Digital banking thrives amidst Covid, likely to grow post the crisis

The growing emphasis on social distancing made online banking the preferred medium for accessing most of the banking services

The Coronavirus outbreak has led to tectonic shifts in individuals’ personal financial situations. With a volatile market and job layoffs, managing finances is a top priority among people. In the current scenario of economic distress, banks have come forward offering financial relief to their customers and businesses.

YouGov’s latest survey reveals a large proportion of urban Indians (58%) believe banks in India are doing an excellent job of helping them during the COVID19 crisis. Very few (12%) believe otherwise and disagree with this view.

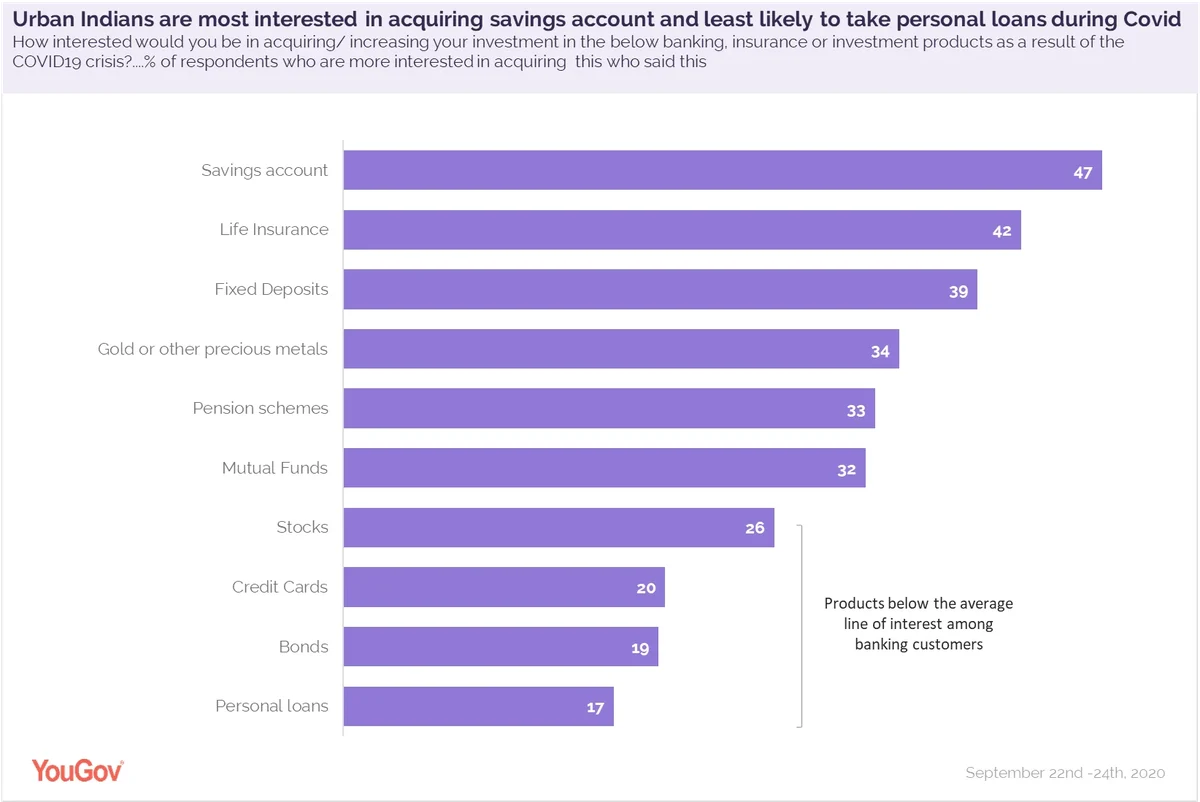

The data shows at present consumers appear to be most interested in acquiring savings accounts (47% saying this) and Life insurance (42%), and least interested in taking personal loans (17%). This demonstrates a clear desire among people to protect current assets and a resistance to accumulating more debt obligations within the current financial environment.

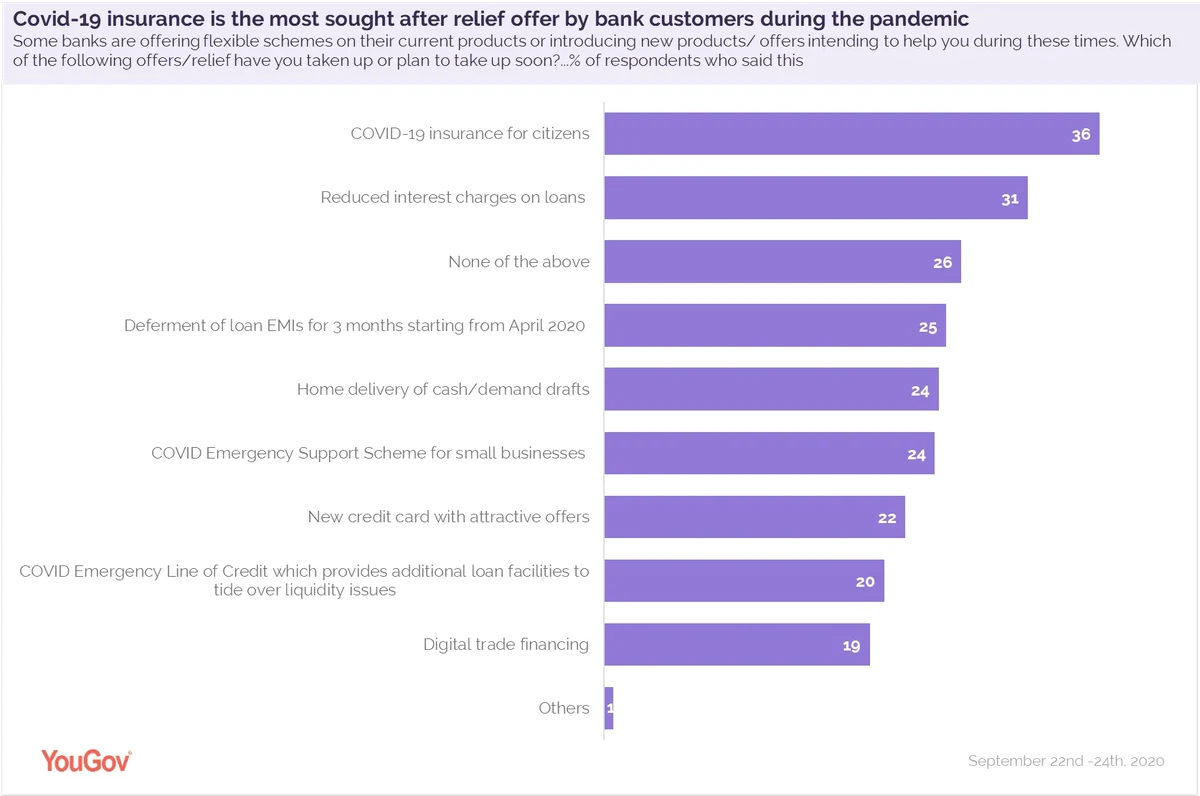

Financial prudence is observed even in terms of interest in bank’s relief offers where the largest proportion of respondents (36%) have either availed or plan to avail Covid-19 insurance for citizens.

Some have sought or are seeking relief concerning debts; such as reduced interest charges on loans (31%) or deferment of EMIS (25%). Young adults aged between 30- 39 years, more likely men than women, seem to be feeling the pinch of debt a bit more than the rest, and are looking out for some relief in this regard.

Comparatively, fewer are looking for offers that could increase their debt, such as new credit card with attractive offers (22%) and COVID Emergency Line of Credit (CELC) for additional loan facilities (20%).

Before Covid-19, two-thirds of respondents (66%) claimed digital banking was their preferred mode of banking and only 22% favoured traditional means of banking.

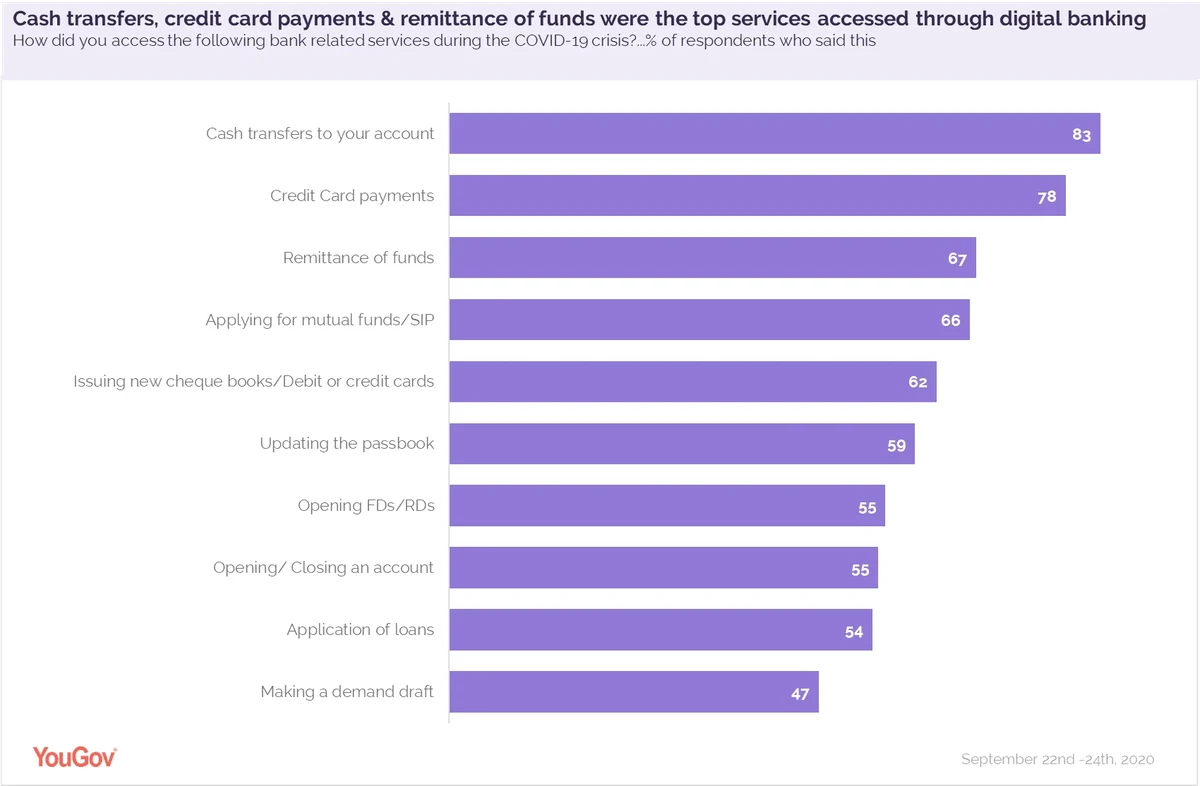

The pandemic has accelerated digital transformation at banks, and ‘online’ emerged as the go to medium for accessing almost all the listed banking services. Online banking was mostly used for cash transfers (83%), credit card payments (78%) and remittance of funds (67%). Private bank users were more likely to use the digital medium than customers of public sector banks.

Among those using digital banking, 71% rated their digital banking experience during Covid-19 as “Excellent” or “Very Good”. It seems like digital banking is likely to grow further as 89% among these respondents claimed they would continue using online medium in the future as well, suggesting financial institutions should remain committed to expanding and developing new banking models post the health crisis as well.

YouGov Omnibus data collected online among 1000 respondents in India between 22nd and 24th September 2020 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country.