Are firms ready for the FCA's new Consumer Duty rules?

The FCA’s Consumer Duty Principle comes into effect in July 2023, and is designed to ensure that FS firms deliver good outcomes for retail consumers. Data from YouGov BrandIndex and Profiles suggests that this might be an uphill climb for many organisations in the sector.

Over the past 12 months, consumer satisfaction with their banks or building societies is high, with more than seven out of ten (72%) customers rating their institutions positively.

But scratch beneath the surface and all may not be well: strong-seeming customer satisfaction could be a byproduct of lower customer expectations – expectations that could be met by simply functioning in a reliable, if not exceptional, fashion. Supporting this, our data also shows that half (52%) of customers do not feel positive towards about the quality their bank or building society delivers, and less than two in five (36%) say their provider offers good value for money.

To meet the FCA’s higher expectations, more might need to be done. Quality and value for money are key metrics that can demonstrate to the regulator that customers are getting a better deal than before. These metrics will need to be tested within firms’ own product catalogue, as well as the wider marketplace. Other than refining the products and service, customer communication will have a key role to play here.

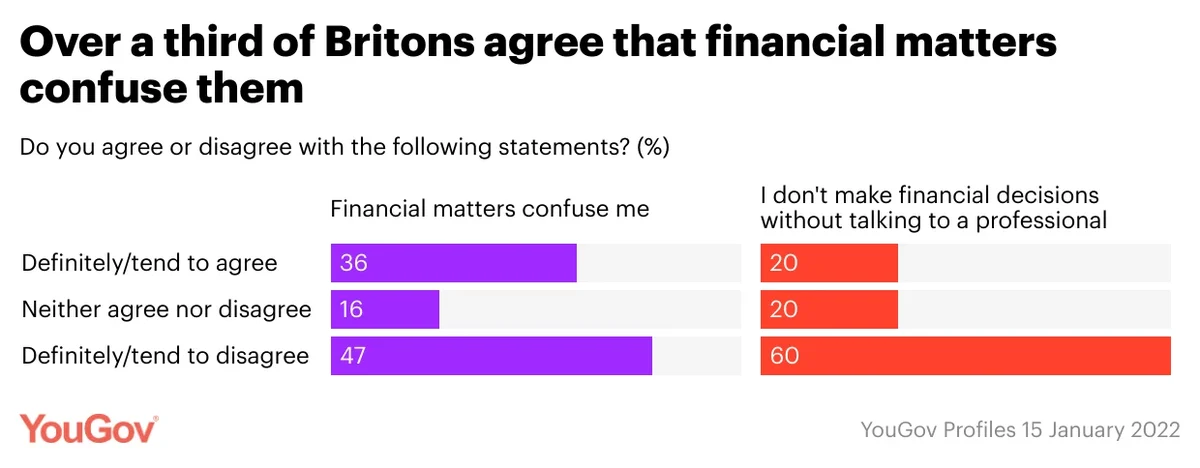

Financial matters are confusing for many. Majority do not take advice while making important financial decisions thus increasing the risk of harm

The need for greater communication is exemplified by the fact that a third of GB adults (36%) agree that ‘financial matters confuse them’. This contradicts an important FCA requirement - “supporting customers in realising the benefits of the products and services they buy.” Clearer communications from financial institutions can help customers make well-informed decisions. Lack of clarity around finances restricts the consumer’s ability to reap the full benefits of any products they may hold.

On that note, YouGov Profiles data indicates that a majority of GB adults (60%) ‘make financial decisions without talking to a professional’. This might represent an opportunity to support customers with clearer communications tailored to their specific requirements and appetite for risk.

Overall, financial services firms have important steps to take over the next few months to deliver on the key outcomes highlighted by the FCA. Investigating and understanding customer expectations is a key first step. Reviewing customer communications should also be extremely high on the agenda. Information needs to be communicated in a digestible, consistent manner which supports customers, and highlights any risks as well as gains.

In response to this, YouGov has developed a range of research solutions that are directly related to the four key consumer outcomes which represent the key elements of this new directive.

The research solutions are designed to provide our clients with all the tools necessary to ensure that their products and services are designed, delivered, and serviced with the new consumer principles firmly embedded.

Methodology

YouGov BrandIndex collects data on thousands of brands every day. Data from surveys of adults aged 18 years and above residing in the UK . Learn more about BrandIndex.

YouGov Profiles is based on continuously collected data and rolling surveys, rather than from a single limited questionnaire. Profiles data for GB is nationally representative of the online population and weighted by age, gender, education, region, and race. Learn more about Profiles.