A look at how Liquid Death is cannibalizing the beverage industry

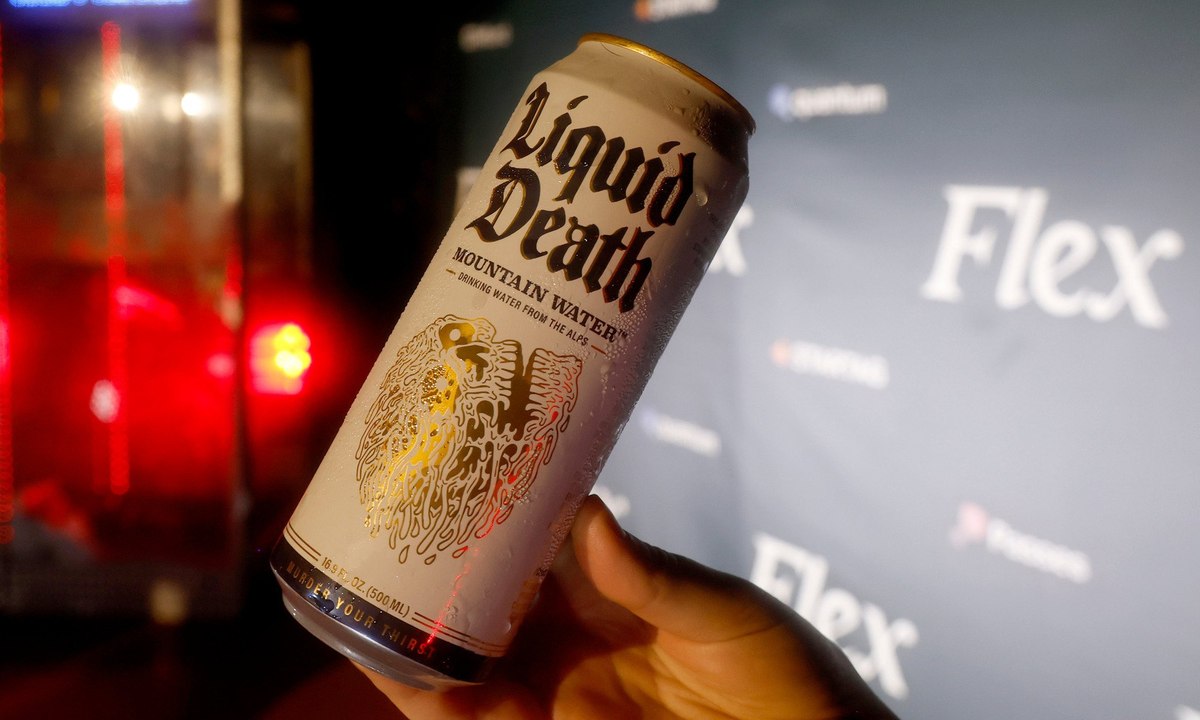

Liquid Death, the canned water company known for its darkly humorous branding (its slogan is “murder your thirst”) and skull-adorned tallboy cans, has been steadily gaining popularity, particularly in the live event space.

Recently, the company launched another outrageous marketing stunt. They’re giving away a fighter jet, in a jab at Pepsi’s unfulfilled promise of a jet giveaway back in 1996.

But is Liquid Death’s marketing just a gimmick? Not according to YouGov’s new analysis, which delves deeper into Liquid’s rising popularity and explores who's considering buying the water and who's talking about the brand. We’ll also get a clearer picture of Liquid Death’s potential customers, what they care about, and how they spend their free time.

The thirst for Liquid Death

Data from YouGov BrandIndex, a daily brand tracker, shows growing interest and conversations around Liquid Death’s brand among US consumers.

Uptick in Purchase Consideration: In 2022, just 2.5% of US adults considered purchasing Liquid Death, but that number jumped to 3.7% in 2023 and again in 2024 to 5.5% so far.

Who’s driving the conversation: Younger demographics are leading the charge in Word of Mouth Exposure, a metric measuring how many people are talking about a brand with their friends and family. Conversations are primarily driven by 18-34 and 35-49-year-olds. Consumers aged 50 and above are less likely to be part of these discussions.

We also looked at Liquid Death’s potential customer base (i.e., those would consider buying from the beverage company) to see what makes them stand out from the typical consumer. Demographic data from YouGov Profiles, an audience intelligence tool, reveals that these individuals are significantly more likely to be Gen Z (born 1997 and later) and Millennials (1981-1996) compared to the general US population. They also tend to have a household income exceeding $50,000. Gender and regional variations are not significant factors.

What also sets Liquid Death’s potential customers apart is their focus on environmental consciousness. These individuals are nearly twice as likely as the overall US population to say they view environmental policy (34% vs. 18%), ecological responsibility (32% vs. 18%), and sustainability in retail practices (21% vs. 11%) as top issues.

This aligns well with the company’s #DeathtoPlastic mantra and eco-friendly brand positioning. By choosing aluminum cans over plastic bottles and donating profits to organizations like 5 Gyres and Thirst Project, Liquid Death appears to be taking a genuine commitment to sustainability.

YouGov data also provides a glimpse into the lifestyles of potential Liquid Death customers. These individuals are more likely to spend their free time at various events and locations, including concerts, malls, theme parks, bars, sporting events, and art galleries.

Liquid Death’s unique marketing relies in its ability to be edgy and authentic all while tapping into consumers who enjoy an active social life and care about the environment. The brand has carved out a niche for itself within the beverage industry, bringing canned water to events and places typically dominated by alcohol.