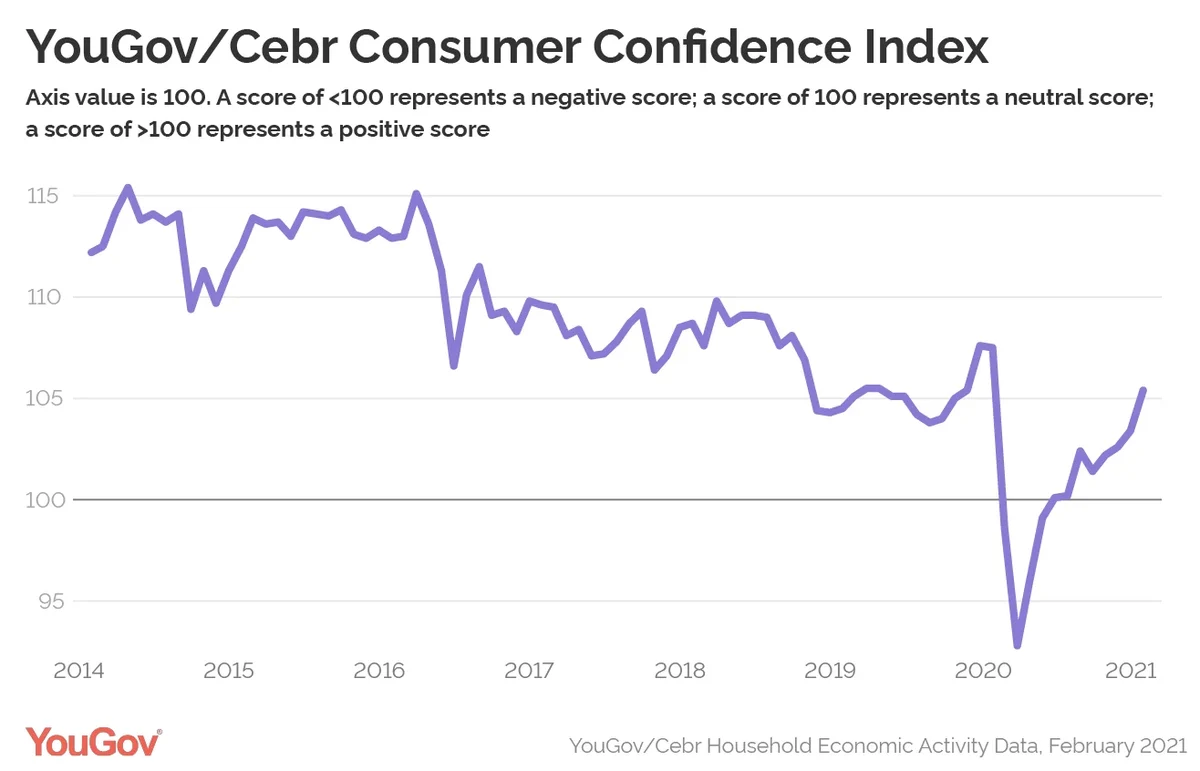

Consumer confidence increases as end of lockdown nears

- Consumer confidence rises to 105.4, the highest level since the pandemic started

- Business activity for next 12 months rises by a record 5.4 points to 124

- Retrospective home value drops but outlook improves

- Household finances improve by 2.1 points but sentiment is still negative

- Job security improves as furlough scheme is extended until the end of September

Consumers continue to feel more confident, according to the latest analysis from YouGov and the Centre for Economics and Business Research (Cebr).

In February, Britain’s consumer confidence score increased by two points to 105.4. Any score above 100 means more consumers are confident than not. Expectations for business activity, house prices and household finances over the next year drive the uptick.

YouGov collects consumer confidence data every day, conducting over 6,000 interviews a month. Respondents answer questions about household finances, property prices, job security and business activity, both over the past 30 days and looking ahead to the next 12 months.

Workers believing activity at their workplace will be higher a year from now provide the largest boost to the underlying metrics, at 5.4. The retrospective measure of business activity, which asks employees if activity went up or down in the past 30 days, also improved 2.7 points and is now in positive territory at 102.5.

The only drop in confidence appears among homeowners estimating how the value of their property changed in the past 30 days, with the measure falling by 1.2 points. The decrease comes as house prices fell for the first time since May, with analysts suggesting it could be an early sign that the market is cooling down. At 108.1, more homeowners than not remain positive, but the measure is still some way off a year ago (115.7).

The outlook for house prices improved by 3.2 points to 116.6, with most owners believing their property will increase in value over the next year. The data was recorded before the Chancellor announced the stamp duty cut will be in place until July and then tapered until October.

Elsewhere, workers felt more secure in their jobs over the past 30 days, as job security improved by 2.4 to 89.7, although this means opinion is still primarily negative. They also feel more positively about the future, with outlook on job security a year from now improving by 0.9 to 112.2.

This came as the Chancellor was expected to announce the extension of the furlough scheme, and UK companies reported their strongest employment intentions since the start of the pandemic.

A higher number of Britons said their money situation improved in the last month than in January, as household finances improved by 2.1 points to 93.1, which is the highest level since before the pandemic.

People also feel more hopeful about what the next year has in store for their finances at 97.2 (+0.7), although a greater proportion still expect their finances to worsen than improve.

Additional research shows that three in ten people (31%) now say the economy will grow a year from now – up from 23% last month. Seven in ten Britons (69%) still take a more pessimistic view, however, and believe the downturn will continue.

Darren Yaxley, Director of Reputation Research at YouGov, said:

"This month’s consumer confidence index indicates that the cautious growth of January has continued into February. February's results saw all but one metric improve on the previous month and the index itself not far off pre-pandemic numbers, reaching the highest point since the coronavirus crisis began.

“January's growth was primarily driven by improvements among consumers’ personal finances, as some were able to save during the national lockdown and outgoings were reduced, and by the resilience of the housing market. However, this month's optimism for business activity over February and for the coming 12 months has been the main drivers for improvement.

“There’s still next month’s Budget by the Chancellor to hurdle, but with the furlough scheme extended, the strength of the vaccine rollout and the recently announced roadmap out of lockdown, it would be surprising not to see these numbers improve even more as we head into the spring."

Kay Neufeld, Head of Forecasting and Thought Leadership at the Centre for Economics and Business Research, said:

“The latest rise in the consumer confidence index underlines the resilience of UK households throughout this third national lockdown. Overall, the economy seems to have adapted to the current restrictions to a somewhat greater degree than previously thought possible, as evidenced by the uptick in the backward-looking business activity indicator. In the labour market, too, we have seen some cautious signs of stabilisation with the number of employee payrolls picking up in both December and January, leading to an increase in both job security indicators this month. With a roadmap for the gradual reopening of the economy now published, we expect the positive consumer sentiment to further aid in the recovery over the coming months.”