Lionesses Fan Profile: An audience that is more open to brands’ social messages

The FIFA Women’s World Cup, which kicks off on July 20, has already sold over a million tickets, making it set to become the most attended standalone women’s event in sporting history.

There is ample reason to believe that the tournament could end up being particularly successful with consumers in the UK specifically. Afterall, the women’s team ended the nations’ major football trophy drought by clinching the Women’s Euro Championship last year – and in doing so, thrust the Lionesses further into mainstream consciousness.

YouGov BrandIndex data shows that 13% of consumers in the UK say they would consider going to the FIFA Women’s World Cup if there were no obstructions such as price or geography. This figure is up from 10.3 about a quarter ago, showing that the figure is trending upwards as the tournament draws closer.

UK consumers have also begun having chats about the tournament, with WOM Exposure scores up from 3.6 in the middle of March to 5.1 as of June 12. While these stats are heading in the right direction, it might be more worthwhile revisiting them in greater detail closer to the start of the event as more people switch their attention to it. In this piece, we analyse the fan following of the women’s team and draw a profile of England women’s team fans, and, in particular, how this groups stacks up against fans of the England men’s team.

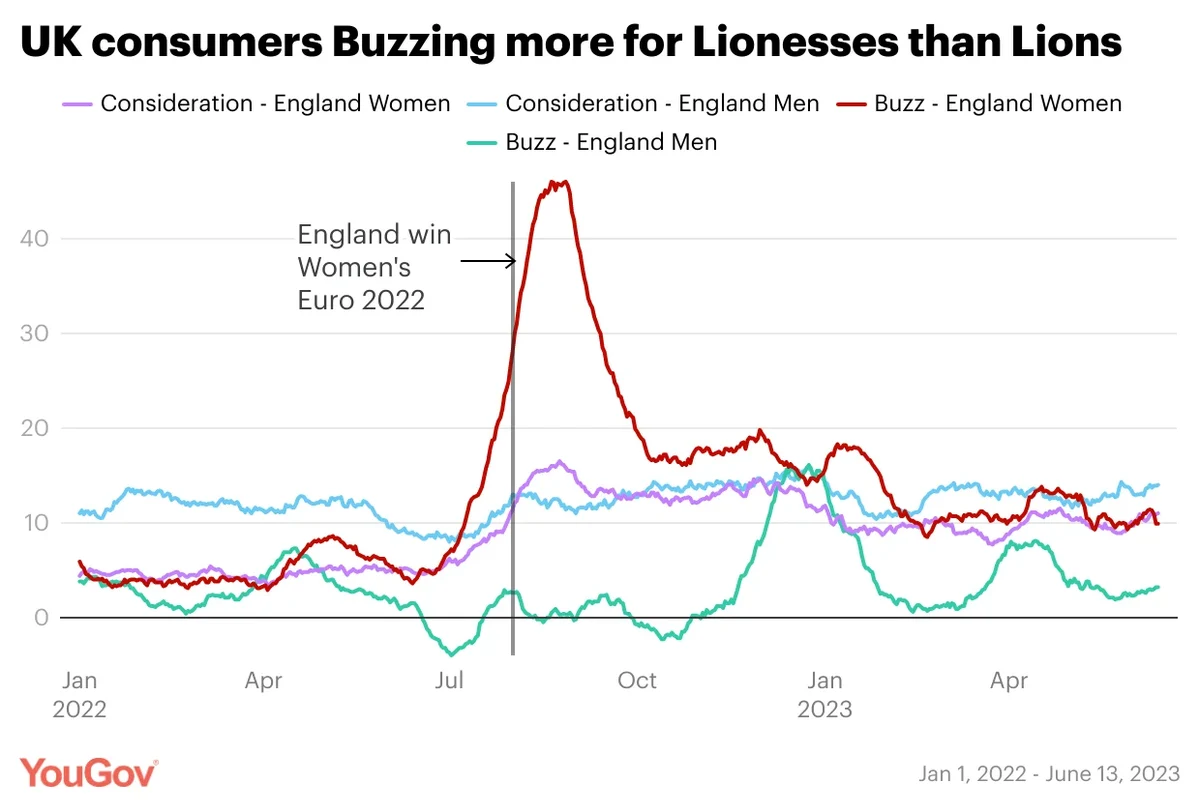

The first thing to note is that the uplift the women’s team received from lifting the Euro 2022 Championship has had more than a transient impact. While the team’s Consideration has dipped from a peak of 16.5 registered soon after the triumph to 11.0 today, this is still much higher than it was at the start of 2022 (4.7). Consideration score here reflects the share of people who indicate an interest in watching a team in person. What’s more encouraging is that scores for the women’s team aren’t too far behind that of the men’s team, which stand just three points ahead at 14.0 currently.

Also, the women’s team has been generating more positive narrative than negative compared to the men’s team, according to Buzz scores. As of June 13, Buzz for the women’s team is 9.9 compared to only 3 for the men’s outfit. Buzz score is the difference between the share of consumers who say they are hearing positive things about a team and those hearing negative things.

So, who are the women’s team followers and do they differ from the msupporters of the men’s team? A fair bit, according to YouGov Profiles analysis of those who say they have watched the women’s team in the past 12 months compared to the men’s.

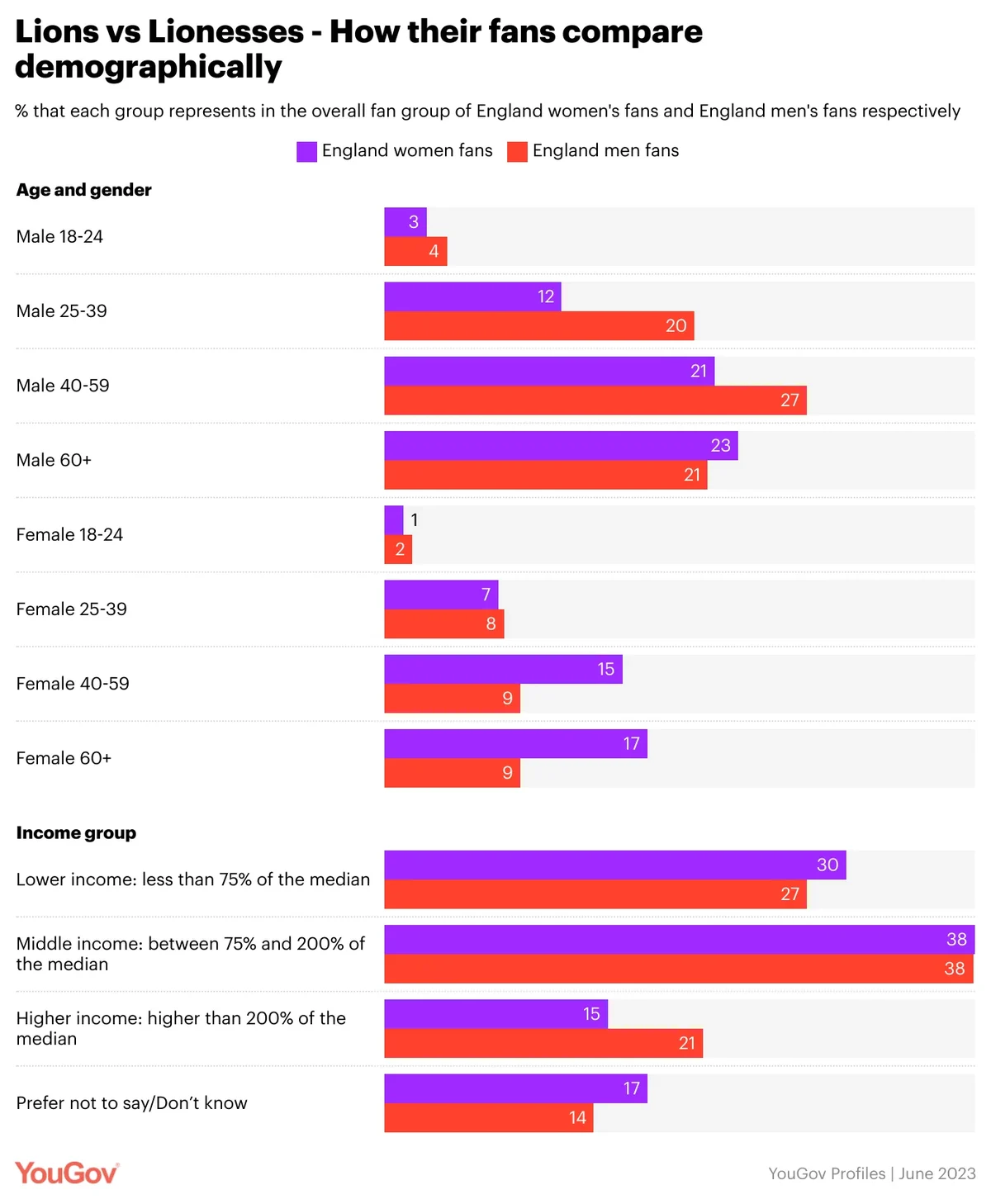

Women aged over 60 are well-represented in the England womens’ team followers group, making up just under a fifth of the audience (17%). This same group makes up just 9% of the men’s team. Conversely, men aged 25-39 make up nearly twice as big a share of the men’s team audience relative to the women’s team (20% vs 12%).

Men’s team followers are also a slightly more affluent cohort, with a fifth of them (21%) falling in the higher income bracket compared to 15% of women’s team followers. But it should be pointed out that the Lionesses’ team audience are four percentage points less likely to have disclosed this information.

Watchers of the Lionesses are more likely to reside in the South West (9% vs 6% of men’s team audience). But there aren’t too many other noticeable variances in the regional distribution of the two fan groups.

YouGov Profiles goes beyond demographic data and can deliver detailed attitudinal insight into audiences as well as information that can help shape marketing and advertising choices. The women’s team watchers are far likelier than men’s team watchers to find “environmental issues” as an acceptable topic for brands to opine on in marketing material (47% vs 37%). They are also more open to brand communication about topics related to immigration (25% vs 16%). By contrast they are less than half as likely to be accepting of brands discussing the monarchy (5% vs 15%) or religious issues (3% vs 17%).

Relative to the men’s group, a greater proportion of the women’s team audience are casual fans with nearly a quarter of them saying they “only watch the finals in sporting events” but the gap isn’t too wide (23% vs 18%). In spite of this, they are slightly more likely to say they will buy products from brands that will sponsor their team (16% vs 13%) and that they love seeing cool sponsors align with their favourite teams (34% vs 31%).