APAC Biggest Brand Movers – January 2023

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

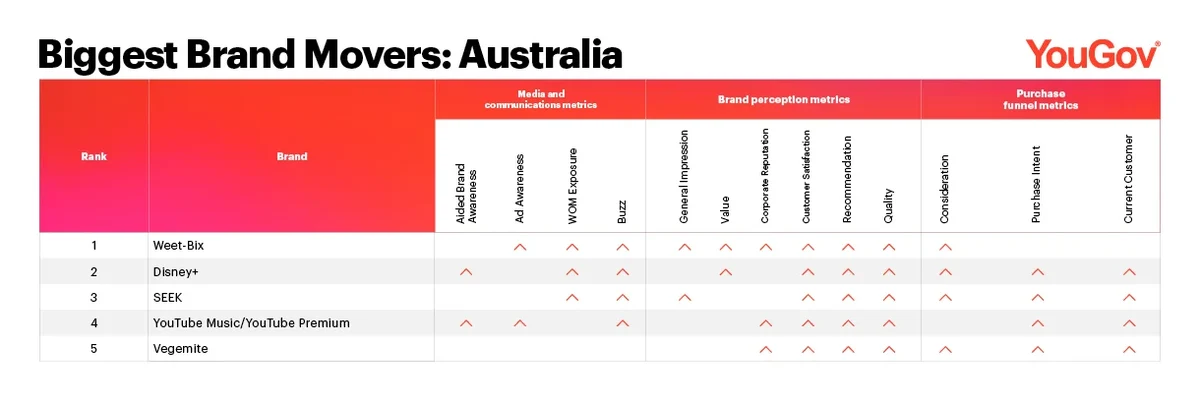

Australia: Weet-Bix swings into first place with campaign targeting cricket fans

Sanitarium’s Weet-Bix is Australia’s Biggest Brand Mover for January.

The cereal brand made gains in 10 out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration).

Weet-Bix ran a promotion targeting cricket fans from end November till early January, inviting Australian residents to post a photo of themselves wearing a Marny-Army shirt (purchasable from weetbix.com.au) on Instagram. Four lucky winners won a meet-and-great session with cricket star Marnus Labuschagne, as well as a trip to Brisbane to see his Big Bash side play. Additionally, Weet-Bix also released a downloadable Back-to-School Cookbook Guide, offering recipe ideas for children’s breakfasts and lunches.

Disney+ is the runner-up, with the OTT streaming provider scoring upticks in 10 metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. SEEK takes third place, with the online recruitment and human resources platform, which owns the JobStreet and JobsDB brands, seeing improvements in nine metrics across all three categories as well.

Google-owned video sharing and media platform YouTube and Bega-owned yeast food spread Vegemite round out the top five, making gains in nine and seven metrics respectively.

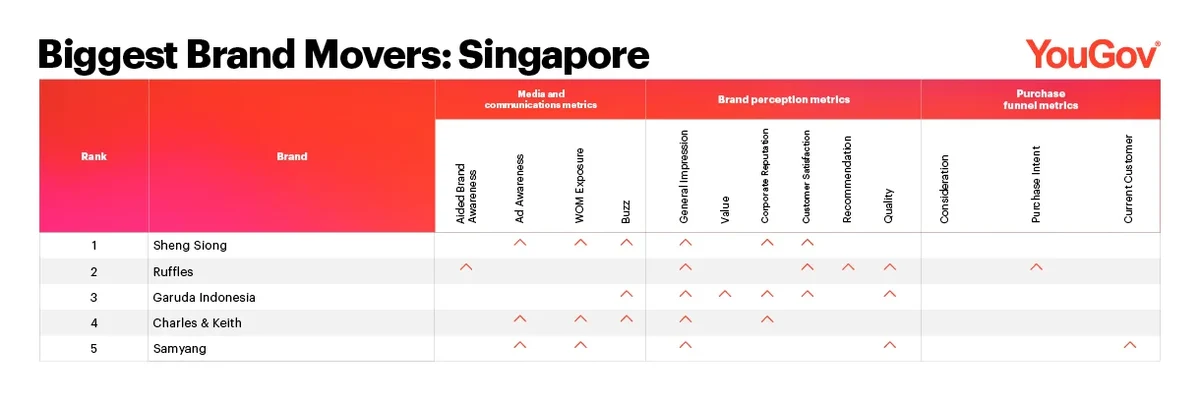

Singapore: Sheng Siong rises to first place by absorbing GST rise for Q1 2023

Sheng Siong is Singapore’s Biggest Brand Mover for January.

The supermarket chain made gains in six out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness, WOM Exposure, Buzz) and Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction).

Following the 1% rise in Government & Services Tax (GST) in Singapore – to 8% from 1 January 2023 – Sheng Siong announced that it will be absorbing the consumption tax hike on all products (except alcohol, tobacco, vouchers, lottery, and infant milk powder) until 31 March 2023, via a “1 per cent counter inflation discount”.

Ruffles is the runner-up, with the potato crisps brand scoring upticks in six metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Garuda Indonesia takes third place, with the airline seeing improvements in six metrics across the Media and Communication and Brand Perception categories.

Homegrown fashion label Charles & Keith, which found itself in the spotlight after a viral TikTok video sparked discussion of its ‘luxury’ status, and Korean instant noodle brand Samyang round out the top five, making gains in five metrics each.

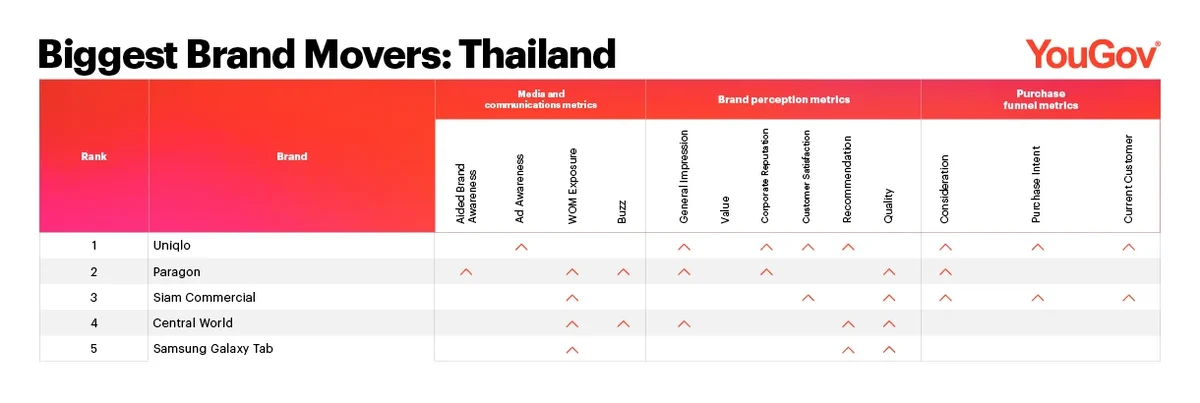

Thailand: Uniqlo leads with new tee designs, celebrity collabs and outlets

Fast Retailing’s Uniqlo is Thailand’s Biggest Brand Mover for January.

The fashion retailer made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad Awareness), Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

In January, Uniqlo Thailand launched a number of tee-shirt designs, including a Sanrio characters collection and skater collection. It also collaborated with local actress Pattie Ung Sira to promote its baggy jeans, besides opening a new outlet in Ram Intra.

Paragon is the runner-up, with the shopping mall scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Siam Commercial takes third place, with the bank seeing improvements in six metrics across all three categories.

Shopping complex Central World and tech brand Samsung Galaxy Tab round out the top five, making gains in five and three metrics each.

Was your brand one of APAC’s Biggest Movers in January?

Uncover the other brands that were among the top ten in Australia, Singapore, Thailand by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for January 2023 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including China, Hong Kong, Indonesia, Japan, Malaysia, Philippines and Vietnam? Contact us and sign up for a free brand health check today!

Methodology: Biggest Brand Movers for January 2023 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between December 2022 and January 2023.

Media and Communication Metrics

- Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

- Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

- Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

- Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

- General Impression – Whether a consumer has a positive or negative impression of a brand

- Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

- Quality – Whether a consumer considers a brand to represent good or poor quality

- Value – Whether a consumer considers a brand to represent good or poor value for money

- Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

- Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

- Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

- Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

- Current Customer – Whether a consumer has purchased a given product or not within a specified period of time