In spite of industry turbulence, crypto investment appeal is up among Americans

One in eight Americans, as of November 2023, say cryptocurrencies are becoming more appealing to them as an investment option – up four percentage points compared to the same month last year (12% vs 8%).

This has happened in spite of a series of controversies hitting the cryptocurrency world. Most notably in recent weeks, Sam Bankman-Fried of defunct cryptocurrency exchange FTX has been found guilty on charges of fraud while Binance ex-CEO Changpeng Zhao is awaiting sentencing for violating anti-money laundering requirements.

This could be an outcome of and/or a factor behind the surge in crypto prices over the past 12 months – publicly available price data for Bitcoin, which is the most popular and the biggest cryptocurrency by total market cap, shows that prices over the past 12 months have surged by 133% (in USD).

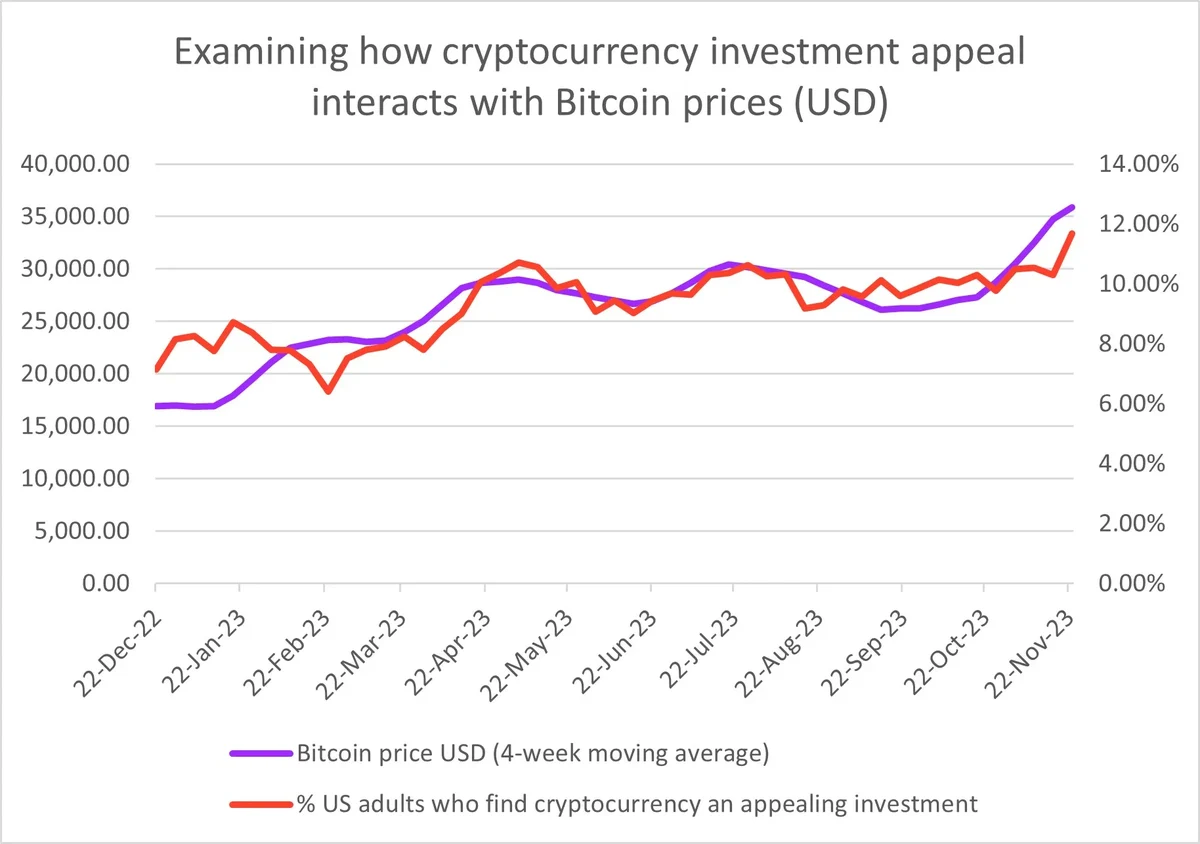

The dual axis chart below examines the relationship between the appeal of cryptocurrency as an instrument of investment and its value – plotting a four-week moving average of Bitcoin prices against a four-week moving average of the percentage of American adults who say cryptocurrencies have become a more appealing investment option.

The two trendlines hug each other quite closely, with the rise in Bitcoin prices often taking the lead and appeal rates following closely behind.

Expectedly – given the positioning of cryptocurrency as a new-age investment instrument – there is significant disparity in the appetite for it among Americans of different age groups.

Looking at monthly averages, the appeal of cryptocurrency investment has risen most sharply among the younger sections of audience. It has spiked from just 18% in November 2022 to 27% as of November 2023 among those aged 18-29. Among those aged 30-44, the share has doubled from 10% last year. Among the older audiences, however, not only are rates lower overall, but there hasn’t been any discernible increase in these already lower percentages either. The share has hovered between 5-7% among folks aged 45-64 for most part of the year, barring a spike to 9% in July. Those aged 65 and over show the lowest appetite with shares dipping to virtually 0% in certain months.

Explore our living data – for free

Discover more banking and insurance content here

Want to run your own research? Start building a survey now

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.