Are you an impulsive spender?

About two in five Brits describe themselves as impulsive buyers – and they tend to be less confident with money in general

There are two types of people: those who are prone to impulsive purchases (41%) and those who are not as easily tempted (47%). Only a small group don’t identify as either (12%).

In fact, whether you’re easily swayed by impulses is a good indicator of how you handle your finances in general.

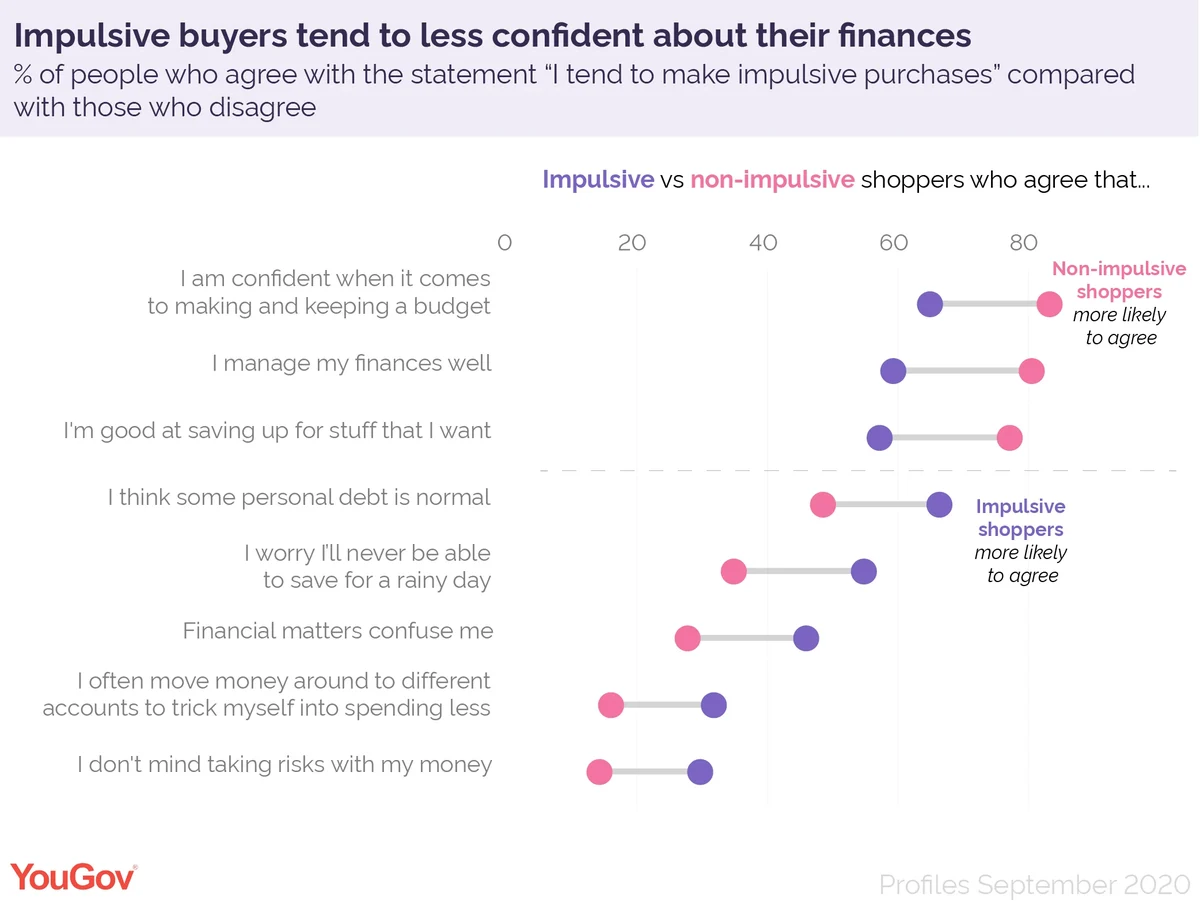

Impulsive buyers are less likely to say they’re good at saving (57% vs 77% of non-impulsive shoppers) and to say they manage their finances well (59% vs 80%). They’re also less confident about budgeting, with 65% saying they can keep a budget compared with 83% of non-impulsive shoppers.

Meanwhile, they find financial matters confusing (46% vs 27%) and take a more laissez faire view on debt – two thirds (66%) say some personal debt is normal compared with half of controlled spenders (49%).

Spontaneous spenders are happier taking risks with their money (30% vs 15%) and are more likely to move money between accounts to trick themselves into spending less (32% vs 16%). At the same time, they worry they’ll never be able to save enough for emergencies (55% vs 35%).

Gender and social grade do little do predict whether someone is an impulsive buyer. But where you’re at in life does.

Over a third of impulsive spenders (36%) are in the pre-family stage, meaning they’re between 18 and 45 and child-free. In contrast, this is only true for a quarter (26%) of non-impulsive consumers.

Meanwhile, three in ten more non-impulsive shoppers (29%) are inactive empty nesters, meaning they’re at least 46-years-old without children living at home and not on the job market. This compares with about a fifth of impulsive shoppers (18%).