Do domestically produced cars have an automatic competitive edge?

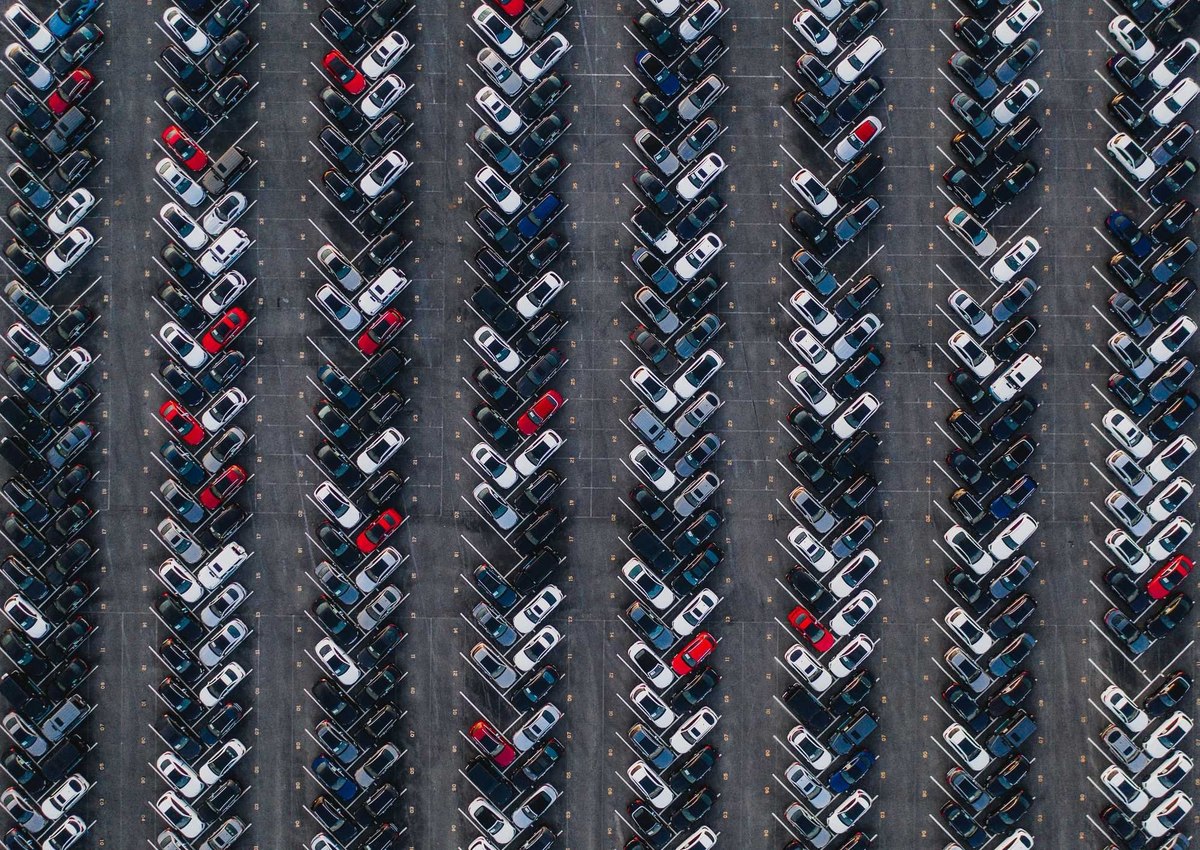

China has recently made major strides in automotive exports, surpassing Japan to become the world’s largest exporter. But how receptive are consumers to cars made overseas?

Respondents across 48 markets were asked if they agree with the statement: I only buy cars made in my country/region. Results show that in some markets there is a high degree of loyalty for the locally built. For example, almost half of urban Indians (47%) prefer cars made within their borders while, 43% of Japanese consumers share a preference for domestically produced vehicles.

But in other markets, there is notably less loyalty In the United States, 31% of consumers support purchasing cars manufactured within the country. Interestingly only around a quarter of consumers in Germany (24%), one of the largest car producers in the world, say they only buy cars made in their country. The sentiment drops to 9% among Britons.

Do consumers think that foreign-made cars are of better quality?

Exploring perceptions of quality, nearly two-fifths of respondents (38%) believe foreign-made cars are of better quality. This opinion is strong in India (46%) and the United States (41%).

In Britain and Italy significant proportion of consumers neither agree nor disagree (46% and 54% respectively) with the notion that foreign-made cars are of better quality.

Not so surprising is the share of Japanese consumers who think foreign-made cars are of better quality (8%). Consumers in Germany exhibit a similarly lower figure of agreement at 18%, indicating a more reserved stance on the perceived quality superiority of foreign-made cars.

Explore our living data – for free

To receive monthly insights about the automotive industry register here.

To read YouGov’s latest intelligence on the auto sector explore here.

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Methodology: YouGov Global Profiles is a globally consistent audience dataset with 1000+ questions across 48 markets. The data is based on continuously collected data from adults aged 16+ years in China and 18+ years in other markets. The sample sizes for YouGov Global Profiles will fluctuate over time, however the minimum sample size is always c.1000. Data from each market uses a nationally representative sample apart from India and UAE, which use urban representative samples, and China, Egypt, Hong Kong, Indonesia, Malaysia, Morocco, Philippines, South Africa, Taiwan, Thailand and Vietnam, which use online representative samples. Learn more about Global Profiles.

Image: Getty Images