How are British attitudes to income and budgeting changing?

With tentative signs that the financial squeeze on households is easing, new data reveals that attitudes to income and budgeting in Britain are polarising between consumers who are struggling and consumers who are comfortable.

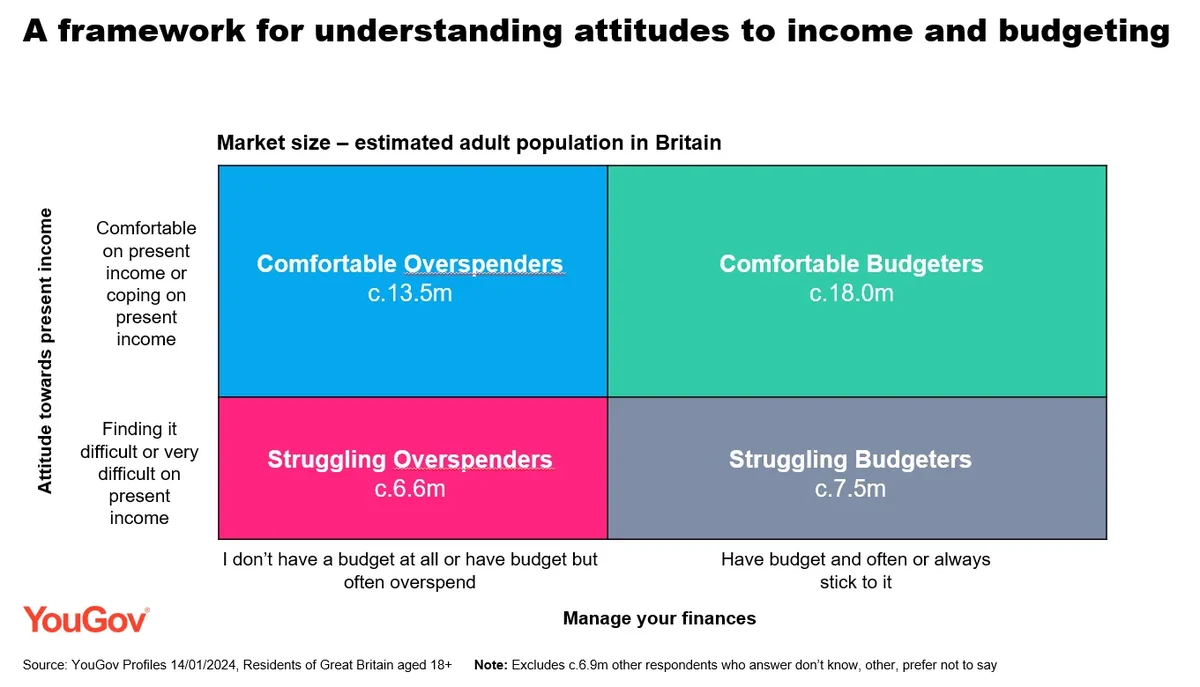

Using data from Profiles, YouGov has developed a framework to explore these themes by segmenting consumers into different categories based on attitudes towards present income and how well they manage their income.

Four types of consumers are emerging.

Comfortable Budgeters

This group are the least affected by the cost-of-living crisis and are coping well. They have a budget and often or always stick to it and retain a high level of financial literacy. Accounting for around 18m people is group the least likely to worry about having enough money.

Comfortable Overspenders

With around 13.5m people this group are also coping well financially, but they tend to overspend. Financial knowledge is the strongest out of any segment category, with a higher-than-average proportion holding stocks and shares. Demographically they are younger than average.

Struggling Budgeters

Skewed towards older people, this group is finding it difficult or very difficult on present income but are budgeting well. Sized at 7.5m, they hold the highest level of distrust towards banks amongst all of the categories.

Struggling Overspenders

These are the ones hit hardest by the cost-of-living crisis, with almost half believing their situation will get worse over the next 12 months. Accounting for around 6.6m people, over a third of this group do not have any savings or investments.

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 26 million+ members. Speak with us today.

Discover more banking and insurance content here