The global evolution of car buying

Traditionally, people buy vehicles either at dealerships or in-person from the owner. In recent years, however, innovators like Tesla have transformed the direct-to-consumer space while online retailers like Carvana and Cazoo have pioneered new ways to reach used car-buyers directly. How quickly is car-buying changing? Which consumers are sticking to tradition and who’s moving online? A new white paper by YouGov explores these questions as well as the drivers of car purchase and the future of vehicle electrification. “The Road Ahead for Future Car Buying,” available here, is based on over 19 000 surveys conducted in 18 global markets.

Online or in the forecourt?

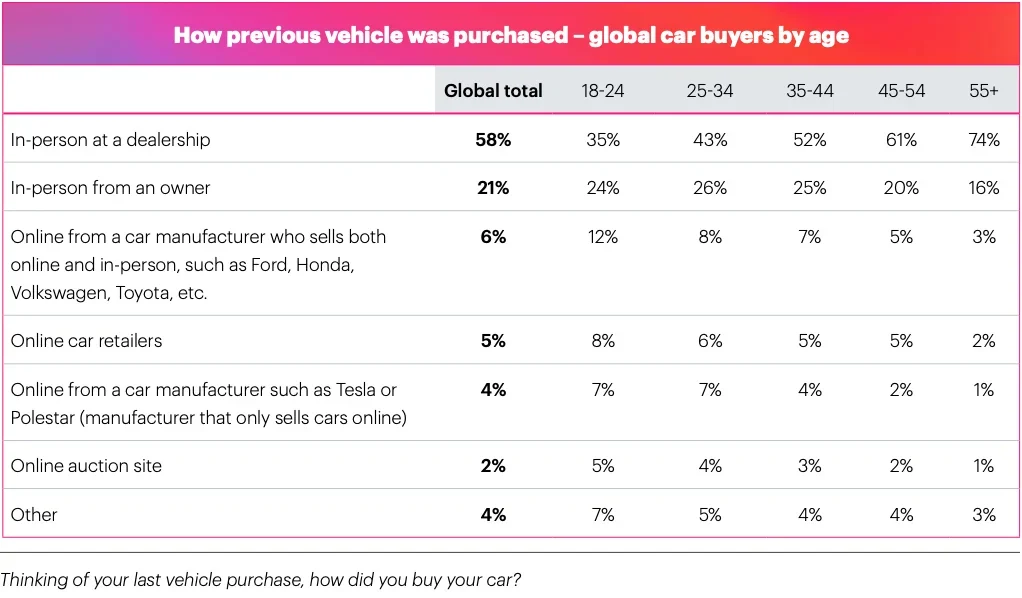

Despite recent innovations, in-person transactions still dominate the car market. Nearly three-fifths (58%) of all consumers bought their last vehicle in-person at a dealership with another 21% buying in-person from an owner. The online trade in cars is smaller but still significant with 17% of consumers buying their last vehicle in this way.

From these overall figures, it may appear that demand for online car purchase is marginal. However, there are significant differences between demographics. Younger car-buyers are not as bound to traditional dealerships as their older counterparts. Only 35% of 18-24’s bought their last vehicle in person at a dealership compared to 74% of those over 55 years. On the other hand, 32% of 18-24’s chose some online option compared to only 7% of those aged 55+. While these are at the extremes of the age range, the pattern is relatively consistent: the younger consumers are, the more likely they are to have purchased online.

When consumers are asked how they’ll consider purchasing their next vehicle, a similar pattern emerges. Traditional in-person paths to purchase will be considered by most buyers, with 68% thinking of purchasing in-person from a dealership and 34% directly from an owner. This compares to 21% who would consider buying from a car online from a manufacturer that also sells in-person, and 15% who would contemplate using an online car retailer.

While consideration for online purchase is still much lower than in-person purchase, YouGov research shows that many consumers are at least willing to consider online paths-to-purchase for their next vehicle, particularly young consumers who are just entering the car-buying market. Nearly half (48%) of 18-24 consumers would consider buying their next car online, declining to only 23% of those aged 55+.

In addition to differences between age cohorts, the YouGov white paper also reveals significant variation between markets. Consumers in China (29%) and Great Britain (26%) are most likely to consider purchasing online from a car manufacturer that also sells in-person, whereas Danish consumers are least likely to consider this option, at 10%. On the other hand, UAE (20%), Hong Kong (23%) and India (19%) have the highest proportion of car buyers who would consider purchasing from an online-only manufacturer such as Tesla.

Download YouGov’s new Auto Report 2022 to explore insights into 18 international markets, including:

- The rise of digital purchasing options

- Who is receptive to buying vehicles online

- Car purchase drivers

- The E-volution and the barriers facing the EV market

Explore our living data – for free

Discover more Automotive content here

Want to run your own research? Start building a survey now

Make smarter business decisions with better intelligence. Understand exactly what your audience is thinking by leveraging our panel of 20 million+ members. Speak with us today.