Consumer confidence ticks upward for second month running

- Six of eight constituent metrics rose despite lack of Brexit clarity

- Second buoyant month sees confidence rise 0.6 points to 105.1

- But overall metric has only been lower in three months since 2014

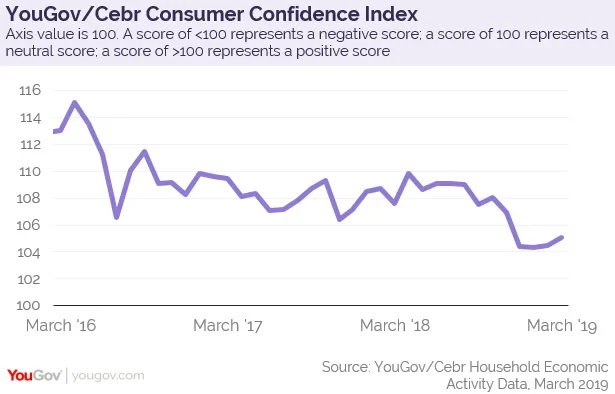

Despite the Brexit deadline drawing ever nearer and the likely outcome being none the clearer, consumer confidence has risen for the second consecutive month - plotting the first buoyant two-month period since the very beginning of last year.

Any score over 100 means more consumers are confident than unconfident, and March’s rise of 0.6 points to 105.1 emphasises the smaller rise seen in February, which was itself the first positive movement in four months.

But it must be pointed out that only three months since the beginning of 2014 have seen a lower consumer confidence score. March's uptick represents a slight inflation in positive sentiment but ultimately does little to reverse the long-term subdued trend.

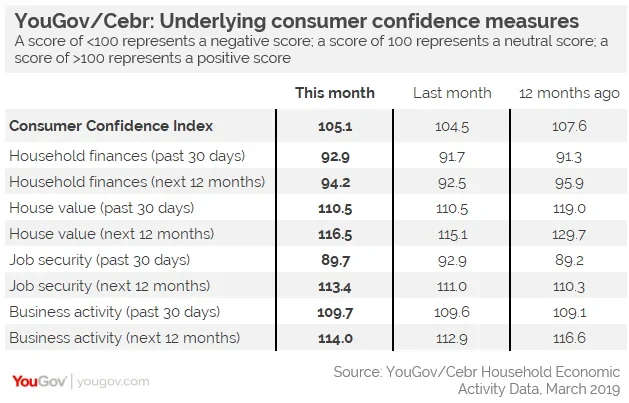

YouGov collects consumer confidence data every day, conducting over 6,000 interviews a month. Respondents are asked about household finances, property prices, job security and business activity, both over the past 30 days and looking ahead to the next 12 months.

Six of the eight constituent metrics were up in March. Household finances over the last month were up 1.2 points to 92.9, and there was an even stronger positive move of 1.7 points in expectations over the coming year to 94.2.

Business activity made a negligible rise from 109.6 last month to 109.7 in March, but over the coming year jumped more than a full point to 114.0.

House values over the last month remained steady at 110.5 – the only of the eight metrics to stay flat month-on-month in March - but outlook for the coming year rose to 116.5

The only fall was job security over the last month, which was down to 89.7, but expectations over the coming year were up to 113.4.

Nina Skero, Director and Head of Macroeconomics at the Centre for Economics and Business Research, said: “This month’s uptick in confidence suggests that consumers are either hopeful that a Brexit breakthrough is within reach or that they have stopped following the daily developments and, in a sense, moved on. Turning away from Brexit uncertainty, there are other reasons for cautious optimism. Wage growth is outstripping inflation by a solid margin, which explains the uptick in both measures of household finances.”