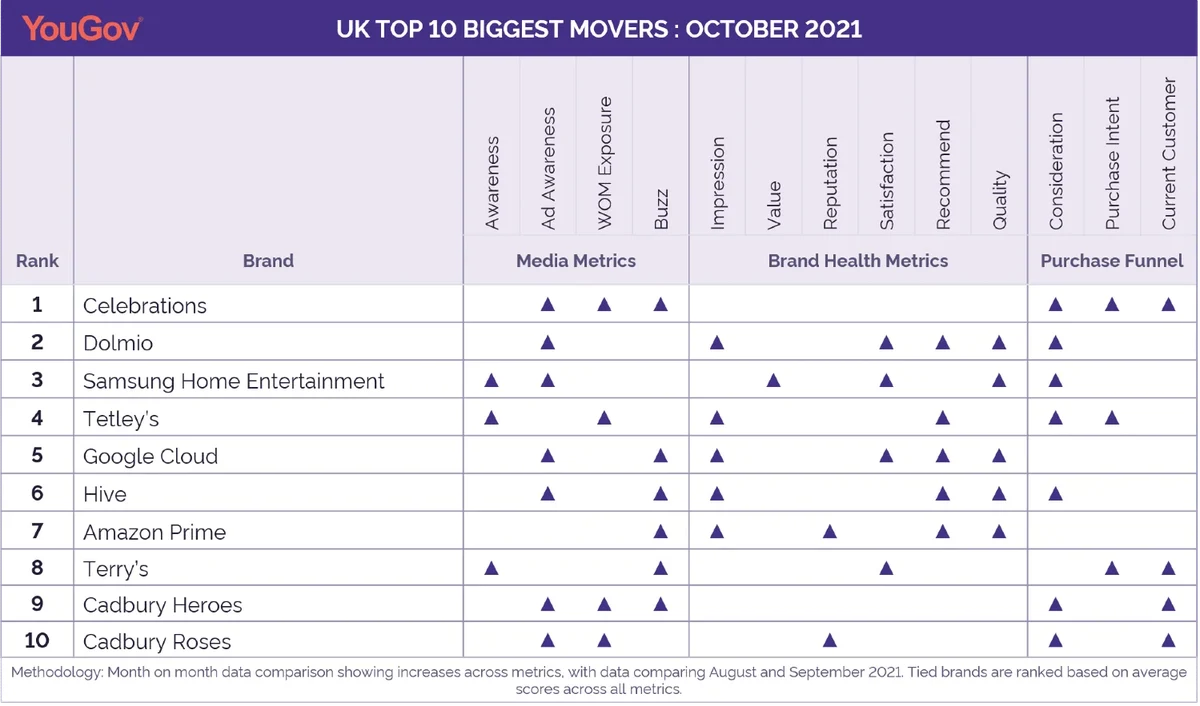

UK – Biggest Brand Movers – October 2021

In the October edition of the Biggest Brand Movers in the UK, a wide range of brands – six in all – have registered statistically significant upticks in six out of the 13 YouGov BrandIndex metrics considered.

Celebrations, the miniature chocolate bar brand, kicks things off in the monthly report of the Biggest Brand Movers, which highlights ten brands that have registered month-over-month upticks in the most YouGov BrandIndex metrics among consumers in the UK.

The Mars-owned brand registered upticks in Media Metrics (Ad Awareness, WOM Exposure, Buzz) and all Purchase Funnel Metrics (Consideration, Purchase Intent and Current Customer). Our data shows that these movements are in line with cyclical upswings that the confectionary brand experiences each year starting in September, in anticipation of the holiday season.

Another Mars-owned brand, Dolmio, features on the list too, with growth in Ad Awareness, Impression, Satisfaction, Recommend, Quality and Consideration. The brand released a range of vegetable pasta sauces recently.

While food and beverage brands are a prominent presence in this month’s Brand Movers, a variety of tech-forward names – Samsung, Google, Hive and Amazon – make the cut too. Samsung’s Home Entertainment segment, which launched the Neo QLED TV recently, enjoyed improvement in Awareness, Ad Awareness, Value, Satisfaction, Quality and Consideration.

Google Cloud made improvements in six YouGov BrandIndex metrics – Ad Awareness, Buzz, Impression, Satisfaction, Recommend and Quality. The cloud computing giant announced cuts to its marketplace fees late last month. Hive, which specialises in smart home products, also gained in six metrics.

Meanwhile, Amazon Prime gained in five metrics, plausibly on the back of several new launches on its OTT platform in September.

Going back to the F&B brands in the list, Tetley’s experienced statistically significant upticks in Awareness, WOM Exposure, Impression, Recommend, Consideration and Purchase Intent.

The list is closed out by three more confectionary brands, namely Terry’s, Cadbury Heroes and Cadbury Roses, each of which registered growth in five metrics. In a sign that consumers in the UK are already getting into the festive spirit, all three brands registered improvement in Current Customer scores.

Methodology

Data for the Biggest Brand Movers in October compared statistically significant score increases across all BrandIndex metrics between August and September 2021. Brands are ranked based on the number of metrics that saw a statistically significant increase from month to month. Metrics considered are:

Media Metrics

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Health Metrics

Awareness – Whether or not a consumer has ever heard of a brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Impression – Whether a consumer has a positive or negative impression of a brand

Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Recommend – Whether a consumer would recommend a brand to a friend or colleague or not

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within in a specified period of time

Discover how the nation feels about your brand. Sign up for a free brand health check