Are credit scores important?

Only half of Brits have checked their score in the last six months

From getting an expensive phone contract to a good rate on your mortgage, having a good credit score affects many aspects of life – and Britons agree that it’s important to maintain a good score. But how often do people tend to check their credit score, and how many Brits are actively trying to boost theirs?

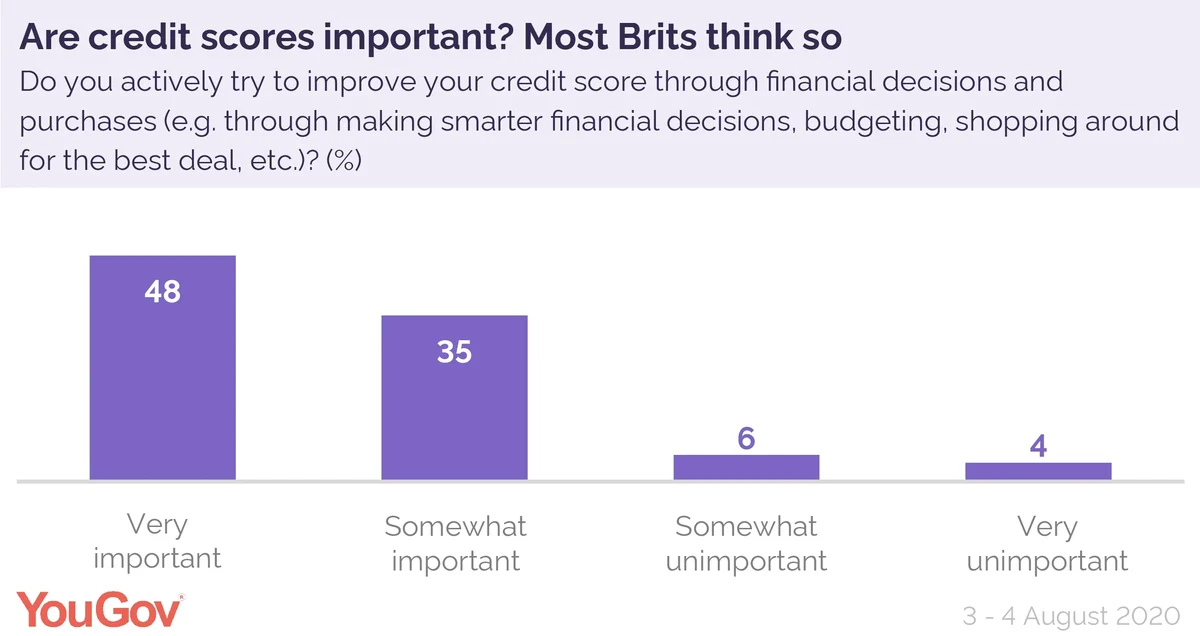

Do Brits think it’s important to maintain a good score?

The majority of Brits think that maintaining a good credit score is important – and 48% say doing so is very important. Only 10% think it’s unimportant.

Breaking the data down between the genders. women are more likely to say maintaining a good score is very important (52%) compared to men (43%). Among the ages, adults aged 18 to 24 are the most likely to say that keeping their credit score in the top categories is very important (57%) – compared to 46% of Brits aged 55 and over who say the same.

How often do Brits check?

With Brits mostly in agreement that it’s best to keep your credit score under control, how often do Brits tend to check?

A plurality (the largest group, but one that is not a majority) of credit score checkers (32%) say they check their score less than once a year however. This is closely followed by a polar opposite 27% who check their scores at least once a month.

Another 23% say they check their credit scores at least once every sixth months, and 12% of credit score checkers do so around once a year.

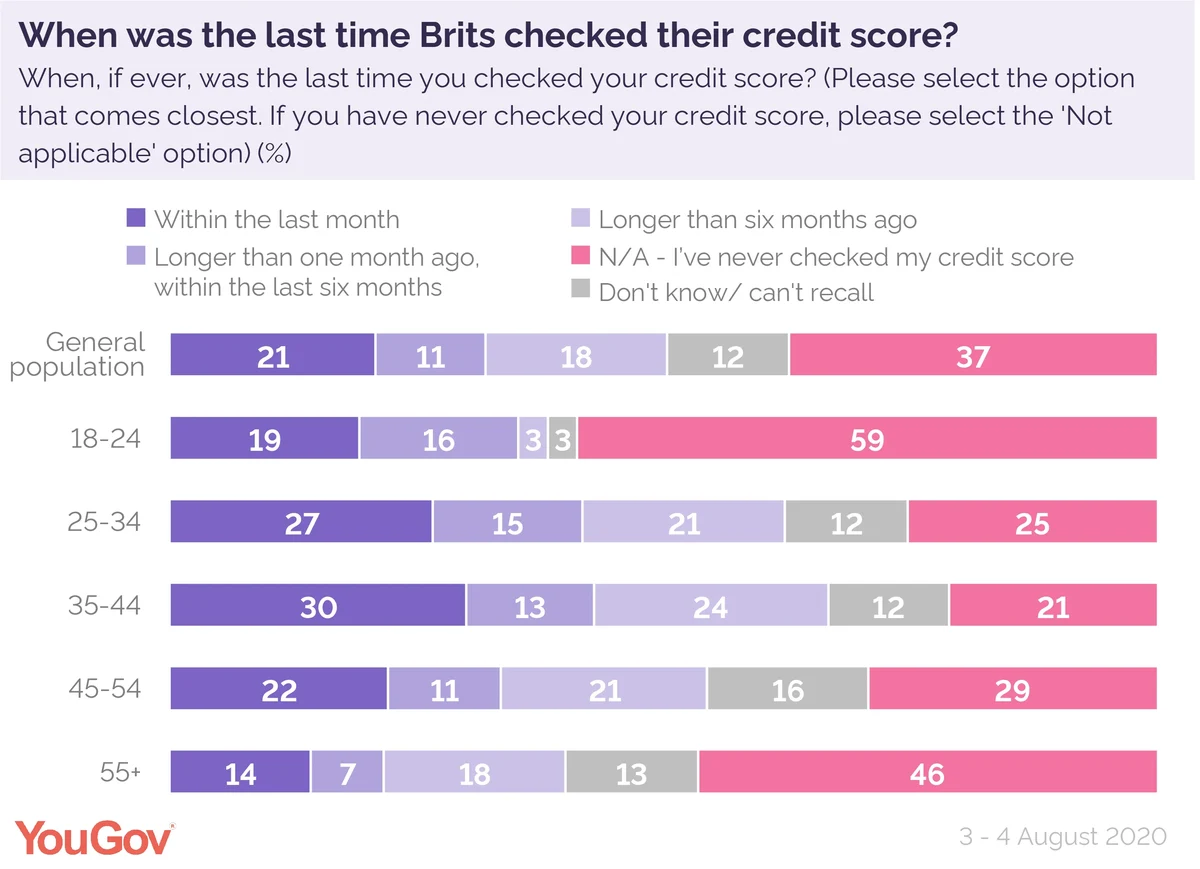

As well as how frequently, YouGov also asked Brits when the last they checked their credit score was, and the results show an interesting pattern among the age groups where the oldest and youngest are least likely to be credit score checkers.

A fifth of the general public (21%) have checked their credit score in the last month, compared to 11% who checked within the last six months. Over a third (37%) say they have never checked their credit score before.

Among the youngest adults, those aged between 18 and 24 the majority (59%) say they have never checked their credit score before. This is comparable to the eldest adults, aged over 55, 46% of whom have never checked their credit scores either.

Middle aged adults are the most likely to have both checked their score at least once, as well as do so most frequently. Approaching two thirds (64%) of adults aged between 35 and 44 say they’ve checked their credit score in the past, with 30% having done so in the last month, only 21% of this age bracket says they never checked their credit score.

Do people actively try to boost their scores?

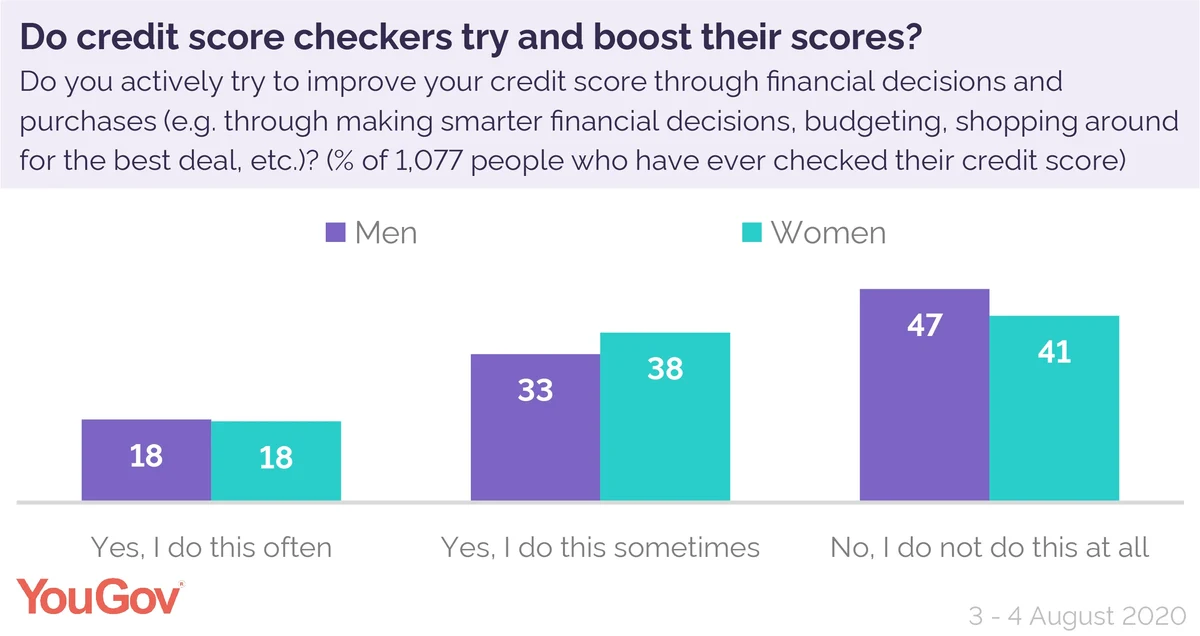

Improving your credit score is one of those jobs we say we’ll get round to one day, but how many Brits actually do? Among Brits who have ever checked their credit score, just over half say they do at least sometimes try to.

Those frequently trying to improve their scores make up 18%, while another 33% try to improve their scores on occasion – for a total of 51%. On the other side are the 47% who do not try to change their score for the better.

See full results here

Learn more about YouGov’s RealTime research here