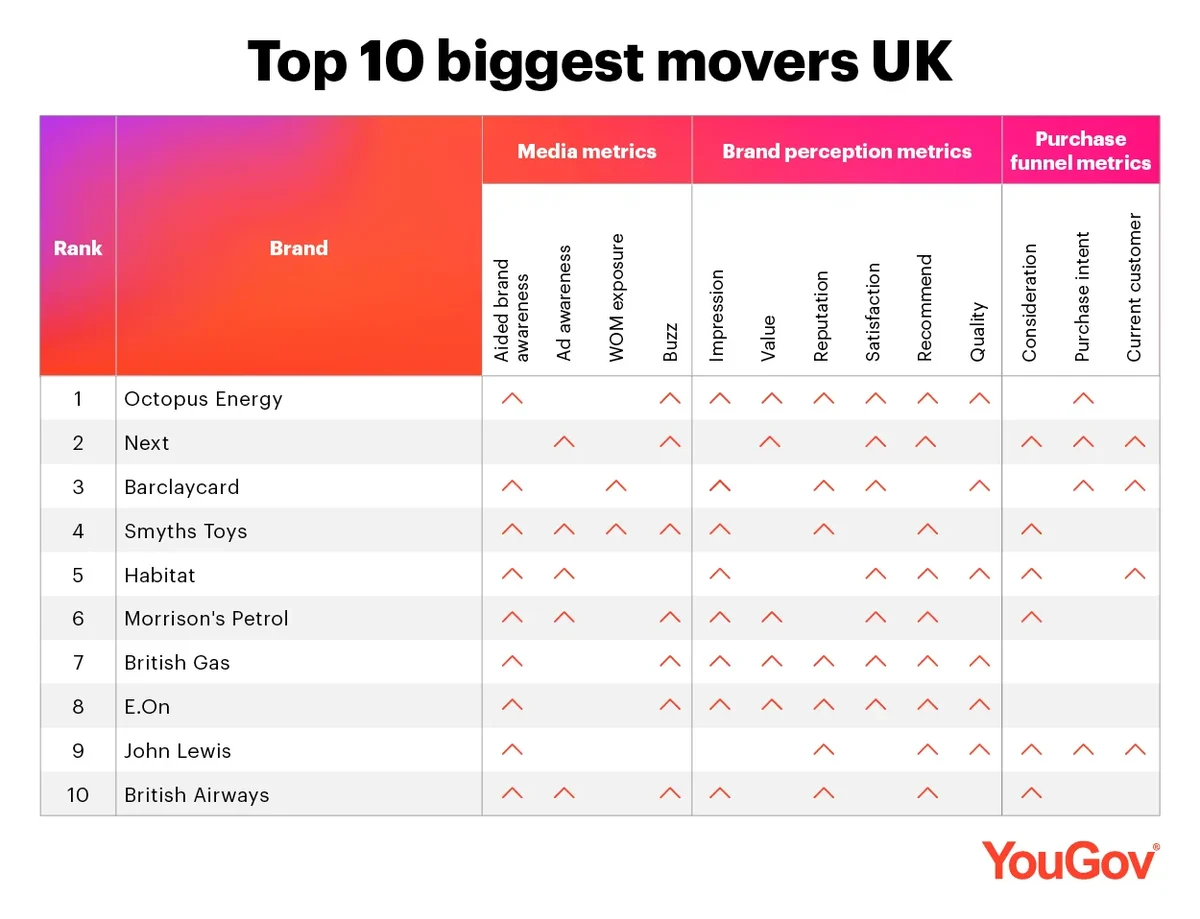

UK – Biggest Brand Movers – November 2022

Octopus Energy, which has been in the news over its acquisition of failed rival Bulb, has hit the right notes with consumers in the UK. The brand, which specialises in renewable energy, grew in all six of YouGov’s brand perception metrics (Impression, Value, Reputation, Satisfaction, Recommend, Quality), two media metrics (Awareness, Buzz) and a purchase funnel metric (Purchase Intent).

Octopus Energy’s acquisition will see them take on 1.5 million customers who were being serviced with billions of pounds of government support after Bulb’s collapse in November 2021. Octopus said the deal would “bring an end to taxpayer losses and uncertainty for Bulb customers and its 650 employees”.

Octopus isn’t the only energy brand that made an impact in October, with British Gas and E.On also featuring in this month’s brand movers after registering upticks in eight metrics apiece. Interestingly, both brands made gains in the same metrics, including six brand perception ones - Impression, Value, Reputation, Satisfaction, Recommend, Quality. These upticks could have to do with the companies taking some of the credit for the October Energy price cap, and an energy bill discount of £400 for the month of October, announced as a measure to tackle soaring energy prices.

On a similar note, Morrison’s Petrol also makes it into this month’s Brand Movers with improvements on seven counts, after announcing a deal that will allow consumers to save 5p per litre of fuel.

Fashion retailer Next makes an appearance on the list with a rise in eight metrics, including Consideration, Purchase Intent and Current Customer. The brand had one of its regular clearance sales recently, which may have contributed to an increase in its purchase funnel metrics.

Barclaycard also features in the list with growth in eight metrics. The brand recently initiated a new service enabling customers to withdraw cash from local retailers and services without making a purchase.

Smyths Toys, which unveiled its winter toys catalogue recently, rose in each media metric (Awareness, Ad Awareness, WOM Exposure, Buzz), three brand perception metrics (Impression, Reputation, Recommend) as well as Consideration.

Home décor retailer Habitat rose in eight metrics. Also in the retail space, John Lewis makes the list with gains in seven metrics. The brand recently announced the expansion of sustainability initiatives, including a plan to introduce “buy back” or “take back” schemes across all product categories by 2025.

British Airways rounds off the list with improvements in seven metrics.

Explore our living data – for free

Methodology

Data for the Biggest Brand Movers in November compared statistically significant score increases across all BrandIndex metrics between September and October 2022. Brands are ranked based on the number of metrics that saw a statistically significant increase from month to month. Metrics considered are:

Media Metrics

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Health Metrics

Awareness – Whether or not a consumer has ever heard of a brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Impression – Whether a consumer has a positive or negative impression of a brand

Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Recommend – Whether a consumer would recommend a brand to a friend or colleague or not

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within in a specified period of time

Discover how the nation feels about your brand. Sign up for a free brand health check