Consumer confidence dip ends quarter of gains

- Consumer confidence dips after a quarter of gains to 99.5, falling back into negative

- Business activity drops 6.1 points to 98.9 from July, ending a quarter of gains

- Job security for August down from an already low 86.4 to 84.4 as the end of furlough approaches

- House value score enjoys 4.2 point increase throughout August, reaching a four-month high of 101.3

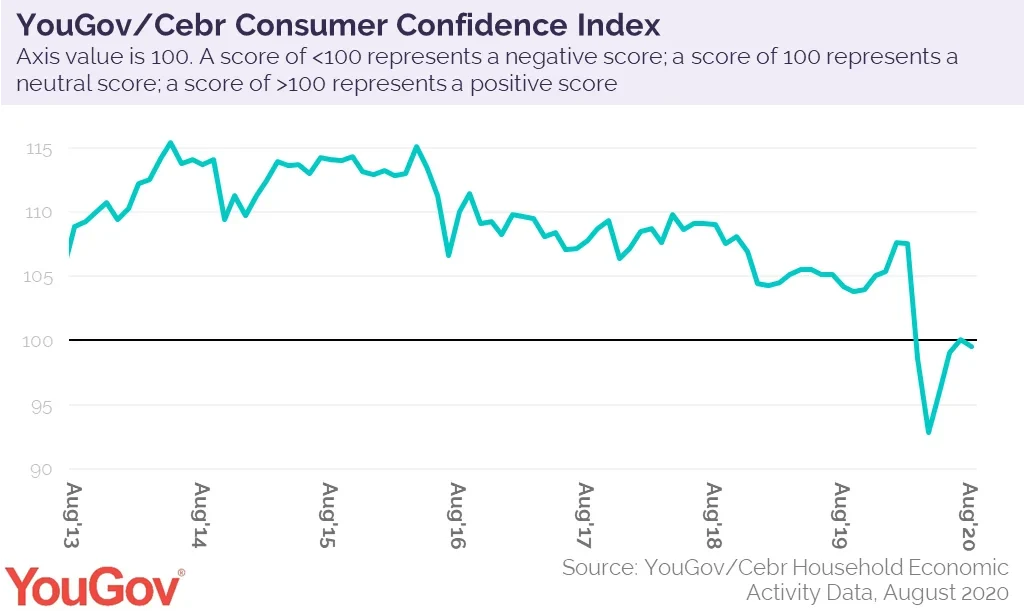

A three-month run of gains in consumer confidence has been brought to an end by a slight dip that has taken sentiment back into negative territory, according to the latest analysis from YouGov and the Centre for Economics and Business Research.

During August the measure slipped from 100.1 to 99.5, with any score below 100 meaning more consumers are unconfident than confident. Britain has been in negative territory since March due to COVID-19 and the unprecedented lockdown, save for a tiny peek above the limit of 100.1 in July.

The metric may have met resistance at the boundary between positive and negative sentiment but is far from catastrophic and does not yet rule out hope of a V-shaped recovery. Indeed, three of the eight constituent metrics that make up the consumer confidence score rose during August.

YouGov collects consumer confidence data every day, conducting over 6,000 interviews a month. Respondents are asked about household finances, property prices, job security and business activity, both over the past 30 days and looking ahead to the next 12 months.

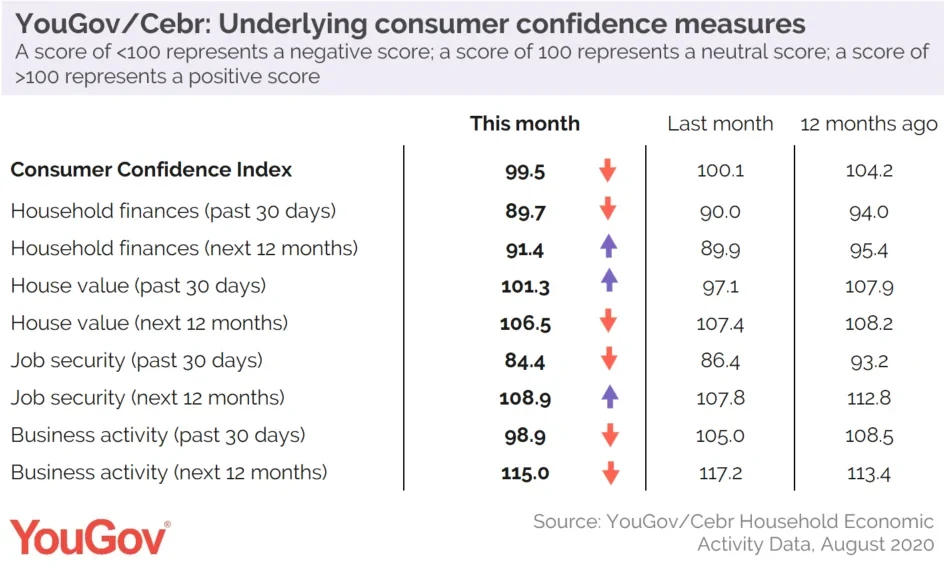

Sentiment around household finances over the past 30 days was down marginally to 89.7 from 90.0 last month showing that people are still feeling the squeeze financially, while expectations for the coming year are up from 89.9 to 91.4. Both these measures are of course still deep in negative territory.

Unstable employment is the likely cause for that squeeze. Job security over the past month was down from an already low 86.4 to 84.4, showing that many still fear the end of the furlough scheme and redundancies by cash-strapped businesses. Those watching the business news will know that there has been a string of high-profile job cuts throughout the high street and manufacturing. However, there is still some longer-term optimism, as the outlook for the coming year is up from 107.8 to 108.9 in August.

Additional research shows that 92% of Britons now expect unemployment rates to rise over the coming year, and only 62% of people believe that it’s unlikely that they themselves will be laid off during the same period.

One area that looks particularly buoyant among the latest results is house prices. Responses showed a rise in sentiment on prices over the past 30 days from 97.1 to 101.3, perhaps fueled by a rush in listings and sales caused by the Chancellor’s stamp duty holiday. This metric has now enjoyed four solid months of gains. Expectations for the coming year are down from 107.4 to 106.5 but remain optimistic. This is the first time both short-term retrospective estimates and longer-term outlooks have been in positive territory since March.

Worryingly, business activity has slipped. Estimates for the last 30 days are down from 105 to 98.9 - a dramatic drop of 6.1 points, and the first drop following a quarter of monthly gains. The outlook for the coming year is still far more positive, despite falling more than two points this month to 115.0, ending a run of four months of gains.

Our research also shows that 80% of Britons believed that the UK would be in either recession or depression within the coming year, between the start of the month and the 11th. Of course, on the 12th of the month it was officially announced that the UK was indeed in recession.

Oliver Rowe, Director of Reputation Research at YouGov, said:

“This dip brings an end to a solid run of gains, but shouldn’t be blown out of proportion. A 0.6 point drop is well within the level of volatility we see even in a stable economic climate. We need to watch next month’s data closely to see where the trend leads.”

Kay Neufeld, Head of Macroeconomics at the Centre for Economics and Business Research, said:

“In August, the Consumer Confidence Index’s three-month summer rally came to an end, with the Index falling by 0.6 points compared to the July reading. Perceptions of current own home values have improved strongly in August, benefitting from a flurry of activity in the housing market and the Chancellor’s stamp duty cut. Forward looking measures of household finances and job security have also picked up, suggesting consumers are more optimistic about the state of the economy in a year’s time. Until then, however, the UK economy must overcome a number of hurdles. Declines in the business activity measure in August might have been compounded by the holiday season, though the approaching end of the furlough scheme will also be on business owners’ minds looking ahead. A strong rebound in economic activity in Q3 is widely expected following the record contraction in the second quarter. How quickly the UK economy will be back on its feet, however, will be decided during a much more uncertain Q4.”