Urban Indians consider ‘Country of Origin’ important but quality and price drive purchases

Indian origin products most likely to have a positive influence on people’s purchase intent while Bangladeshi goods are least likely to do so

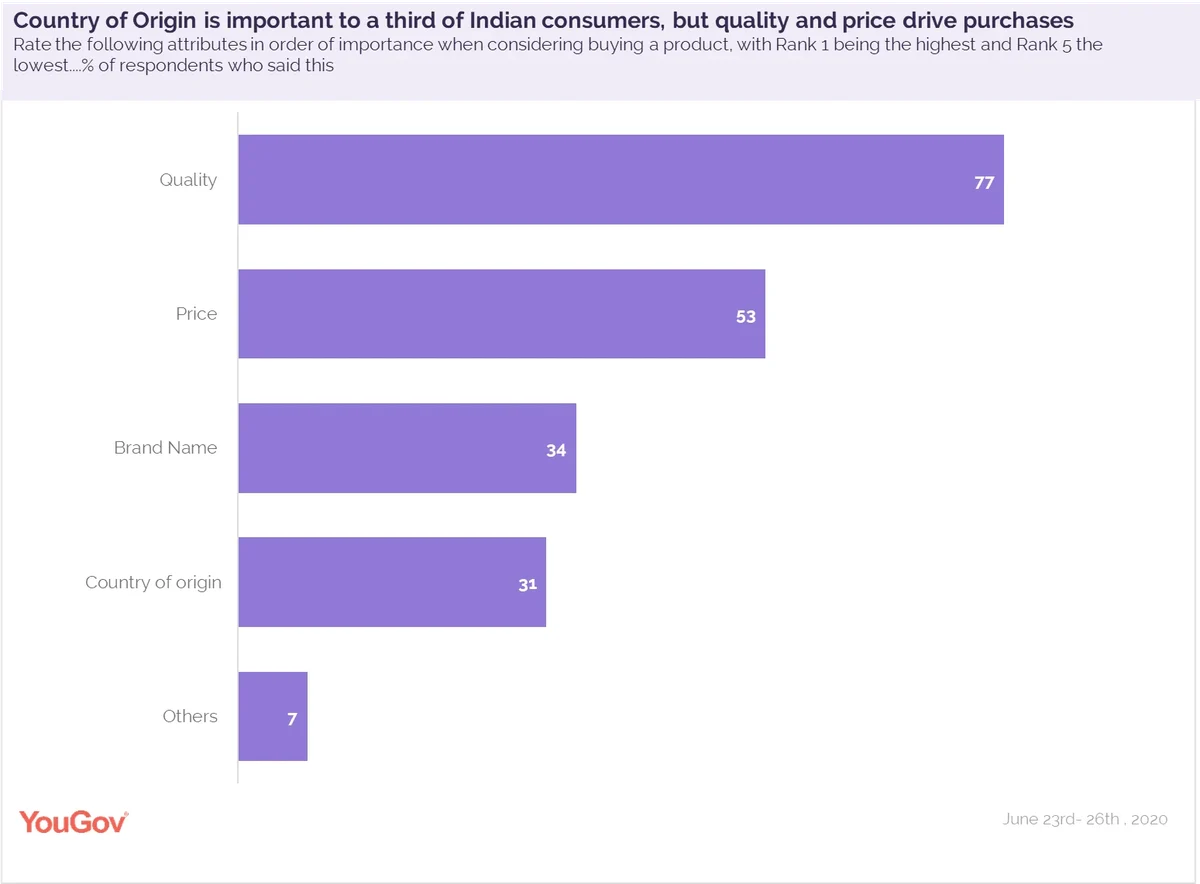

As the government orders e-commerce players to display the country of origin of products sold on their platforms, YouGov’s latest survey reveals three in ten urban Indian respondents (31%) consider the Country of Origin of a product important when buying it, but it ranks lower than other factors. The Quality of the product (77%), its price (53%) and the brand name or the parent brand (34%) are all notably more important when deciding what to buy.

While it is less of a motivating factor when making a purchase, 44% respondents always seek information related to a product’s origin. 40% on the other hand, look for this information for certain products or services and 16% rarely or almost never bother about the origin of the product.

Thinking about the different countries manufacturing products, the majority of respondents (88%) were most likely to say products of Indian origin had the greatest influence on their purchase intention. Apart from homemade goods, products made in America (71%), Japan (64%) and Germany (55%) have also had an impact on their purchase intent, suggesting products from certain countries can aid brands to some extent.

On the other hand, products of Bangladeshi origin were most unlikely to have an influence, followed by those made in Hong Kong (66%), Taiwan (65%) Sweden (64%) and China (58%), all of these are likely to reduce or have no impact on purchase intent.

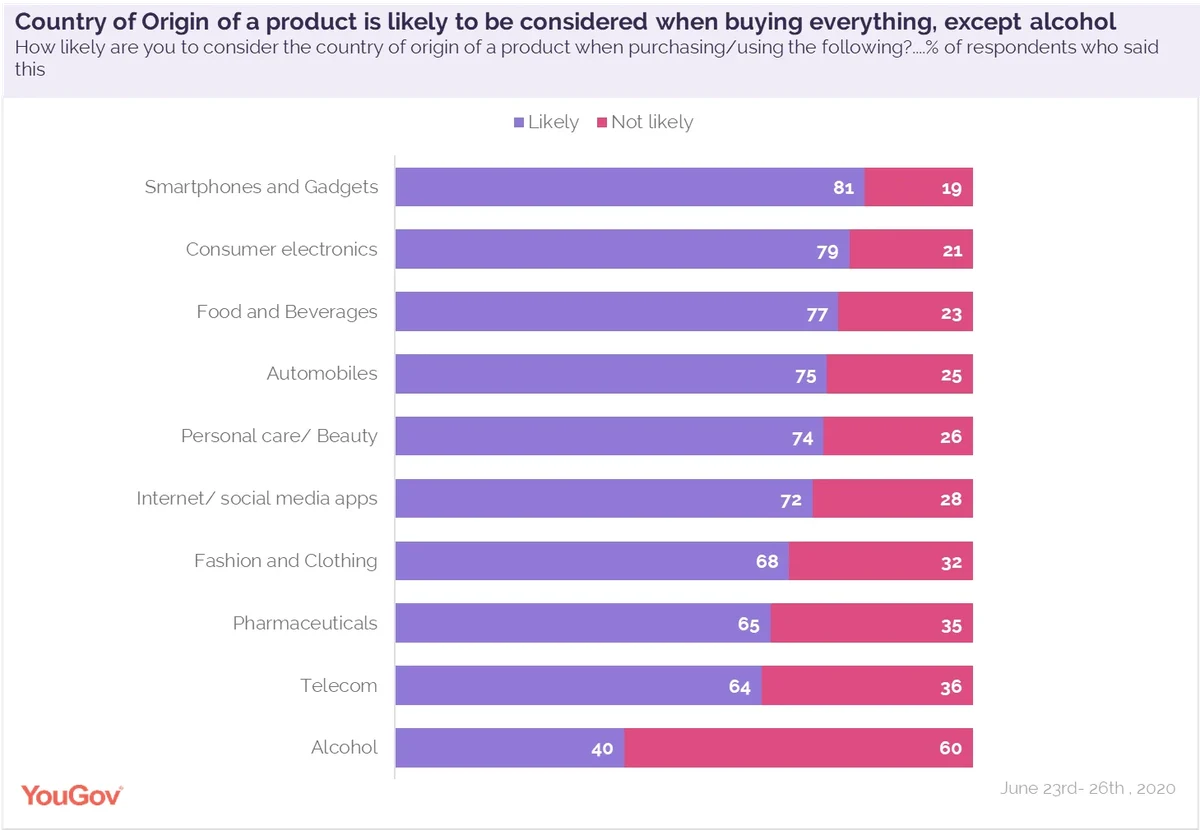

When it comes to some of the leading categories sold worldwide, we saw for almost all the categories people are likely to consider the origin place of a product, except for buying alcohol. Consideration is the highest for ‘Smartphones and gadgets’ category (with 81% saying this), followed by ‘Consumer electronics’ (79%), ‘Food & Beverages’ (77%) and Automobiles (75%).

The recent episodes involving China have angered Indian consumers and many Chinese smartphone brands are facing a backlash on social media. The smartphone market in India is heavily dominated by Chinese brands and currently more than half of the respondents are using some Chinese smartphone, with Xiaomi leading the race, followed by Vivo, RealMe and Oppo. In response to the calls to boycott Chinese goods, 43% of all respondents claimed to have stopped using at least one or more Chinese products or services, with Chinese smartphone users being more likely to say this as compared to non-Chinese phone users (45% vs 39%).

The negative sentiment is likely to affect their future choices as well, with a quarter of Chinese smartphone users indicating their intent to boycott Chinese products in the future.

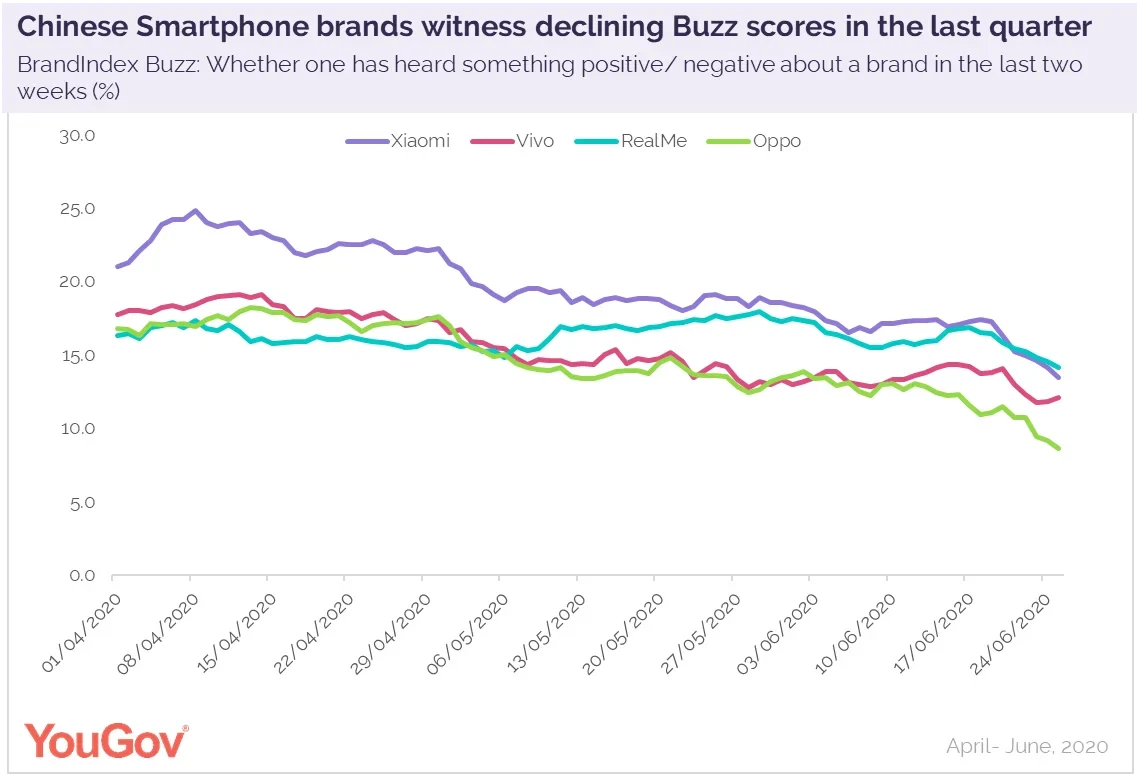

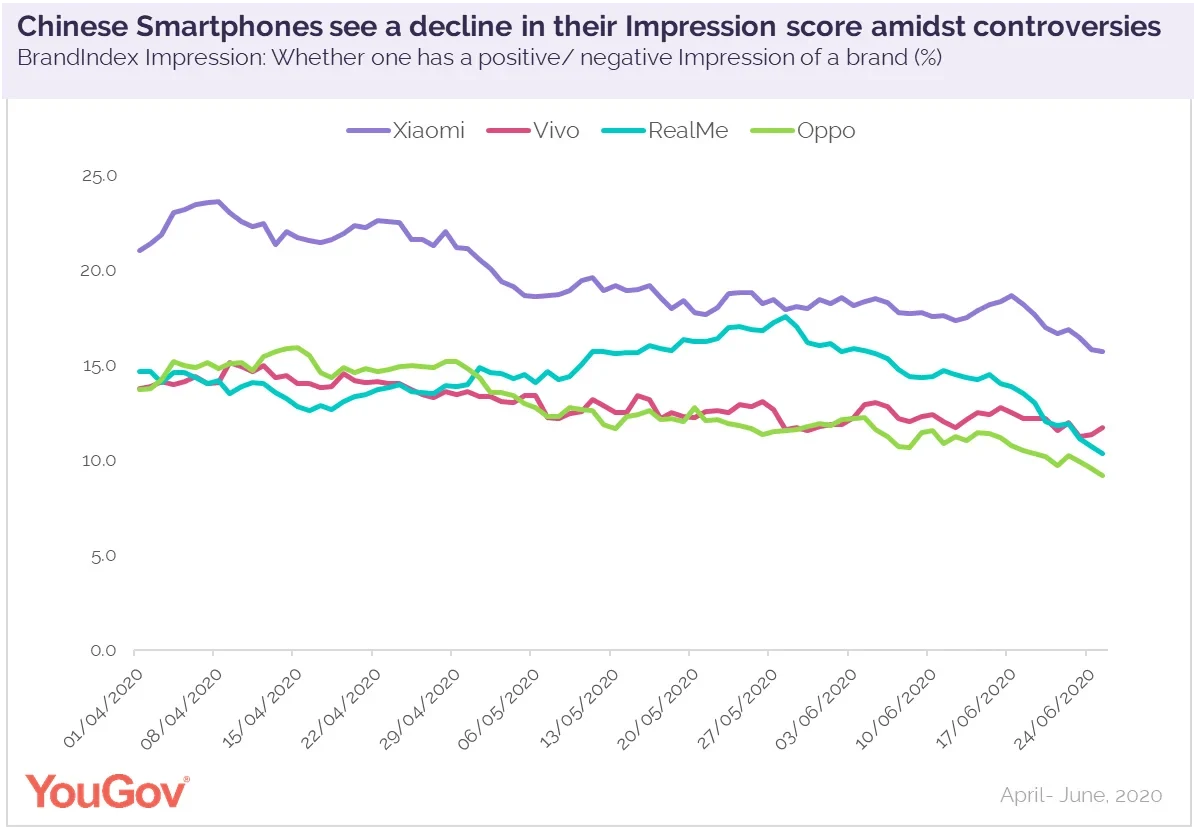

We looked deeper into the smartphones category to see how the recent media and news events have affected consumer brand perception of some of the leading smartphone brands in India. Data from YouGov BrandIndex shows the strong negative emotion around Chinese goods could be a reason for the declining perception scores of some of the leading Chinese smartphone brands. In the last quarter, Xiaomi, Vivo, RealMe and Oppo have witnessed declining Buzz scores (whether one has heard something positive/ negative about the brand).

Around the same time, Impression (whether one has a positive/ negative impression of the brand) for these brands has also plummeted.

However, these movements are more likely to be influenced by the current geopolitical situations rather than solely the country of origin of a product. In the coming weeks, YouGov will continue tracking these brands to see the impact of upcoming events on brand perception and purchase behaviours

Data collected online by YouGov Omnibus among 1024 respondents in the country between 23rd and 26th June 2020 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country