How badly did 2022 affect the public image of energy suppliers?

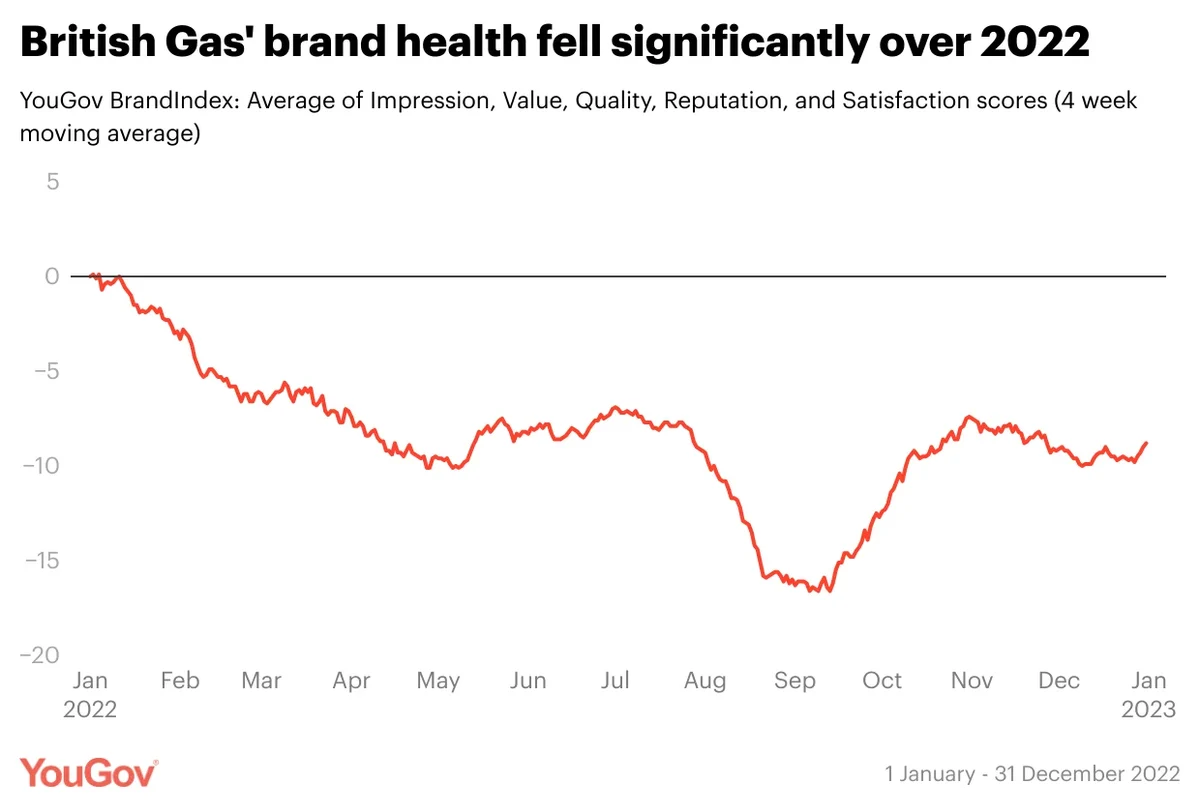

2022 saw the energy sector earn significant excess profits, but with bills skyrocketing, a number of major suppliers took a reputational battering. Data from YouGov BrandIndex shows that British Gas (0.2), EDF Energy (0.9), E.On (0.9), Scottish Power (-0.7) and OVO Energy (3.5) all ended 2021 with Index scores – a measure of overall brand health – that ranged from modestly positive to only mildly negative.

But despite government interventions such as the Energy Price Guarantee, each of these suppliers ended 2022 with perceptions far more negative than they were before the crisis began. British Gas saw Index scores fall to -8.8, EDF declined to -5.4, E.On to -4.6, Scottish Power to -6, and OVO to -1.3.

British Gas saw the most significant decline, and digging into the individual brand health metrics shows that, over 2022, our metric tracking general Impression of the company plummeted by 10.6 points from -0.7 to -11.3. Perceptions of the energy giant’s quality deteriorated from 6.0 to -2.3 (-8.3) during the year, and it will not be especially surprising that – with energy bills increasing by 54% from April 2022, increasing further later on in the year – Value for Money scores went from bad (-12.4) to worse (-22.1), recording a fall of 9.7 points.

Between January and December 2022, British Gas’ Reputation scores, which measure whether consumers would be proud or embarrassed to work for a brand, also tumbled from solidly positive (4.8) to solidly negative (-7.3).

Consumers were perhaps always likely to have an adverse response to an increase in energy bills, and while suppliers have financially benefited from the revised energy price cap, factors such as the war between Russia and Ukraine have reportedly also played a part in rising costs. Nevertheless, if British Gas and other players in the sector have made more money, it has come at a cost to their brands. If they cannot reverse the damage in 2023, they may wish to think about how they can avoid further blows to their public image.

This article originally appeared in City A.M.