The ABC’s on Sponsorship Evaluation

How to effectively identify, evaluate and report on commercial partnerships in sport.

How to find the right brand or sport for sponsorship

Sponsorship is a powerful tool which can create strong engagement between fans and a brand. Some of the earliest modern sponsorship activations can be traced back to the 19th century where tobacco companies printed images of famous Cricket and Baseball players and placed them in their cigarette packs as a marketing tactic.

The primary issue is that so many sponsorships are incredibly random without a clear and concise purpose for wanting to become a sponsor. So often, a sponsorship is established because of available budget, cold-reach outs, a CEO supporting a certain team or league, for philanthropy reasons or because a sport or team has ‘a lot of fans’.

One key area for YouGov Sport in recent years has been assisting brands and sports organisations and providing them with a ‘sponsorship fit report’ or our ‘brand prospecting tool’. Using our existing data tools, we track more than 700 brands across 16 key metrics daily and can evaluate how a particular brand or its category is performing among any key sports audience. With this report a brand can then have a thorough understanding of what their key business problems are and which sports audience is best equipped to help them solve it.

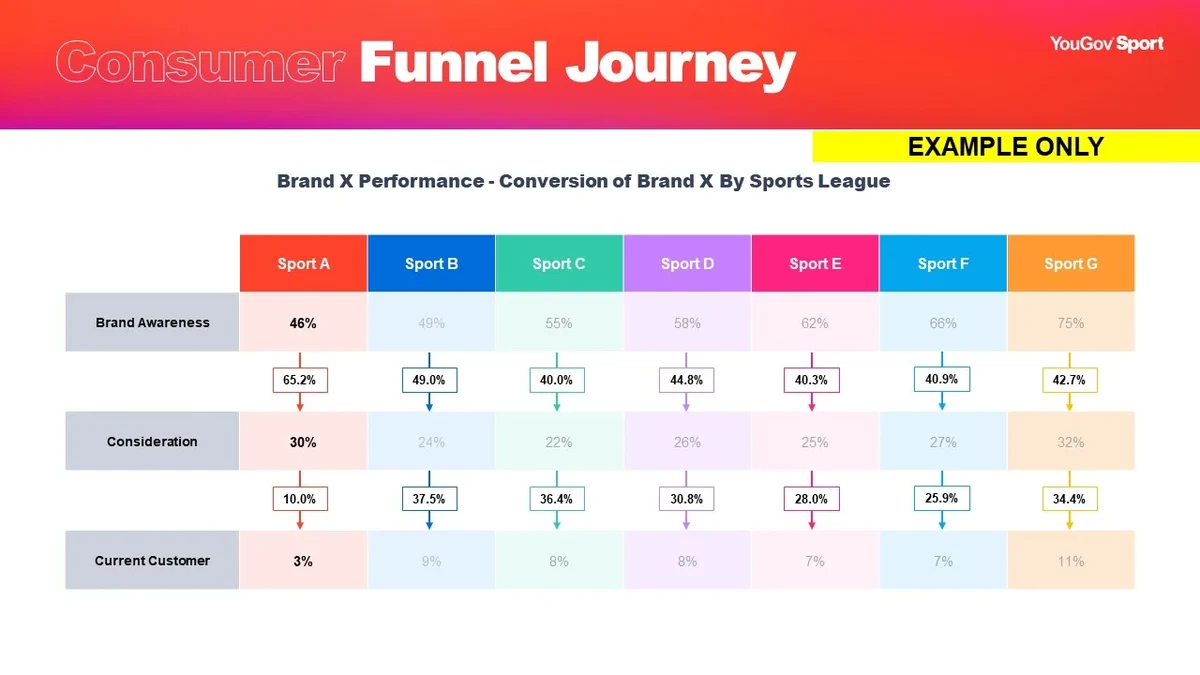

Developing a consumer funnel journey chart is one popular method for identifying a business problem for a brand. Consider the below, Brand X is being evaluated across 7 different sports audiences. Sport A provides the best opportunity for Brand X for several reasons.

(a) Awareness of Brand X is the poorest among Sport A (46%). Through sponsorship Sport A can potentially help deliver much larger growth to this metric compared to other sports.

(b) Despite poor awareness conversion into consideration for Brand X is strongest (65.2%). This suggests that if sponsorship can successfully drive awareness there should also be a stronger uptake in consideration for the brand.

(c) Sport A boasts huge consideration for the brand but is poor at converting them into customers (10.0%). If sponsorship can successfully understand what the key barrier is to customer uptake, then there is huge potential for customer acquisition.

Case study 1: In late 2022 a major automotive brand approached YouGov Sport to conduct a sponsorship fit report. This report identified each unique aspect of different sports audiences, which audiences offered the biggest market opportunity and upside and which sports audience the brand was underperforming among. This report led to their brand sponsoring the recommended league in 2023 with a clear purpose, reason and vision for doing so.

Huge opportunity awaits for brands who target smaller sports audiences

Who doesn’t enjoy the story of David vs. Goliath. It’s quite simple the AFL, NRL and Cricket are the sports which have the most fans and thus attract the most eyeballs whether through viewership, attendance, or membership. This is a powerful, compelling, and influential story to put fourth to brands for sponsorship but is this all that matters?

With large fandom comes a long-list of partners and in some cases runs the risk of developing an oversaturated market where only those top-tier sponsors with the money to invest achieve meaningful recall. Instead, perhaps opportunity could lay in other areas where less sponsors go….(Red Bull does this better than anyone!).

Where these tier 2 and 3 sports organisations fall behind is that they are yet to develop a truly insightful and simple ‘brand story’ which showcases the ways in which their fans are truly unique compared to others and how this uniqueness is a perfect fit for certain brands. What can your fanbase offer that others can’t? This question can be answered if you have access to the right data and tools.

Case study 2: Our YouGov Profiles data highlights the uniqueness of NBL fans who of any major fanbase boast the largest skew of youthful fans making them hip and trendy and in-touch with the next generation. This is such a simple data point which presents a powerful opportunity for brands wanting to tap in and associate themselves with millennials or Gen Z (think fashion, health & beauty, wellness, crypto or BNPL). Our data also highlights how coffee brands and cafes are an exceptional fit for those who support the Australian Swim team who as a fanbase were shown to consider, consume and love coffee more than most others and offers a great opportunity for a brand in this space to engage with.

How to onboard and establish meaningful sponsorship KPIs

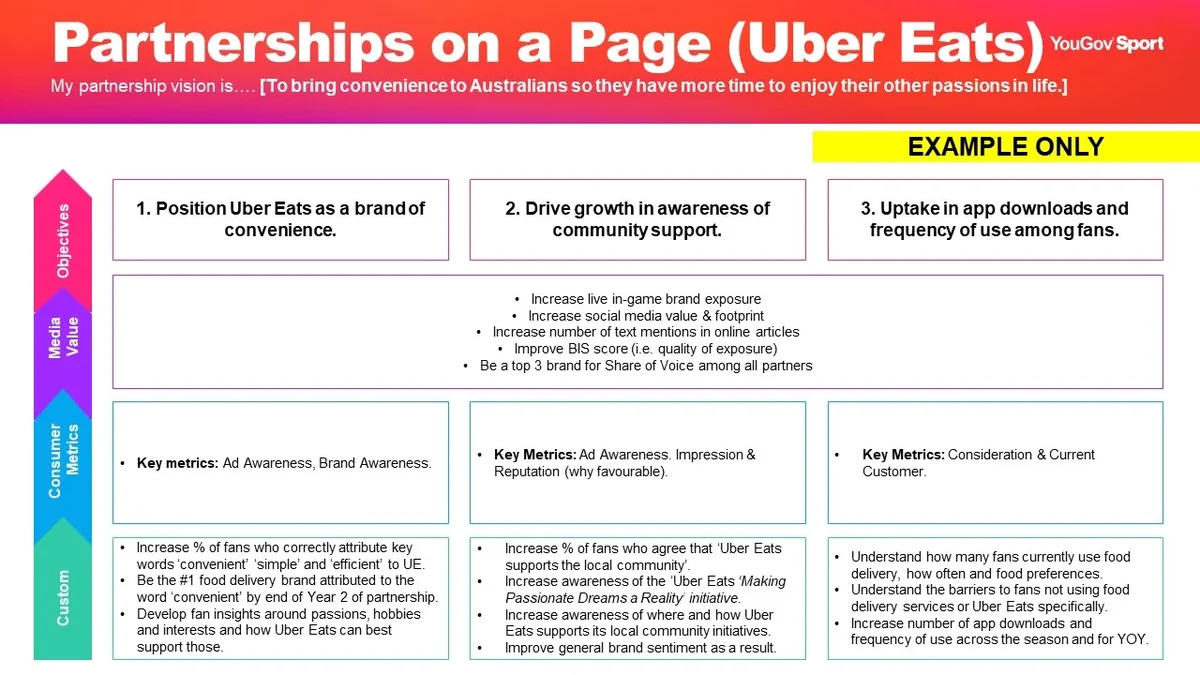

Once a brand has a detailed understanding of the business problem it faces it can then begin working with that league, team or event who can best help solve it. Our first recommendation always is for a brand to complete a partnership on a page template (example below).

Over the years sports have been slowly integrating this as a key process, however much work is still needed to do them thoroughly. Some of the biggest errors are when sponsors are unable to establish a simple, concise, and clear vision or set of sponsorship KPI’s that are not too broad or unrealistic for the timeframe or investment committed. Sports organisations equally need to be accountable for these KPI’s and not over-promise what can realistically be delivered.

The biggest barrier currently is the lack of involvement of research agencies in this process. If you want your sponsorship evaluated well, a brand needs to know what research and data is available, how the methodology is evaluating its sponsorship and to ensure each KPI is tracked and has tailored data behind it. Still to this day the very large majority of sports organisations do not integrate research specialists into this process and reports and data can’t be tailored in its most meaningful way.

If you ONLY look at sponsorship through a media value lens you are doing it wrong

If you are a brand or commercial team who is currently evaluating your commercial partnerships through a media value lens only (i.e., viewership reach and worth of an asset) then you are behind the 8 ball. While media value plays an integral role in sponsorship evaluations, media as a standalone measure is only going to answer half of your story.

Let’s consider an event that generates a huge audience and in turn a brand’s major sponsorship asset is valued in at $4m. For a basic evaluation you could sell this story in and without looking closely under the hood could declare this a success. However, what’s missing is whether this exposure had any recall and if so, did it have any meaningful impact when it came to shifting fans general attitudes or sentiment to the brand. Did the exposure shift the dial on established KPI’s? Did this exposure drive growth in awareness, consideration or was there an uptake in customers across the event or compared to the prior year? If you don’t know or the answer is NO, then what has that partnership actually accomplished for you?

This is the gold standard for commercial sponsorship reporting…

A commercial sponsorship evaluation report should be aesthetically pleasing, simple to read and understand and each insight should be tailored uniquely to each sponsor’s objectives. More data does not necessarily mean better. If you don’t involve the research agency upfront and establish clear KPIs which should all be tracked, you will continue to receive generic reports.

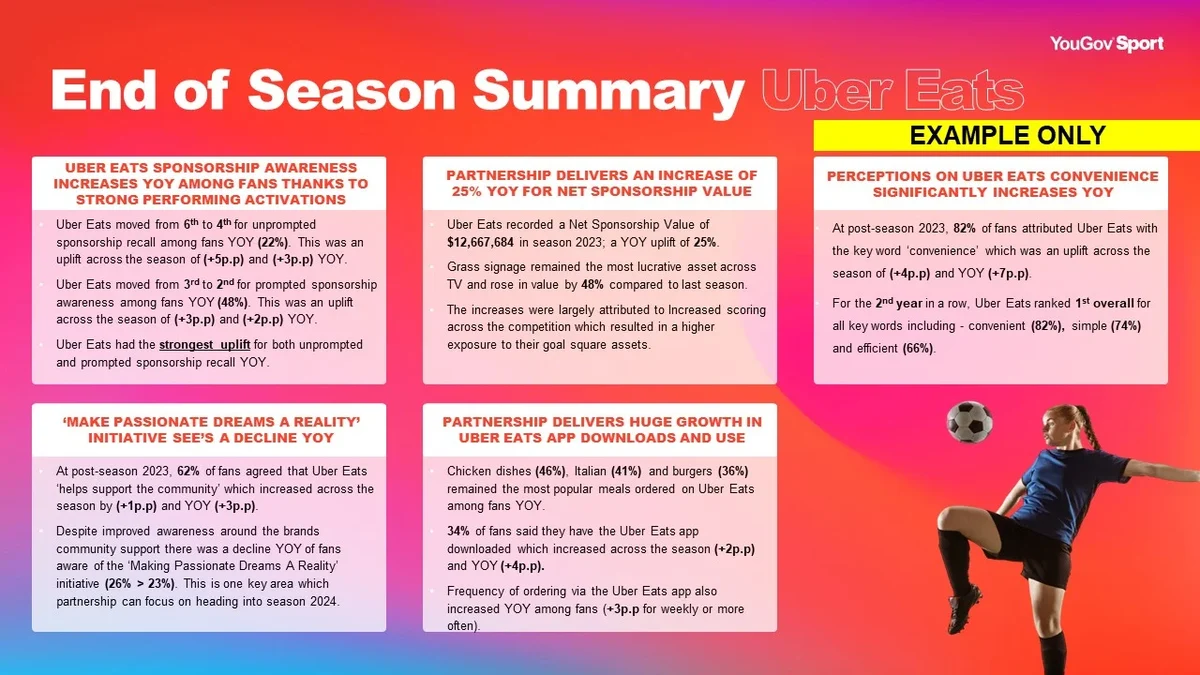

YouGov Sports recommended approach is to use a single research provider who can deliver media value, fan and consumer metric insights as well as running a custom bespoke research piece pre- and post-season. This bespoke research will enable you to capture the more niche sponsor KPI’s (i.e., sponsorship awareness, asset recall, word attributions, bespoke sponsor based questions). By using all 3 methods data can be pulled from each to form a custom tailored, detailed, and insightful report for sponsors (see below Uber Eats example based on KPIs provided).