US: Measuring purchase conversions of 3 popular hotel chains among sustainable travelers

In the competitive world of hospitality, hotels vie for the attention and loyalty of travelers as they embark on vacations and search for the perfect stay.

Identifying how effectively a brand can move consumers through the different stages of its purchase funnel and measuring how they fare across a range of consumer perceptions are crucial parts of understanding the strengths and weaknesses in a marketing strategy and gaining insight into where a brand stands against other competitors in the hospitality sector.

Stay up-to-date with monthly insights into the travel industry

Using data from YouGov BrandIndex — which monitors several key measures of brand health daily —we explore the performance of three renowned US hotel chains to uncover how successful Holiday Inn (IHG), Hampton Inn (Hilton) and Courtyard by Marriott are at converting awareness into actual bookings.

And to make this data both relevant and topical for hotel marketers, we’ll look specifically at sustainability-minded hotel guests in the US who meet the following two criteria:

- Stayed at a hotel for leisure in the past 12 months

- Fit the Planet Protectors or Price Point Green consumer groups from YouGov’s sustainability segmentation

- Planet Protectors are engaged environmentalists, happy to pay more for products that are good for the environment and interested in issues related to sustainability

- Price Point Green consumers care about the environment and make an effort to protect it, but the key factor that affects their purchase decisions is price

Stage 1: Awareness

At the top of the purchase funnel is Awareness, a measure of if consumers have ever heard of a brand. All three hotel brands have high rates of Awareness among sustainability-minded hotel guests but it’s Holiday Inn that’s the clear leader at 99.4%. Hampton Inn ranks second at 92.1% and Courtyard by Marriott is in third at 88.8%.

Stage 2: Consideration

When it comes to the brands that sustainability-minded guests would consider staying at the next time they’re in market for a hotel, Holiday Inn and Hampton Inn are neck-and-neck with a 39.2% and 38.8% Consideration score respectively.

Looking at their conversion rates from Awareness to Consideration, it’s Hampton Inn with the edge of 3-points (42% vs. 39% for Holiday Inn), indicating that the hotel chain is effective at converting consumers from this segment into considerers despite a lower rate of Awareness.

Roughly three in 10 (30.4%) of sustainability-minded hotel guests would consider Courtyard by Marriott and the brand converts at a rate of 34% between Awareness and Consideration. Despite Courtyard by Marriott’s lower score and conversion rate at this stage, it begins to make up for lost ground at the bottom of the funnel.

Stage 3: Purchase Intent

The Purchase Intent stage shows the brands consumers would be most likely to stay with and while Holiday Inn (9.8%) earns the highest Purchase intent score, it’s Courtyard by Marriott that fares best at converting sustainability-minded hotel guests from Consideration to Purchase Intent.

The Marriott brand of hotels earns a Purchase Intent score of 8% and converts at 26% from the Consideration stage, slightly edging out Holiday Inn (conversion rate of 25%) and Hampton Inn (20%).

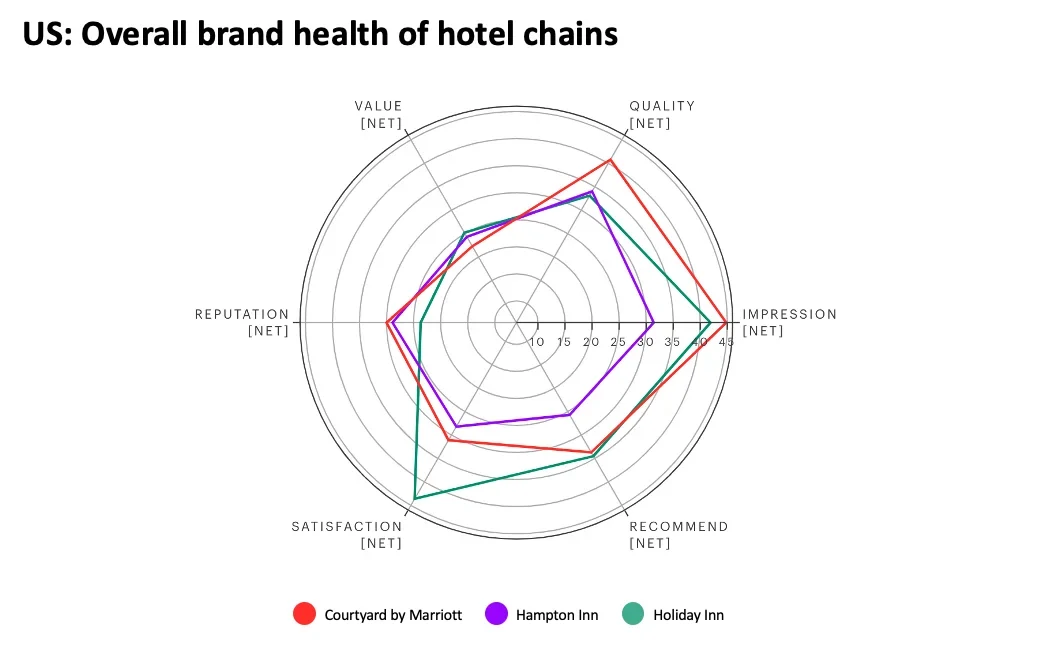

Overall brand health

We’ve just covered how effective these three hotel brands are at moving consumers through the purchase funnel, but we can delve even deeper to see how the brands earned their success among sustainability-minded hotel guests.

To do so, let’s examine the six metrics comprising each brand’s Index score — a measure of overall brand health.

- Impression (how consumers view a brand): All three brands have positive Impression scores, with Courtyard by Marriott in the lead (44.8) followed by Holiday Inn (41.9) and Hampton Inn (31.4)

- Recommend (whether consumers would recommend a brand to friends and colleagues): Holiday Inn (34.5) and Courtyard by Marriott (33.7) are virtually tied in this category, with Hampton Inn trailing with a score of 25.7.

- Satisfaction (whether consumers are currently satisfied or dissatisfied with a brand): While all three brands are in positive territory, Holiday Inn (43.6) is the dominant brand in this regard and Satisfaction represents the brand’s strongest driver of overall brand health.

- Reputation (whether a consumer would be proud or embarrassed to work for a brand): There’s little that separates Courtyard by Marriott (30) and Hampton Inn (28.9) in this category. However, this measure is the weakest of the six for Holiday Inn (23.7).

- Value (whether a consumer considers a brand to represent good or poor value for money): This is the weak link for both Courtyard by Marriott (22.3) and Hampton Inn (24.3). Despite this, all three brands are within 3-points of one another in terms of Value.

- Quality (whether a consumer considers a brand to represent good or poor quality): Quality is Hampton Inn’s strongest metric of the six measured in overall brand health (34). Hampton Inn’s score is nearly level with Holiday Inn’s Quality score (33.1) but it’s Courtyard by Marriott that leads in terms of Quality perceptions with a score of 40.8.

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.

Explore our living data – for free

To receive monthly insights about travel and tourism register here.

To read YouGov’s latest intelligence on the travel industry explore here.

Photo: Getty Images