YouGov Framework: Attitudes to travel and sustainability in Britain

As pandemic-enforced restrictions are lifted and demand for travel picks up, a new YouGov framework explores the attitudes of those planning a holiday and how their destinations might be influenced by their attitudes towards sustainability.

The study, which focuses exclusively on Brits intending to go on holiday in the next year, segments and analyses groups of consumers on the basis of their sustainability quotient and whether they plan to go on an overseas or domestic trip in the next 12 months.

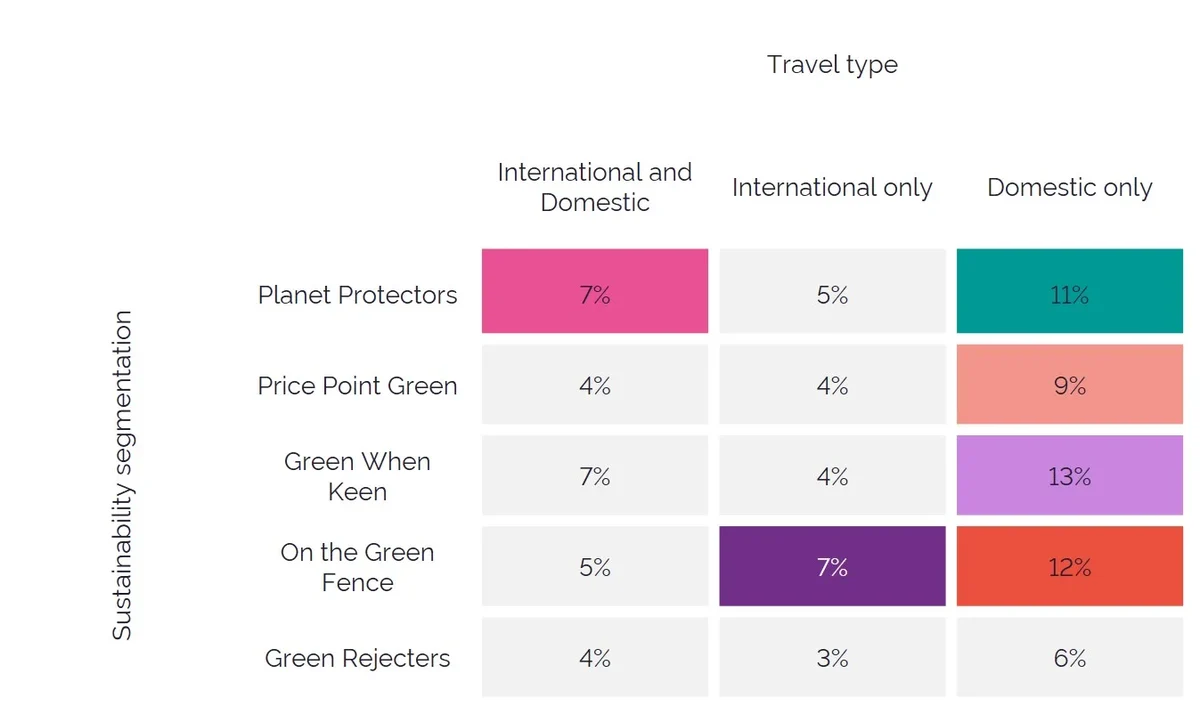

The sustainability quotient is derived from the YouGov proprietary Sustainability Segmentation, which categorises consumers on a five-point scale ranging from Planet Protectors (most sustainability-inclined consumers) to Green Rejecters (least sustainability-inclined consumers).

The nature of the holiday destination type is based on the question: “Which, if any, of the following trips are you planning to take in the next 12 months?”. All data is from the year up to 13th June 2021.

From the grid above, we analyse only the groups of consumers that fall into one of the coloured boxes, which represent a mix of the biggest and most interesting segments.

Domestic Holiday Makers and On The Green Fence

This group has an older skew with half of the consumers (49%) aged over 55, compared to just 38% of the national population. Another demographic highlight is that almost six in ten consumers (59%) in this group are women, compared to 52% of the overall population.

People in this segment are somewhat indifferent about matters relating to the environment. Four in ten (40%) share the opinion that people worry too much about the environment (vs 29% of the broader population). At 40%, they are twice as likely to not have an opinion on environmental policy than the general population (20%).

The group is slightly more budget conscious; six out of ten keep a strict budget when on holiday (58%) against a half of the national population (49%). That perhaps explains why a higher proportion of them (38%) prefer taking holidays in their own country rather than abroad (vs 31% of the general population).

Domestic Holiday Makers and Planet Protectors

This group also has an over-representation of women (58% compared to 52%). However, unlike the first segment, it has a higher proportion of younger people. Three in ten, as opposed to a quarter of all Brits, are aged between 25-39 (31% vs 25%).

This group cares deeply about the environment with seven in ten (68%) considering themselves as environmentalists and nine in ten (88%) indicating a willingness to pay more for products that are good for the environment, far outmatching the average Brit in both aspects. Just over four in ten (44%) prefer domestic destinations for their holidays (vs 31%).

Both Holiday Makers and Planet Protectors

This consumer segment is male heavy. Six in ten consumers (61%) in this group are men compared to 48% of the overall British population.

The group also has a strong representation of financially well-off consumers, with 42% of them having a monthly disposable income of £250 to £999 (vs 29%). Moreover, nine in 10 (92%) show a willingness to pay more for products that are good for the environment compared to 57% of the overall population.

Almost the whole group says it always tries to recycle (99% vs 90% nationally). Two-thirds of them (67%) prefer holidaying overseas compared to under a half of the general population (47%).

International Holiday Makers and On The Green Fence

This segment has a strong representation of older age groups, with six in ten (60%) aged over 55 (vs 38%). Over a half of them are men (56%, vs 48% nationally).

Two-thirds of members (67%) in this category aren’t concerned about their energy supply being ‘green’, instead prioritising price. Only 46% of the national population share the same view on energy.

Seven in ten members say they are passionate about travelling compared to just over a half of all Brits. About three-quarters of them prefer holidaying abroad (vs 47%). As seen in the chart below, social media usage is far lower for some one in this group compared to the average Brit.

Domestic Holiday Makers and Green When Keen

This segment has a younger composition than average with a third of consumers (33%) aged between 25-39 compared to a quarter of the national population (25%). Women are a slightly larger proportion of this segment at 55% (vs 52% nationally).

Eight in ten members would consider installing solar panels on their roofs (vs 59%), but they are also likelier to feel that planet-friendly products are more expensive (83% vs 77%).

A small but potentially significant statistical variance for marketers of holidays is that this group has a slightly higher inclination for having some form of physical activity on holidays (53% vs 49%).

Domestic Holiday Makers and Price Point Green

A third of the consumers in this group are aged 40-54 compared to only a quarter of all British adults belonging to that age bracket. Females constitute 55% of this segment (vs 52%).

These consumers are far likelier than the average Brit to regard climate change as the biggest threat to civilization. They are also more inclined towards lifestyle choices that are commonly viewed as sustainable, such as actively trying to reduce less electricity and making efforts to recycle.

While 46% of this group has lesser than £250 disposable monthly income (vs 42% nationally), they are 10 percentage points likelier than the average Brit to be keen on spending more while travelling (52% vs 42%).

Who's your most critical audience right now?

Request an audience profile