Is the pandemic slowing Monzo’s momentum?

YouGov data reveals that, though there are question marks over its future, the brand has enjoyed year-on-year growth in some key metrics

Monzo has not had the best 2020: mass layoffs, a funding round that came with a 40% drop in valuation and a major shakeup in the boardroom have led to negative media coverage, reputational damage, and massive losses.

The bank has even been forced to admit that disruption from the COVID-19 pandemic has led to “significant doubt” over whether it can continue as a “going concern”.

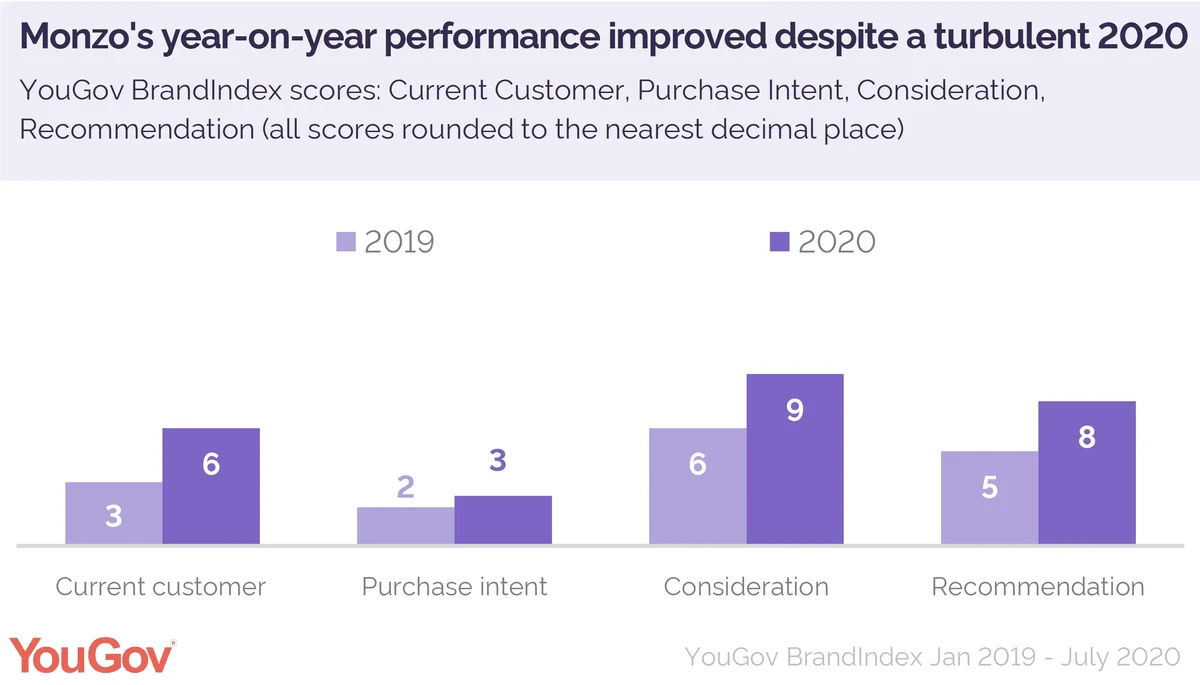

If you were to look at YouGov’s data for Monzo between 2019 and 2020, however, you would see a brand with a steadily growing customer base, rising consideration, and increasingly satisfied users – among other things. There is a clear gap between the bank’s current misfortunes and its success with its target audience.

Monzo’s current customer growth, for example, is trending upwards at a rate that’s much faster than the wider finance sector. Between 2019 and 2020, current customer scores increased from 3.3 to 6.1 – a performance high enough to take it from the 22nd highest performing bank in terms of customer share to the 13th. Reputation also increased by three points year-on-year (from 4.8 to 7.8), as did impressions (from 6.2 to 9.7) – while recommendations went from 4.9 to 7.5. Purchase intent saw a smaller increase (from 2 to 2.6), but by comparing 2019 to 2020, Monzo has generally been on an upwards trajectory.

But despite this success the bank is facing a serious existential threat. Recent headlines have suggested that, despite enjoying wide appeal, Monzo has failed to find a proper business model and is effectively sitting on its customers cash. The COVID-19 crisis may have thrown these problems into sharp relief: a pandemic ultimately does not care about how well a bank is branded or how much customers like its app.