Traveling the digital path: Online travel portals and the American consumer's journey

Expected to grow at a CAGR of 5.2%, the global online travel agency market is projected to reach USD 1,060.01 billion in 2027. A recent YouGov Surveys: Serviced poll of 18 international markets also revealed Americans' preference to purchase travel services online, with less than a tenth saying they would rather do so through a physical establishment.

Evidently, American travelers looking to book and plan their travel online are a gold mine. But which online travel portals in the US have been the most successful at tapping this mine?

Using data from YouGov BrandIndex, let's explore the performance of three prominent online travel portals in the US – Expedia, Trivago, and Orbitz - and reveal their consumers' journey towards actual sales.

Stage 1: Awareness

At the top of the purchase funnel is Awareness, a measure of whether consumers have ever heard of a brand. The Expedia Group owned, and Seattle-based Expedia registers the highest rate of Awareness among consumers in the US (84.9%). German hotel search and price comparison website Trivago ranks in a slightly distant second at 72.1%. Travel fare aggregator and travel metasearch engine Orbitz, another Expedia Group subsidiary, closes out the top three, with a little more than two-thirds of Americans saying they are aware of the brand (68.3%).

Stage 2: Consideration

When it comes to the brands that Americans would consider the next time they’re booking and/or planning travel, Expedia once again leads the pack with a Consideration score of 22.3% followed by Trivago at 12% and Orbitz at just 8%.

Looking at their conversion rates from Awareness to Consideration, it’s Expedia with a clear edge 26% vs. 17% for Trivago and 12% for Orbitz, indicating that the online travel agency is most effective at converting consumers into considerers.

Stage 3: Purchase Intent

The Purchase Intent stage shows the brands consumers would be most likely to actually buy from and much like in the case of the first two stages of the purchase funnel, this stage is also led by Expedia with a score of 7.9% - a score that is more than three times that of Trivago (2.2%) and seven times that of Orbitz (1.1%).

Converting at a rate of 35%, Expedia fares the best at moving consumers through the purchase funnel - from Awareness to Consideration to Purchase Intent. Despite their low rate of conversion from the Awareness to the Consideration stage, both Trivago and Orbitz enjoy a substantial, albeit lower, conversion rate in the last stage of the purchase funnel (18% and 12% respectively).

Overall Brand Health

Expedia’s performance throughout the purchase funnel journey marks it as the strongest contender of the three brands measured in this analysis. However, a deeper look at BrandIndex data can help us understand the selected brands’ overall performance and success amongst consumers in the US.

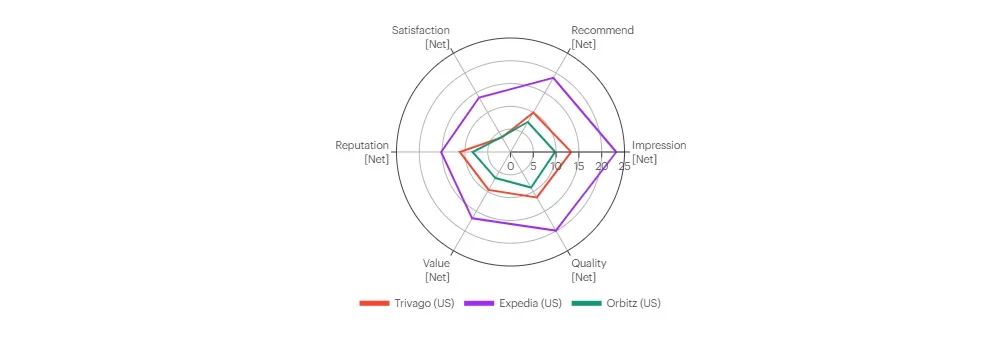

We can do so by examining the six metrics comprising each brand’s Index score – a measure of a brand’s overall brand health.

- Impression Score (how consumers view a brand)

All three brands have positive Impression scores, with Expedia clearly in the lead (23.2) followed by Trivago (13.3) and Orbitz (9.8).

- Recommendation Score (whether consumers would recommend a brand to friends and colleagues)

Perhaps unsurprisingly, Expedia leads the pack in this category too with a score of 18.8 points, followed distantly by Trivago at 10 points and Orbitz at 7.6 points.

- Satisfaction Score (whether consumers are currently satisfied or dissatisfied with a brand)

While all three brands are in positive territory, Expedia (13.8) is the most dominant brand in this regard. Notably, Satisfaction represents one of the brands' strongest drivers of overall brand health.

- Reputation Score (whether a consumer would be proud or embarrassed to work for a brand)

All brands display similarly positive scores in the category – Expedia (15.2), Trivago (11.1), and Orbitz (3.8).

- Value Score (whether a consumer considers a brand to represent a good or poor value for money)

While Expedia stands out of the pack in this category with a score of 16.8 points, value for money is one of the weaker links for both Trivago (9.6) and Orbitz (6.6).

- Quality Score (whether a consumer considers a brand to represent a good or poor quality)

Much like with all other measured metrics, Expedia leads the three brands with a score of 19.9 percentage points followed distantly by Trivago (11.5) and Orbitz (9). Quality is also one of Orbitz’s strongest metrics of the six measured in overall brand health.

Explore our living data – for free

Discover more travel and tourism content here

Want to run your own research? Run a survey now

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.