APAC Biggest Brand Movers – July 2022

APAC Biggest Brand Movers highlights the ten brands that have registered the most statistically significant month-on-month upticks in consumer perception metrics across a selection of Asia-Pacific markets. These rankings identify the brands which have logged the greatest number of improvements across 13 metrics each month – ranging from aided brand awareness and corporate reputation, to purchase consideration and customer satisfaction. The data is taken from YouGov BrandIndex, a syndicated brand tracker which continuously collects data on thousands of brands around the globe every day.

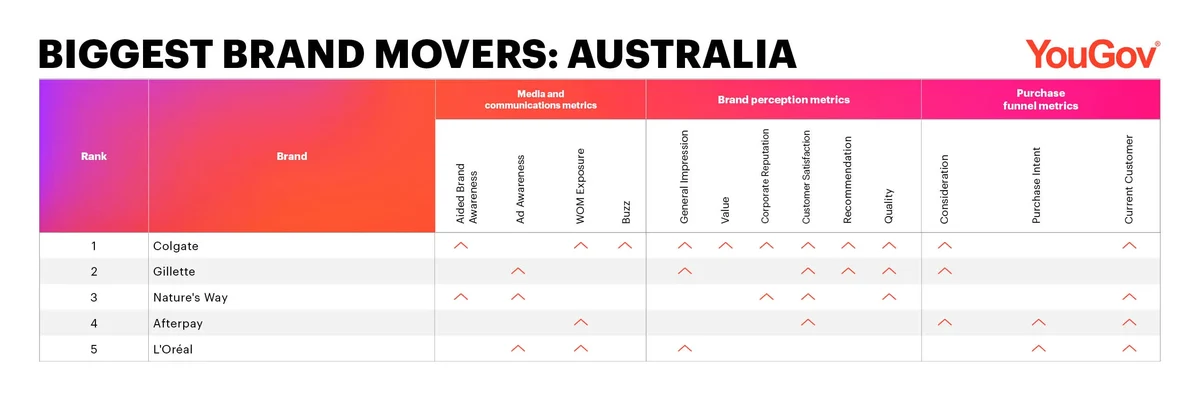

Australia: Colgate climbs to top of table with wild adventure campaign

Oral hygiene brand Colgate is Australia’s Biggest Brand Mover for July.

It made gains in 11 out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Current Customer).

The American brand recently launched a campaign to promote the 12-hour antibacterial properties of its Colgate Total toothpaste, which features survival consultant Megan Hine using the product while out in the wild. Hine is best known for her work with British adventurer Bear Grylls in the 2015-16 television show Mission Survive.

Gillette is the runner-up, with the Procter and Gamble-owned razor brand scoring upticks in six metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Nature’s Way takes the third place, with the health supplement brand seeing improvements in six metrics across all three categories.

Buy Now Pay Later provider Afterpay and French cosmetics brand L'Oréal round out the top five, making gains in five metrics each.

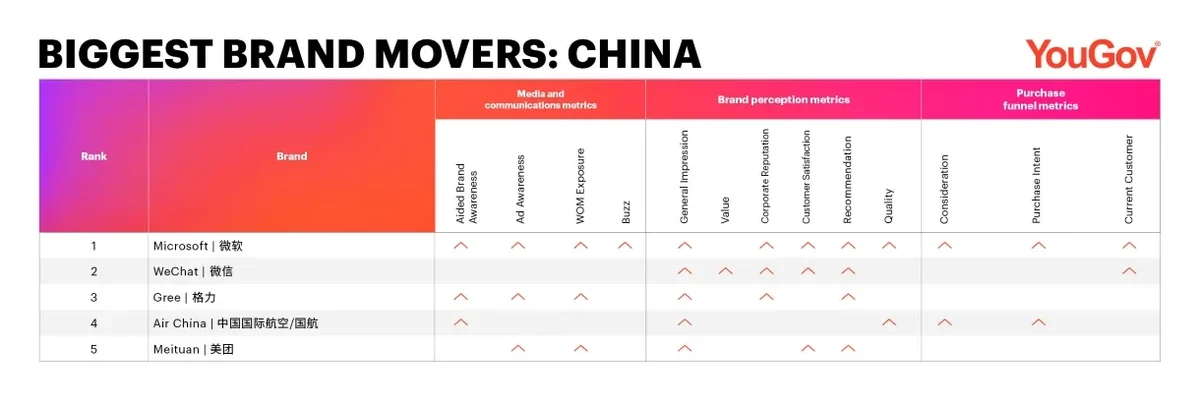

China: Microsoft rises to first place with gaming expansion

IT brand Microsoft 微软 is China’s Biggest Brand Mover for July.

It made gains in 12 out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, Ad Awareness, WOM Exposure, Buzz), Brand Perception category (General Impression, Corporate Reputation, Customer Satisfaction, Recommendation, Quality) and Purchase Funnel category (Consideration, Purchase Intent, Current Customer).

The American computer software and technology company recently partnered with major Chinese gaming companies Tencent 腾讯 and NetEase 网易 to bring some of their titles into Microsoft’s gaming subscription service Xbox Game Pass.

WeChat 微信 is the runner-up, with the instant messaging, social media and mobile payment app scoring upticks in six metrics across the Brand Perception and Purchase Funnel categories. Gree 格力 takes the third place, with the Guangdong-headquartered appliance manufacturer seeing improvements in six metrics across the Media and Communication and Brand Perception categories.

National carrier Air China 中国国际航空公司 and e-commerce platform Meituan 美团 round out the top five, making gains in five metrics each.

Indonesia: TikTok clinches top spot with educational content campaign

Bytedance’s TikTok is Indonesia’s Biggest Brand Mover in July.

It made gains in eight out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Ad awareness, Buzz), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Recommendation) and Purchase Funnel category (Current Customer).

The video sharing platform recently launched a campaign titled "#SerunyaBelajar Ada on TikTok", to encourage users to create more fun and educational content, which featured singer-actress Cinta Laura Kiehl as campaign ambassador. Additionally, TikTok videos about a “mental age test” website was also going viral during the month, according to media reports.

KAI Access is the runner-up, with PT Kereta Api Indonesia (Persero)’s train ticket booking app scoring upticks in seven metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Alfamart takes the third place, with the local convenience store chain, seeing improvements in five metrics across the Brand Perception and Purchase Funnel categories.

E-commerce platform Shopee and Meta-owned instant messaging platform WhatsApp round out the top five, making gains in four metrics each.

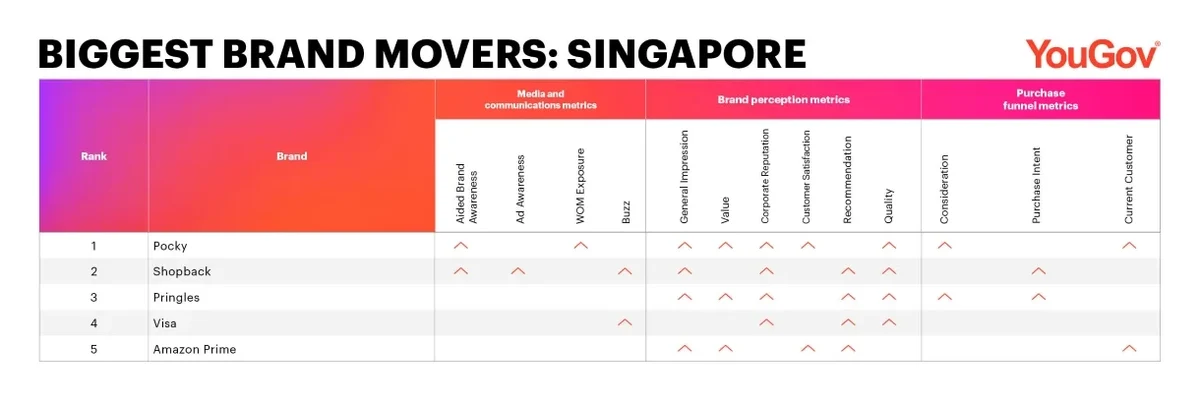

Singapore: Pocky ranks highest with Japan food fair

Ezaki Glico’s biscuit stick brand Pocky is Singapore’s Biggest Brand Mover in July.

It made gains in nine out of 13 YouGov BrandIndex metrics, across the Media and Communication category (Aided Brand Awareness, WOM Exposure), Brand Perception category (General Impression, Value, Corporate Reputation, Customer Satisfaction, Quality) and Purchase Funnel category (Consideration, Current Customer).

The Japanese snack was one of the items on display at major supermarket chain NTUC FairPrice’s Korea and Japan Fair, held across multiple outlets, in early July.

Shopback is the runner-up, with the homegrown cashback reward and online coupon brand scoring upticks in eight metrics across the Media and Communication, Brand Perception and Purchase Funnel categories. Pringles takes the third place, with the Procter and Gamble-owned potato snack brand seeing improvements in seven metrics across the Brand Perception and Purchase Funnel categories.

American electronic and card payments provider Visa and e-commerce subscription service Amazon Prime round out the top five, making gains in five metric each.

Was your brand one of APAC’s Biggest Movers in July?

Uncover the other brands that were among the top ten in Australia, China, Indonesia and Singapore by requesting your free copy of YouGov’s APAC Biggest Brand Movers Report for July 2022 here.

Wonder who are the Biggest Brand Movers in other APAC markets – including Hong Kong, Japan, Malaysia, Philippines, Thailand and Vietnam? Contact us and sign up for a free brand health check today!

Methodology

Biggest Brand Movers for July 2022 ranked brands according to the number of statistically significant score increases they achieved across the following BrandIndex metrics, between June and July 2022.

Media and Communication Metrics

Aided Brand Awareness – Whether or not a consumer has ever heard of a brand

Ad Awareness – Whether a consumer has seen or heard an advertisement for a brand in the past two weeks

Word of Mouth Exposure – Whether a consumer has talked about a brand with family or friends in the past two weeks

Buzz – Whether a consumer has heard anything positive or negative about a brand in the past two weeks (net score)

Brand Perception Metrics

General Impression – Whether a consumer has a positive or negative impression of a brand

Customer Satisfaction – Whether a consumer is currently a satisfied or dissatisfied customer of a particular brand

Quality – Whether a consumer considers a brand to represent good or poor quality

Value – Whether a consumer considers a brand to represent good or poor value for money

Recommendation – Whether a consumer would recommend a brand to a friend or colleague or not

Corporate Reputation – Whether a consumer would be proud or embarrassed to work for a particular brand

Purchase Funnel Metrics

Consideration – Whether a consumer would consider a brand or not the next time they are in the market for a particular product

Purchase Intent – Whether a consumer would be most likely or unlikely to purchase a specific product

Current Customer – Whether a consumer has purchased a given product or not within a specified period of time