Tesla v BYD: How do the two EV brands stack up in the UK?

The push for electrification has shaken up the auto industry, with new players emerging in the category. Perhaps, no two other brands highlight this shift in the industry quite as profoundly as Tesla and BYD. In this piece, we dive into YouGov data to understand how the two brands are perceived, who’s considering each brand and how they stack up against each other.

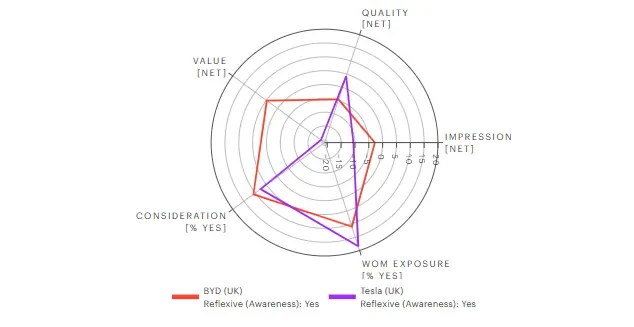

Tesla is way more recognizable to the average consumer in the UK, with 93.5% of the population saying they have heard about the brand at some point. BYD’s awareness trails quite considerably, with only a fifth saying they have heard about the brand (21.2%). This disparity in Awareness rates has knock-on effects, with Tesla enjoying a sizeable lead over the Chinese EV maker in key metrics like WOM Exposure (17.2 vs 2.3) and Consideration (7.1 vs 2.3).

In spite of this Tesla trails behind on Impression (-9.9 vs -0.6) and Value (-18.1 vs 1). These scores are presented as net scores with share of negative responses subtracted from the share of positive responses, which can result in a more popular brand having a bigger negative score. But Quality, which is also presented as a net score, sees Tesla in the lead again (3.9 vs -1.0). This shows that UK consumers are more likely to think of Tesla vehicles as being good quality rather than poor.

It can also be useful to look at what happens to the scores when adjusting for the varying Awareness levels. With the updated data, BYD shows marked improvements in its adjusted metrics, especially in Consideration, where it surpasses Tesla (10.8 vs. 7.6). Similarly, BYD outpaces Tesla in Value (4.8 vs. -19.4) and sees an improved Impression score (-2.8 compared to Tesla’s -10.6). However, Tesla continues to lead in Quality (4.2 vs. -4.6) and maintains its significant advantage in WOM Exposure (18.4 vs. 10.9).

These adjusted scores suggest that, despite Tesla’s dominance in awareness, BYD resonates more positively with its smaller audience in certain key areas, such as value and consideration. This highlights the potential for BYD to carve out a niche in the market as it works to grow its brand recognition in the UK.

Who’s considering each brand?

YouGov Profiles can help brands and marketers draw up a picture of a target audience with intricate detail. In this article, we use it to look at how the audiences of the two brands stack up demographically.

Looking at income groups, BYD’s considerers skew more heavily toward the middle-income bracket, with 43% of its audience in this category compared to 34% for Tesla. Meanwhile, Tesla attracts a greater proportion of higher-income consumers (35% vs. 23% for BYD), reflecting its premium market position. Both brands see a relatively small proportion of their considerers coming from lower-income groups, although BYD edges ahead slightly (20% vs. 15%).

Gender demographics reveal that both brands skew male, with 79% of BYD’s considerers identifying as male, compared to 73% for Tesla. However, Tesla sees a higher proportion of female considerers at 27%, compared to BYD’s 21%.

Age-wise, there is a stark difference in the profiles of the two brands. Tesla attracts a younger audience, with 45% of its considerers in the 18-34 age bracket, compared to 32% for BYD. This trend continues in the 35-54 age group, where Tesla has 42% of its considerers versus 29% for BYD. In contrast, BYD appeals more to older consumers, with 38% of its considerers aged 55 and above, compared to just 13% for Tesla.

These insights highlight the contrasting appeal of the two brands. Tesla's younger, more affluent audience reflects its position as a high-tech and aspirational brand, while BYD’s stronger appeal among middle-income and older demographics suggests its positioning as a more value-oriented and pragmatic choice in the EV market. As electrification continues to reshape the industry, understanding these demographic nuances will be crucial for both brands as they refine their strategies in the competitive UK market.

Image Credit: Kindel Media on Pexels