From tax exemptions to job creation & agricultural boost, here’s what Indians expect from Budget2021

YouGov’s latest survey explores people’s expectations from the 2021 Union Budget

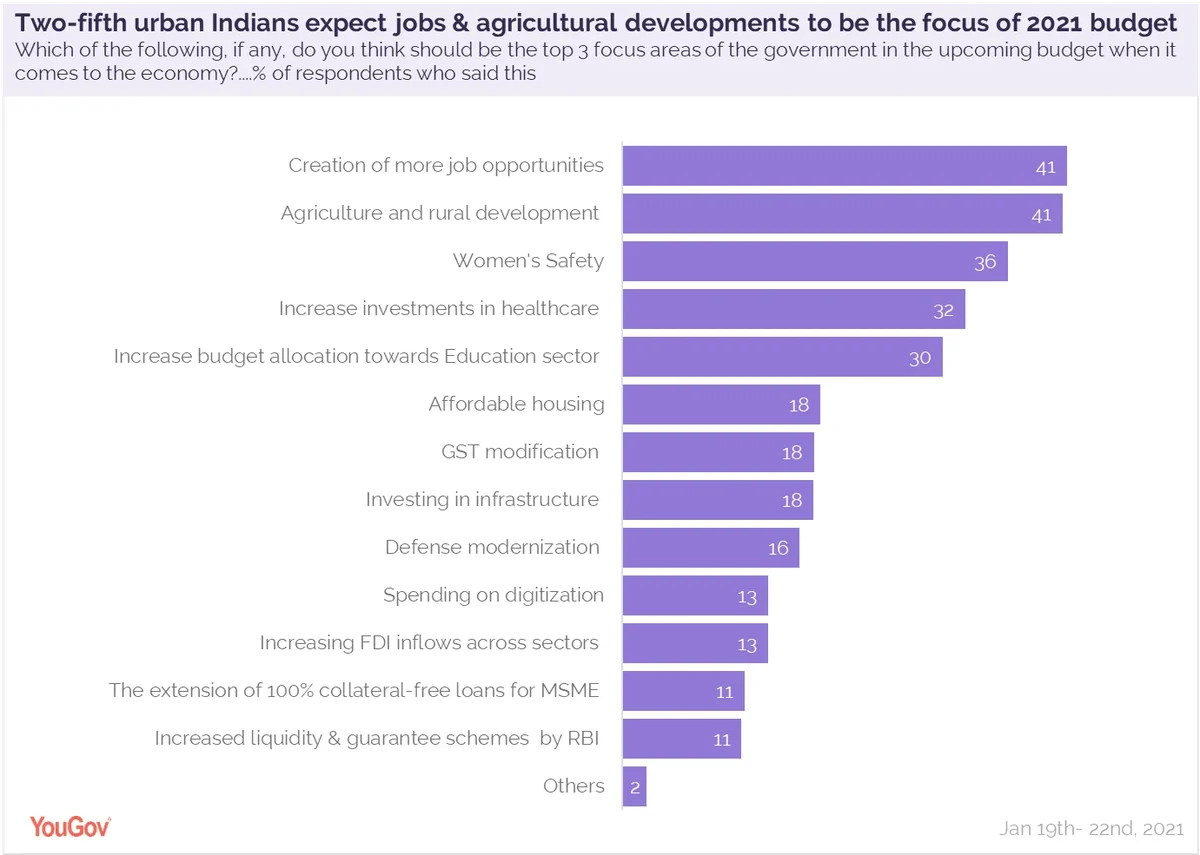

Ahead of the upcoming Union budget, YouGov’s latest survey reveals two in five urban Indians want the government to focus on job creation as well as agricultural & rural development (41% each) in the 2021 budget.

The economic upheaval caused by the pandemic has raised people’s expectations from the government, putting a greater focus on the economy. In comparison to last year’s findings, where women safety was the top concern of people, jobs and agricultural development have taken precedence this year.

However, women safety remains a concern for many, with 36% saying it should be the prime highlight of the forthcoming budget.

The Coronavirus pandemic has put a strong focus on health, with three in ten (32%) respondents saying the government should emphasize on increasing investment in healthcare this year. Just as many (30%) feel there should be an increase in budgetary allocation towards the education sector.

Among the different generations, surprisingly job creation seems to be more of a priority for Gen X (47%) respondents than millennials (37%) and Gen Z (39%).

Similarly, women are more likely than men to say jobs should be a focus area in the budget this year (44% vs 39%)

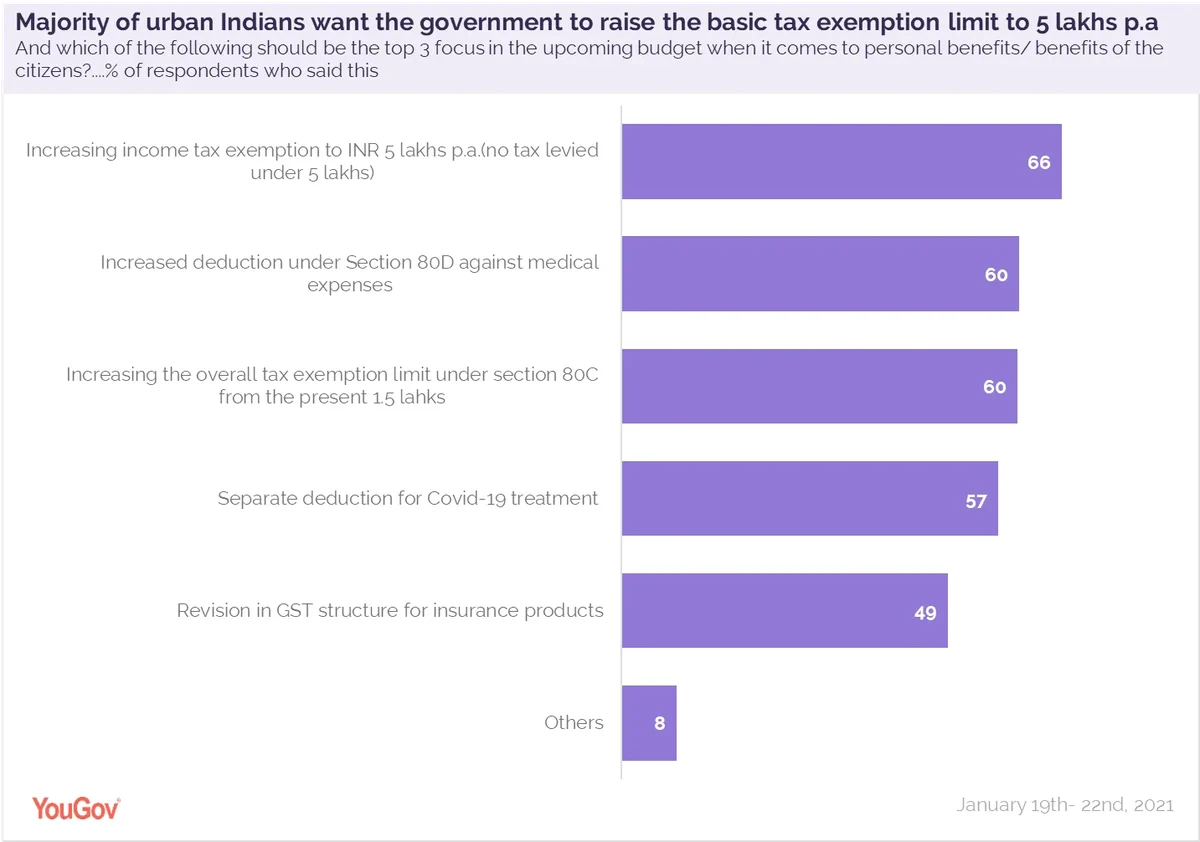

When it comes to the individual expectations of the salaried class in India, two-thirds (66%) want the government to raise basic tax exemption limit for an individual to ₹5 lakh from the current limit.

Three in five (60%) expect the finance minister to increase deductions in medical expenses (under 80D), and just as many (60%) desire a rise in the overall tax exemptions limit under section 80C. People from tier I cities of India are most likely to have these expectations as compared to the other residents of India.

A large proportion (57%) feel Covid treatment-related expenses should be considered a separate item under tax deductions, while half (49%) are hoping for a revision in the GST structure for insurance products.

In order to cover the additional expenses incurred due to the pandemic, the government recently proposed adding a coronavirus cess on individual taxpayers. When asked about this, only three in ten (30%) seem to be in favour of this idea. A vast majority are either opposed to this idea (37%) or unsure about it (33%).

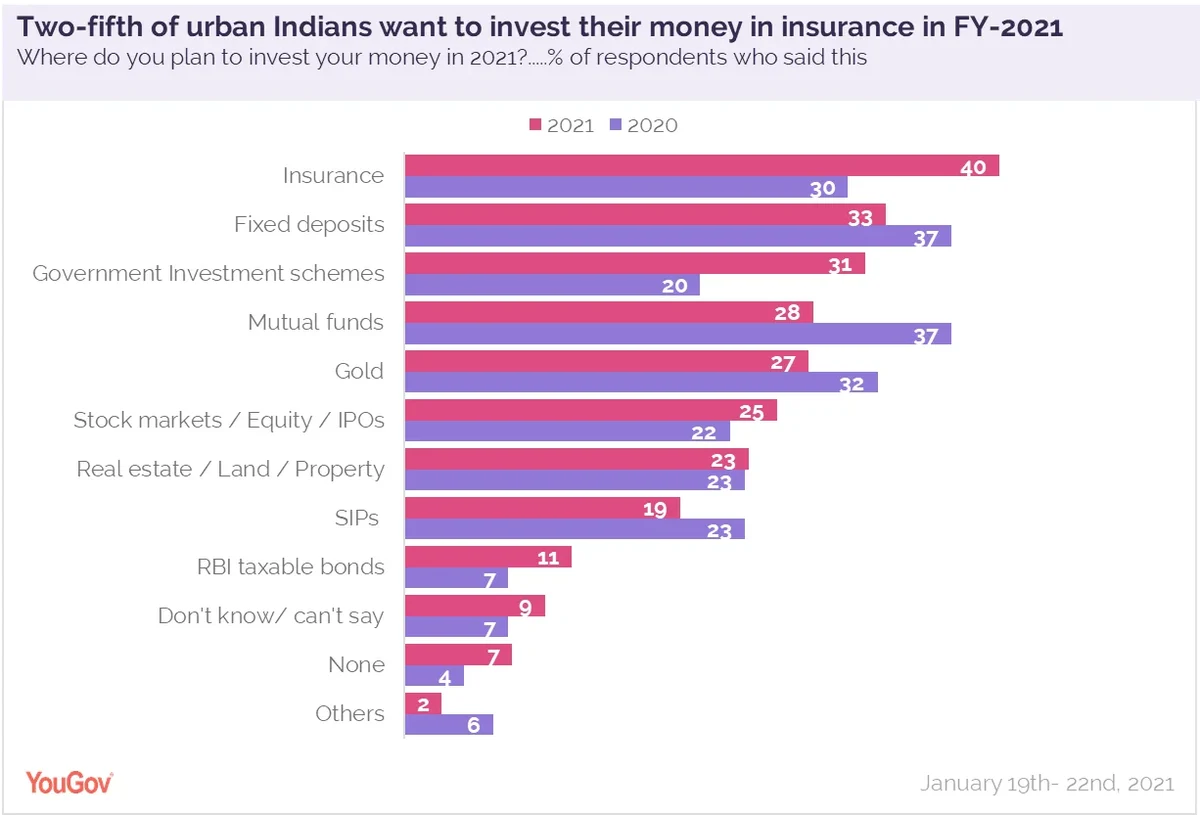

The Covid-19 pandemic has made healthcare a priority and placed health and life insurance at the forefront of investments. The data shows two in five (40%) respondents are likely to invest in insurance (health, life, etc.) in 2021. The figure is much higher than last year’s numbers, where only 30% said they would be investing their money in insurance.

Young adults between 30-39 years are most likely to invest in insurance this year as compared to the rest (at 48%).

After insurance, a third (33%) of urban Indians prefer to remain safe and are likely to invest in fixed deposits in 2021. One in three (31%) are likely to invest in Government saving schemes. Those claiming to invest in mutual funds have reduced over the past year, from 37% in 2020 to 28% in 2021.

Even though the stock market in India has been on a winning streak, expected to show further improvement, people are still not confident and investment in stocks remains a low priority at 25%. Intend to invest in real estate and SIPs also remain low this year- at 23% and 19%, respectively.

YouGov Omnibus data collected online among around 1175 respondents in India between Jan 19th-22nd, 2021 using YouGov’s panel of over 6 million people worldwide. Data is representative of the urban adult population in the country.