Consumer confidence rises at fastest rate for a year

- Headline consumer confidence sees greatest monthly improvement since January 2017

- Household finances over past 30 days shows biggest month-on-month increase since November 2014

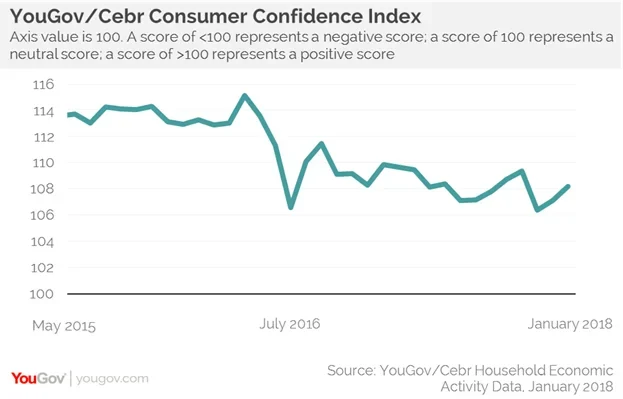

UK consumer confidence has seen its greatest month-on-month increase since January 2017, data from YouGov and the Centre for Economics and Business Research finds.

The latest analysis shows that the YouGov/Cebr Consumer Confidence Index stands at 108.2 this month – up from 107.1 in December. However, while any score over 100 means more consumers are confident than unconfident, it is still notably below where it was 12 months ago (when it stood at 109.8).

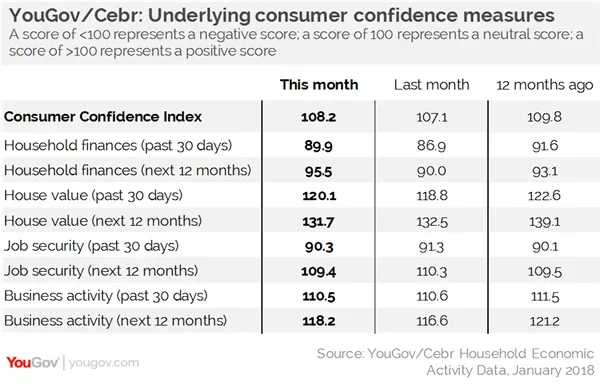

YouGov collects consumer confidence data every day, conducting over 6,000 interviews a month. Respondents are asked about household finances, property prices, job security and business activity, both over the past 30 days and looking ahead to the next 12 months.

The data shows that four measures have improved in January while four have declined. Both the forward and backward job security scores have fallen as have business activity over the past 30 days and house values over the next 12 months.

However, the drop off in these metrics was more than matched by notable increases elsewhere. Both household finance measures have improved – with the score looking back over the previous 30 days improving by its largest monthly amount since November 2014. The tracking data also saw improvements in house value over the previous month, and business activity over the coming year.

Higher than expected GDP figures, a drop in inflation and now an uptick in consumer confidence - the new year is off to a promising start. With household finances and upcoming business activity metrics both on the rise, the 2018 slowdown that many had expected looks less likely to materialise. At Cebr, we expect the UK’s economic performance this year to remain broadly in line with that seen in 2017. It’s not all good news though, as consumers remain doubtful about job security and future house prices.

Image Getty