US: YouGov’s Retail Rankings 2021

YouGov’s Retail Rankings 2021 is a fresh look at the most impactful retailers based on their performance in the last 12 months.

This analysis looks at the top performing retail brands in the United States based on the data YouGov collects from members of the public. Using YouGov BrandIndex – a daily brand tracker – every company’s performance is measured against a range of metrics to determine its Index score. Index scores are calculated by taking the average of our Impression, Quality, Value, Satisfaction, Recommend and Reputation metrics. Rankings are calculated by taking an annual average.

Given the variety of services and products in the retail environment, YouGov provides an overall ranking among all retail brands while also highlighting top performers in key categories like Mass Merchandisers and Drug Stores, Department Stores and Fashion, and Auto-related retail.

Get in touch to see YouGov’s full list of Retail Rankings 2021

Overall retail

Consumer appetite for home improvement surged amid the pandemic and that’s reflected in

Lowe’sand

HomeDepot’ssuccess over the last 12 months. Lowe's is the top performing retail brand in this year’s ranking, followed closely by Home Depot, and both brands were positioned well to shoulder a pandemic as essential retailers. With consumers spending more time at home amid the pandemic, many turned to the retailers for their home improvement projects.

It was a similar picture for

AceHardware, the largest retailer-owned hardware cooperative in the world and fifth best-performing brand this year. Ace’s success appears linked to another top ten performer this year –

OfficeDepot. The two brands have been

vendor partners in the past and became even more involved in each other’s businesses in 2016

when Office Depot became a supplier in Ace’s purchasing program. The brands were able to rely on one another while supply shortages caused other retailers to shift suppliers.

Pandemic-induced shopping fervor also gave top performing big-box retailers such as

Best Buy,

Barnes & Noble,

Target,

Staples,

Bed Bath & Beyond, and

Costcoa boost in their brand performance.

Some specialty businesses such as

Best Buyshut down completely and re-opened up slowly to understand the full impact of the pandemic

on physical orders and measure demand for online purchases. This led to an overhaul of its omnichannel strategy – mainly focusing on curbside pickup for online orders and restructuring physical store space to better serve warehouse and fulfillment operations.

Mass merchandisers, club, value & drug stores

Target

is the biggest retail winner in this category and there are a few big drivers for its success emerging from the pandemic. Target’s robust offerings via its website and app, drive-up and delivery services, and updated in-store experience were all part of its omnichannel strategy over the last year. The retailer is also known for its limited-edition collaborations with fashion brands like Lilly Pulitzer, Hunter and Missoni.

Both

Walmartand Walmart-owned

Sam’s Clubearn spots on the top ten list in this category but it’s

Costcothat takes the position as the top performing warehouse club by a difference of ten points.

Walgreens

,

CVS, and

Riteaidall earn top spots amid a year when drugstores played a vital role in administering vaccines to Americans.

Department stores & value fashion

Well-established brands such as

Kohl’sand

Macy’stook first and second place, respectively, in YouGov’s evaluation of department stores and value fashion. The retailers both reported

sales and earnings above expectations in the second quarter of 2021

and carried that momentum into the back-to-school season – arguably the busiest part of the year for both brands next to the holidays.

The rankings also indicate strong demand for off-price retail over the last year, with brands such as

Marshall’s,

Burlington,

Ross, and

NordstromRackearning top spots among other large-format clothing stores like

JCPenney, Nordstrom, Dillard’s and Bloomingdale’s.

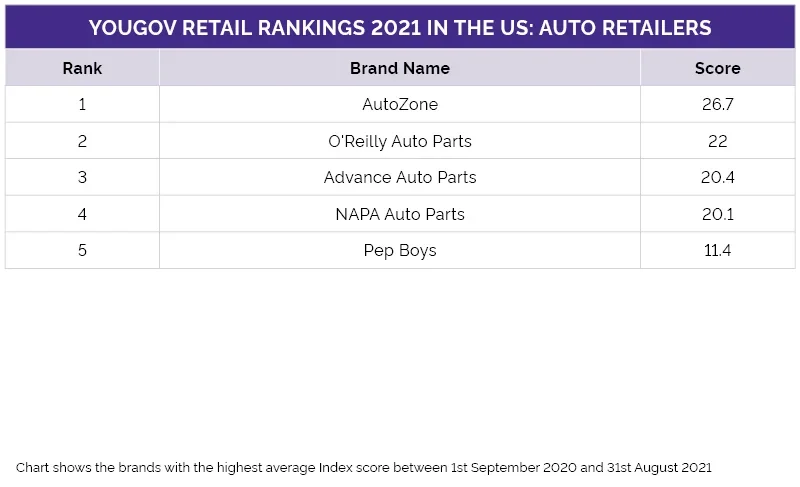

Auto retail

The auto parts retail category seems to be recovering as we emerge from the pandemic and that’s likely to be for several reasons. For one, people are relying on personal transportation in an effort to avoid using public transportation. This coupled with

people buying used cars and hanging on to them longer over the last year

created opportunities for the top performing brands in sector:

AutoZone,

O’ReillyAutoPartsand

AdvanceAutoParts.

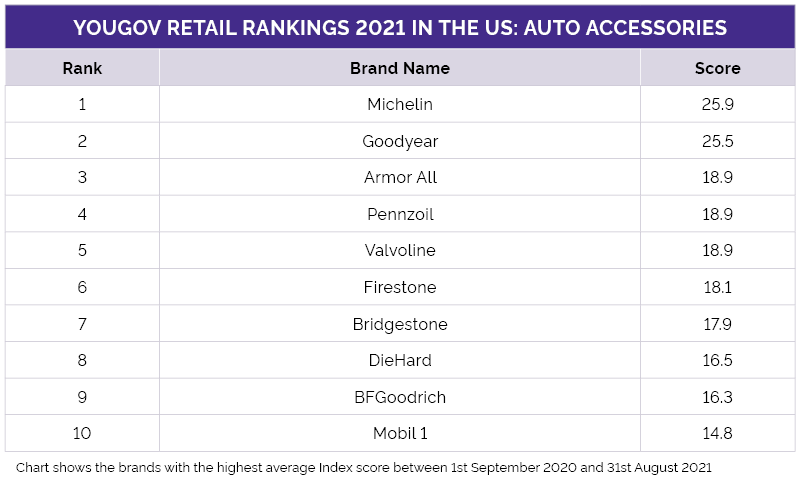

Among auto accessory makers, Michelin and Goodyear are the clear top two performers over the last year. The pandemic impact on Goodyear does not seem to have dampened the brand’s ambition to grow at all and the tyre-maker acquired a major rival – Cooper – a few months ago in an effort to expand its global footprint.

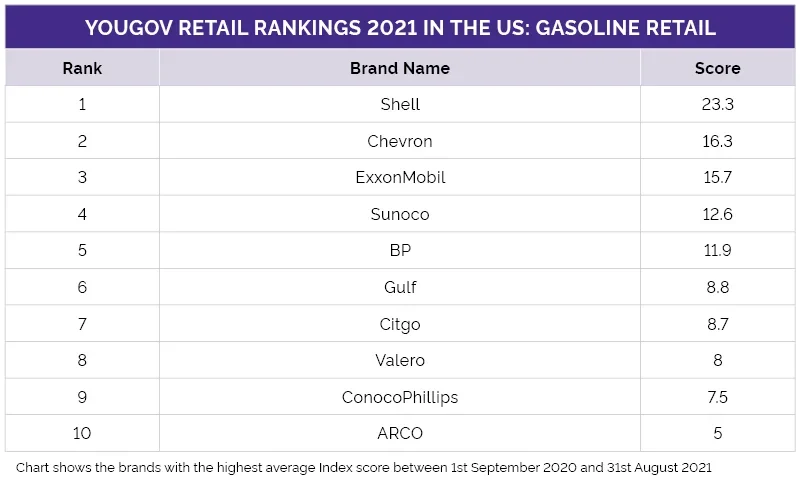

Demand for fuel has increased as summer approached and Americans began traveling and commuting more amid vaccine rollouts and greater consumer confidence. In YouGov’s analysis of the top fuel retailers in the US, Shell, Chevron and ExxonMobil emerge as the top brands over the last year.

Get in touch to see YouGov's full list of Retail Rankings 2021

Methodology: The brands in YouGov Retail Rankings were ranked based on their Index score, which is a measure of overall brand health calculated by taking the average of Impression, Quality, Value, Satisfaction, Recommend and Reputation over a period of 12 months.

The rankings chart shows the brands with the highest average index score between September 1st 2020 until August 31st 2021. The scores are representative of the general population of adults 18+ (some are online representative).

All scores listed have been rounded to a single decimal place; however, we have used additional precision to assign ranks. All brands must have been tracked for at least six months in order to eligible for inclusion in the rankings.