Stamp duty cut revives optimism but effect may be short-lived

Two in five property sellers expect the pandemic will force them to sell for less, despite the Government’s stamp duty cut triggering a housing market boom

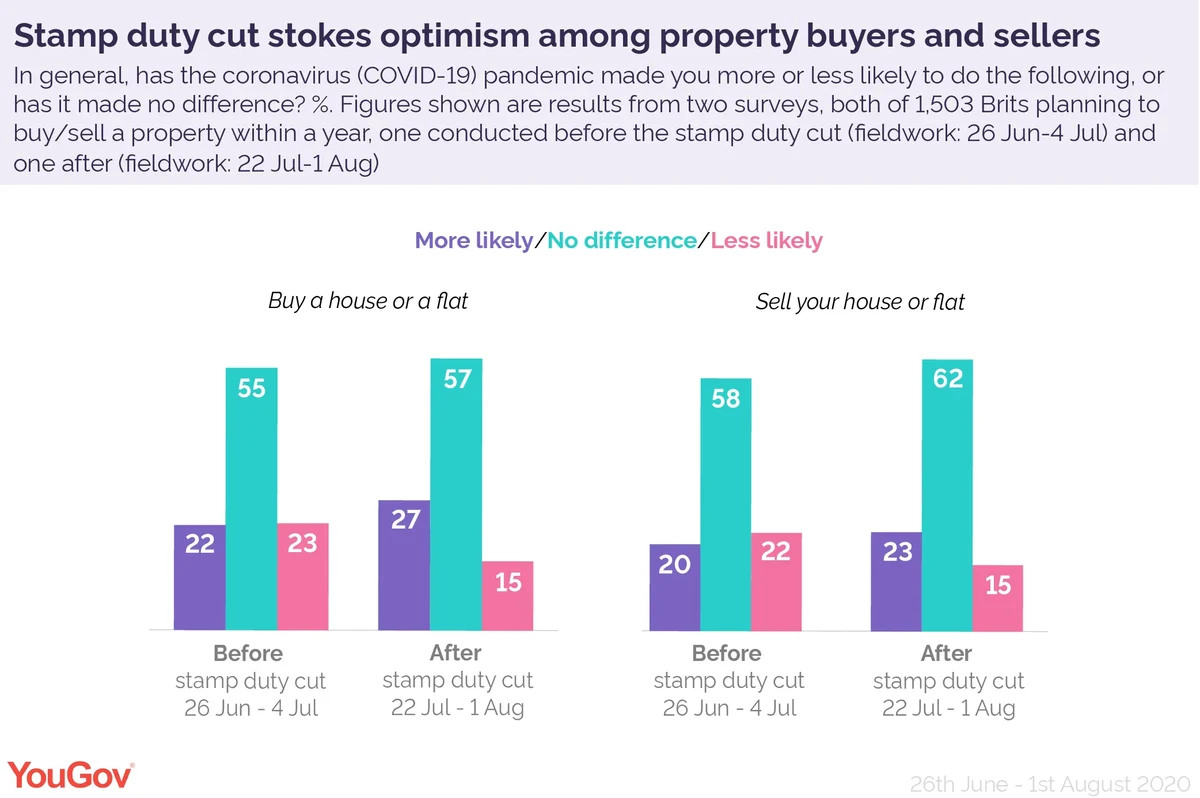

The stamp duty cut, which came into effect on 8 July, has shifted expectations among buyers and sellers. Over a quarter of people planning to buy in the next 12 months (27%) said the pandemic had made them more likely to do so on 1 August – up by five points from 4 July.

In the same period, the number of people planning to buy within a year who said the coronavirus outbreak had made it less likely dropped from 23% to 15%.

The policy, which prompted a £30,000 jump in average prices, also changed sentiment among sellers but not to the same extent. The figure of people planning to sell within a year who said the pandemic had made them less inclined to do so dropped by 7 points to 15% after the stamp duty cut. But unlike among buyers, there was no significant increase in sellers saying the coronavirus crisis had made them more likely to sell.

The majority of buyers (57%) and sellers (62%) still say the pandemic has not had any impact on their plans. This is largely in line with before the stamp duty cut, when 55% of buyers and 58% of sellers said this to be the case.

Stamp duty cut improves sellers’ price expectations but outlook still bleak

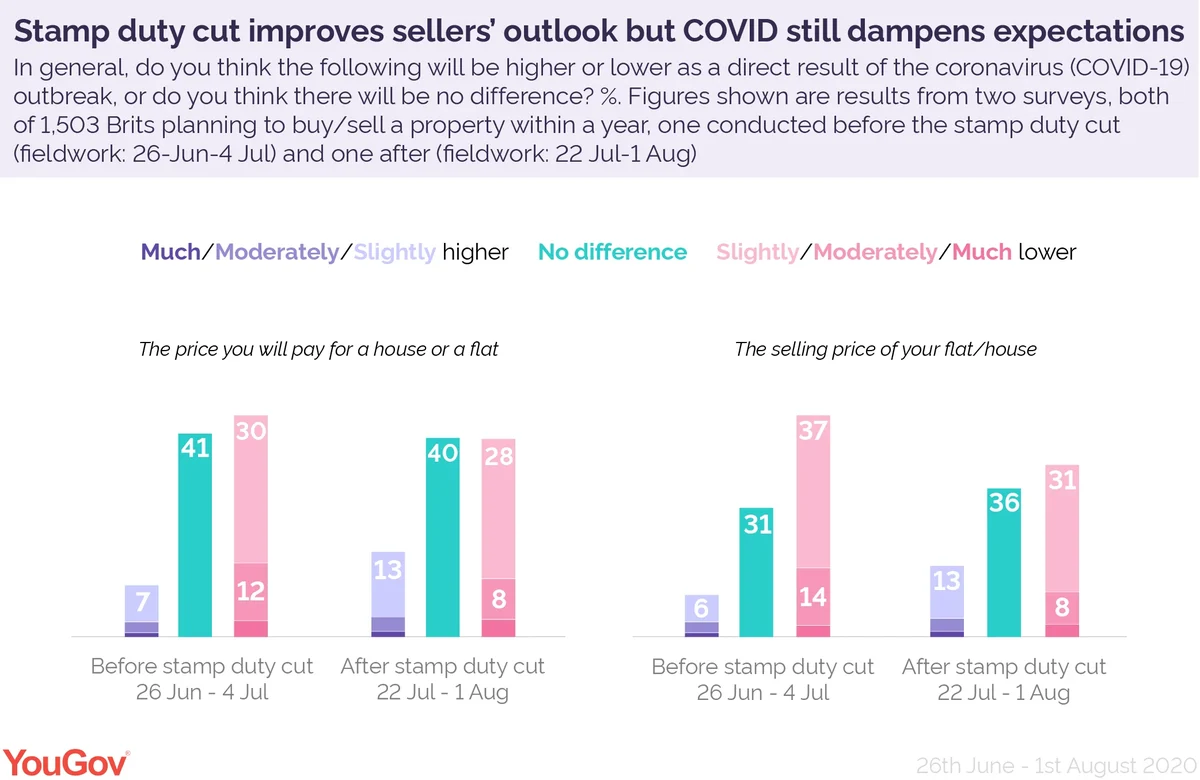

One in six sellers (17%) now say they expect to sell for a higher price as a direct result of the coronavirus outbreak – up by 7 points compared with before the tax cut.

But two in five sellers (42%) still believe the pandemic will force them to settle for less, down from just over half before the policy change (54%).

This means that while the stamp duty change is likely to benefit some sellers, a large proportion still think the coronavirus outbreak will leave them worse off.

Buyers’ expectations have also shifted slightly – but for them the change is not necessarily positive. Two in five (40%) now believe they will pay less because of coronavirus, down from 45% before the stamp duty cut. But one in six (17%) expect to pay more – an increase of seven points.

The tax cut especially benefits people buying and selling more expensive properties. Before the Government announced it, seven in ten sellers in London (71%) expected to lower their price because of the pandemic, while only 6% believed they could get more. But the latest figures show one in five buyers in the capital (19%) now believe they will profit from the pandemic, while the number of people who say they will sell for less has dropped to 55%.

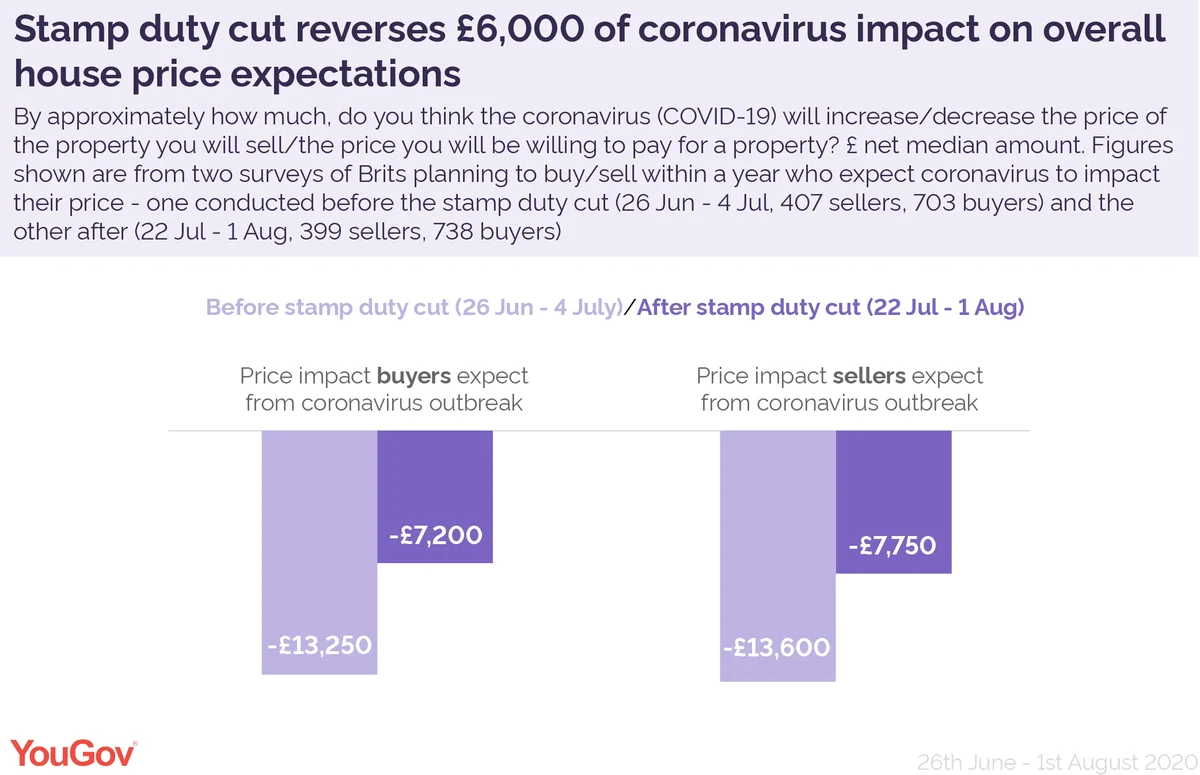

Stamp duty cut reverses £6,000 of coronavirus impact on expectations

All sellers who think the coronavirus crisis will impact the price they can sell their property for now expect to lose a net median amount of -£7,750. This is down from -£13,600 before the stamp duty cut.

Buyers who think the crisis will impact what they pay for a property have very similar expectations and now expect to save a median amount of -£7,200. This is down from -£13,500.

But the real impact is likely to be much more severe once the stamp duty holiday ends in April 2021 and unemployment has gone up – possibly with a No-Deal Brexit thrown into the mix. Think-tank CEBR forecasts a 14% drop in house prices next year – which is well above what buyers and sellers currently expect.