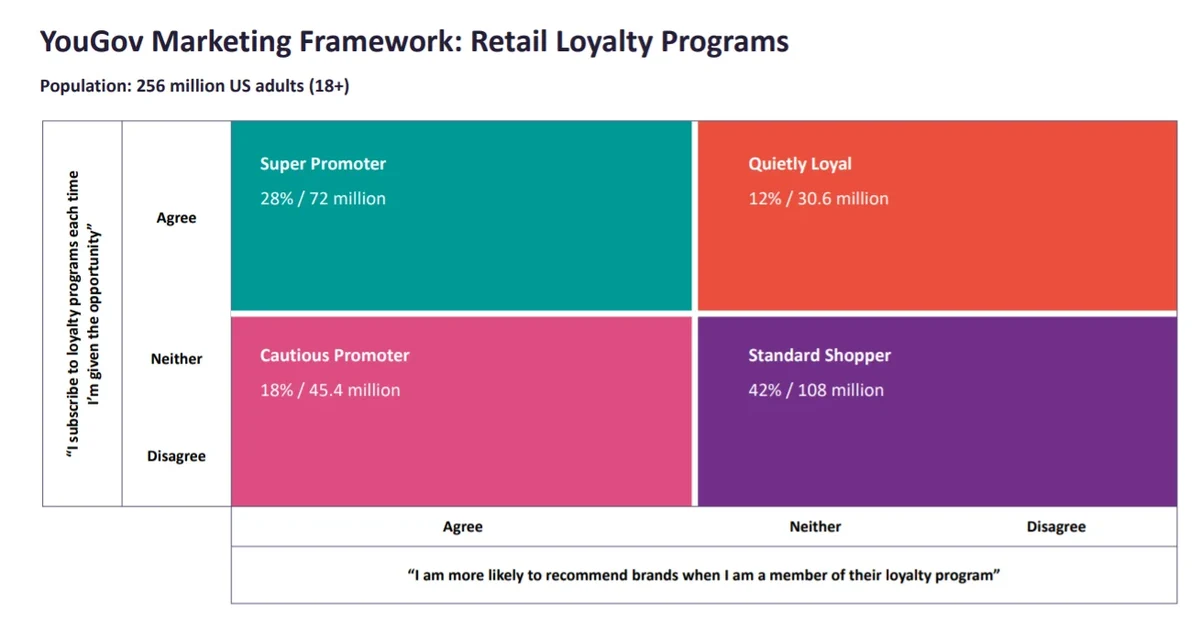

In our latest framework, we look at the intersection of consumer attitudes toward loyalty programs, specifically if US consumers sign up for them and whether they recommend the loyalty programs they’re subscribed to.

Below are the four major audience segments in this framework:

- Super Promoter: This group subscribes to loyalty programs each time they are given the opportunity and are more likely to recommend brands when they are a member of their loyalty program.

- Quietly Loyal: This group features consumers who subscribe to loyalty programs each time they are given the opportunity but aren’t more likely to recommend those brands.

- Cautious Promoter: While this group is a pickier in who they endorse, they don’t subscribe to loyalty programs each time an opportunity comes up. Cautious Promoters are more likely to recommend brands whose programs they are subscribed to.

- Standard Shopper: This category, which represents 42% of the population, features those who don’t readily subscribe to loyalty programs and nor are they more likely to recommend the brands that they subscribe to.

Super Promoter

This group makes up 28% of US adults, representing a considerable market of 72 million Americans. Demographically, this group tends to be made up of Millennials (48%) and parents of children under the age of 18 (33%). Two in five ‘Super Promoters’ also work full time (40%).

These ‘Super Promoters’ are more than twice as likely than the general public to avid shoppers – 49% of them say that they spend a lot on clothes, compared to just 24% of the general public. In addition, 81% say they like to try new brands and 52% are willing to pay more for luxury brands.

Quietly Loyal

This accounts for 12% of US adults, representing 30.6 million consumers. They are likely to subscribe to loyalty programs each time they are given the opportunity but aren’t more likely to recommend those brands.

They are made up predominantly of women (61% vs. 51% of general consumers) and are more likely to be non-parents (70% vs. 58% of Nat Rep)

'Quietly Loyal’ consumers stand out for their propensity to enjoy testing new products before they go on sale (61%) and take advantage of sales, coupons and deals every time they shop (78%).

The main reasons this group is willing to subscribe to loyalty program are for partner rewards (44%) and higher value rewards (32%). This group also comprises of 50% of consumers who are currently subscribed to supermarket loyalty programs.

Cautious Promoter

Roughly one in five US adults (18%) make up the ‘Cautious Promoter’ group, with a market of 45.4 million consumers who are selective of the loyalty programs they sign up for and only recommend those specific ones.

Among all ‘Cautious Promoters’, 40% are millennials and half of this group are currently not employed compared to 42% of all US adults.

Brands that get it right with ‘Cautious Promoters’ can reap the benefits of firm brand loyalty (75% say they are more loyal with brands when they are a member vs. 50% of US adults) and increased spending (68% spend more money as loyalty members vs. 54% of US adults).

Consumers from this group are also more likely to be swayed by brand advertisements if the views expressed by a brand align with their own views (67%).

Rewards earned from loyalty programs is likely to play an important role when this group decides to become a member. The top three factors that would convince them to sign up for loyalty programs are discounts and offers (21%), free products and experiences (18%), and points that translate into some kind of reward (16%).