More than half of mutual fund investors in India are thinking of increasing their investments

Although mutual fund penetration still has room to grow, people who’ve been investing for more than 2 years are looking to add to their MF investments while many new millennial investors are still hesitant

More than half of mutual fund investors in India (53%) are planning to add on to their current investments, however, many new investors are still uncertain about it, new YouGov research reveals.

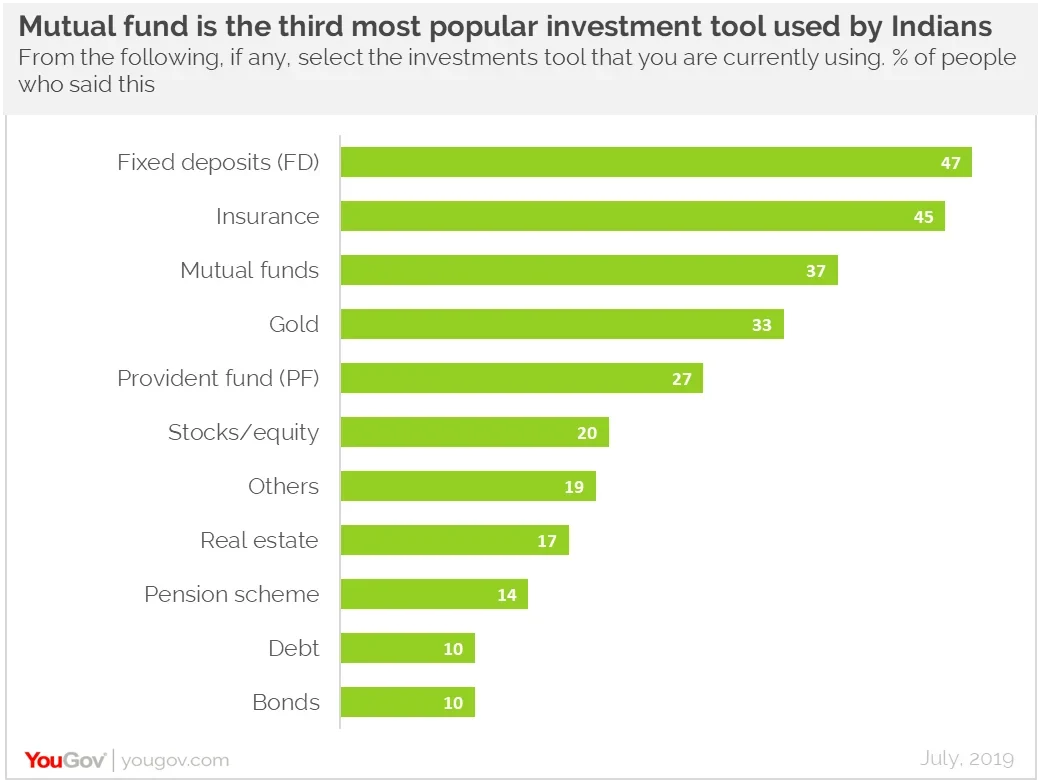

The ‘Mutual Funds Sahi Hai’ campaign aims to create awareness among people about mutual funds and the benefits of investing in it. YouGov surveyed people to know about their investments and to see where do mutual funds stand in their financial ecosystem. The research shows that currently, mutual fund is the third most popular investment tool used by people in India, after fixed deposits (47%) and insurance (45%).

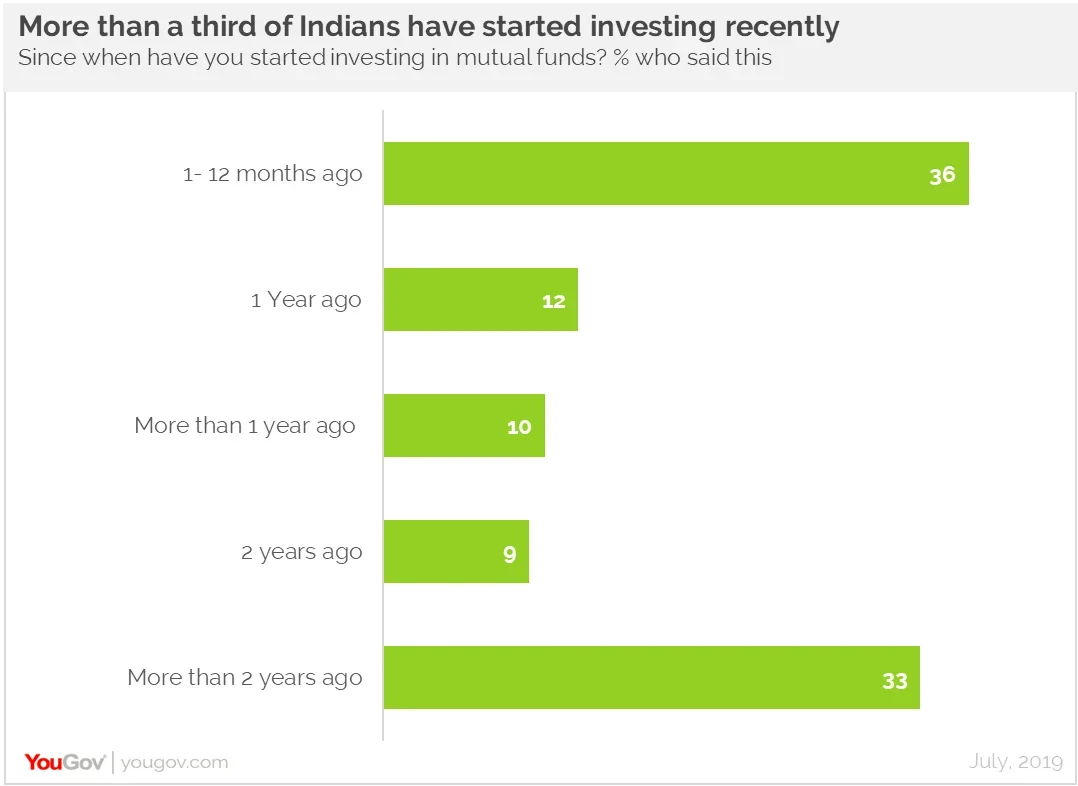

At present, around 37% people said they are investing in mutual funds and the majority of them (88%) agree with the statement – ‘Mutual fund a good investment tool’. From these investors, more than a third (36%) have started investing recently, somewhere within the last year (between 1- 12 months ago) and almost as many (33%) have been investing for longer and started more than two years ago. The new investors’ cohort is dominated by millennials (23- 38 years), while the seasoned investors’ group has a dominance of Generation-X (40-54 years) and Baby boomers (55-73 years).

The data shows that there are differences in the actions and expectations of the new and old investors. At present, one in three (31%) of the people investing in mutual funds said they invest around 6-10% of their salaries in mutual funds. A higher number of new investors said this as compared to those who are old in the game (37% vs 25%).

From the various types of equity funds, it is interesting to note that the new investors are more inclined towards small-cap funds and more than half (56%) have invested their money there. On the other hand, the old investors have fairly distributed their money in all kinds of funds, but most of them (49%) have invested in mid-caps.

Looking at the time period since people started investing, the old investors who have been investing since more than two years are most likely to expect a return of above 10%, with a third of them saying they expect this result. New investors, on the other hand, seem to have lower expectations, a fifth is likely to want return above fixed deposit rate of 6.5% or above EPF rates of 8.65%.

Using monthly SIPs is the most preferred route to make investments (said by 51%), followed by making lump sum investments (25%). A third (30%) are flexible with both the ways. New investors prefer monthly SIPs more than the old investors (62% vs 40%), while old investors appear to be more flexible and 38% of them said they prefer both the ways.

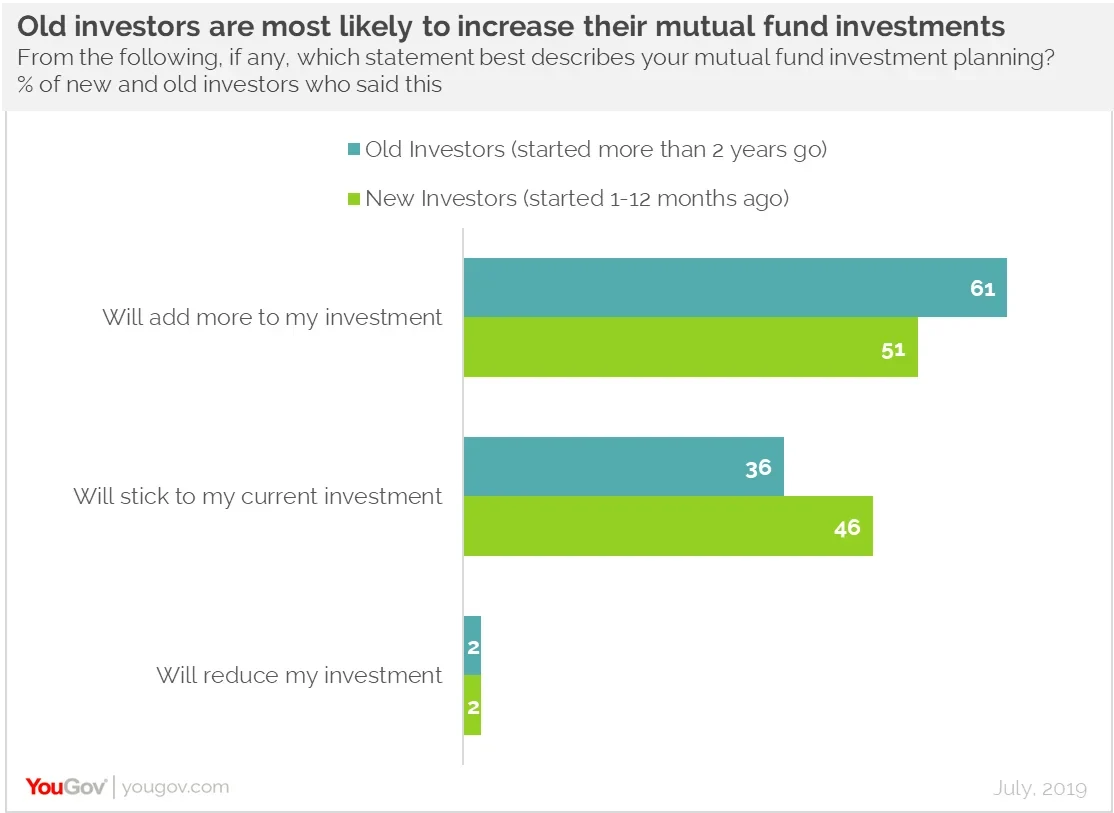

Even though their expectations vary, both sets of investors seem to be happy with the return they are getting on their investments. Three in five of the old investors (62%), as well as the new investors (60%), said their returns are in line with their investments. The ones who have been investing since long are optimistic about their move and are more likely to agree with the statement of increasing their investment (61% vs 51%), while a higher number of new investors plan to play safe and are more likely to stick to their current plan of investment (46% vs 36%).

Speaking about this, Deepa Bhatia, General Manager, YouGov India, said, “Although Indian mutual funds have been seeing strong growth in retail investors in mutual funds, there is still ample room for growth. The data seems to suggest that over time and with enough experience the confidence and comfort of investing grows. It’s interesting that millennials are inclined to invest in small-cap funds even though their return expectations are lower than investors with more experience. This mismatch shows that fund houses and financial planners need to better understand their customers and educate them, especially the new ones and help them choose products in line with their expectations.”

Data collected online by YouGov Profiles among around 1019 respondents in India in July 2019 using YouGov’s panel of over 6 million people worldwide. Data is representative of the adult online population in the country.