Despite slowdown in the auto market, 2 in 5 people are looking to buy a car

Hyundai is the top car brand being considered by future buyers

Things aren’t looking too bright for the auto sector in India. Amidst high fuel prices, rising insurance costs, and the popularity of ride-hailing apps, there seems to be an industry-wise slowdown in car sales. However, the recent budget announcements such as tax exemption and TDS extension could help in stimulating demand for small cars.

New YouGov survey explores people’s likelihood of buying a new car amidst the tepid demand in the market. It revealed that around 2 in 5 people are looking to buy a car in the next 12 months.

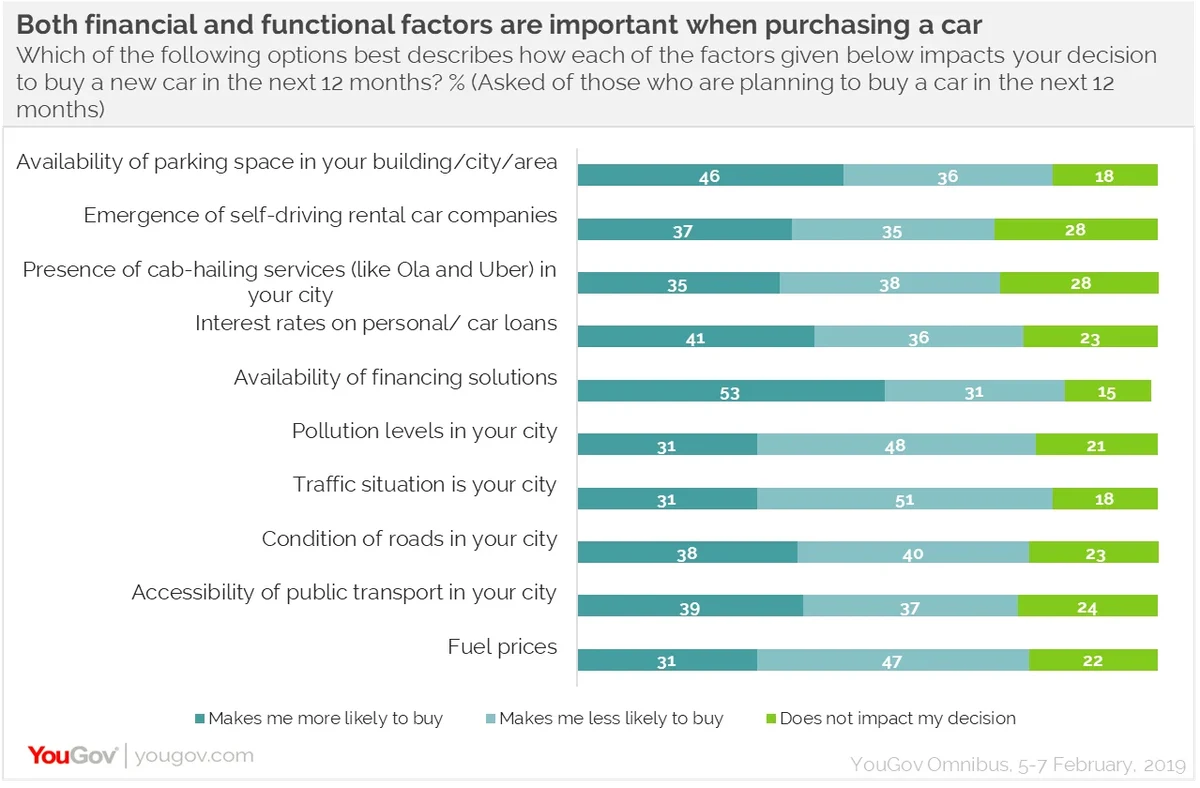

Amongst those who are planning to buy a car, naturally, financial factors such as availability of financing solutions (53%), interest rates on personal/ car loans (41%) and fluctuating fuel prices (31%) came out as the top factors influencing purchase decisions of people. It is interesting to note that apart from these, functional factors such as availability of parking space (46%), accessibility of public transport (39%) and options of self-driving rental cars (37%) are equally important while deciding to buy a car.

With the increasing traffic and pollution levels in metros and big cities, factors such as conditions of roads, pollution levels and traffic situation can lead to an adverse impact on people’s choices. Even presence of cab hailing services impacts the decision of 38% people, who may be less inclined to buy a car in the presence of these services.

Another interesting insight is that 41% from those looking to buy a car are open to considering the idea of buying a second hand car. Expectedly, for 45% of these people the affordability factor is paramount, especially for those residing in tier- 2 cities. But what is remarkable is the influence that the availability of well-maintained pre-owned cars have on the car buying decisions of around a third of people (28%). This is a prime consideration factor for tier-3 city residents, with 42% of them stating so.

We decided to look deeper and see what brands are people considering for their next big buy. Our audience segmentation tool, YouGov Profiles, suggests that Hyundai emerges as the number one brand on the minds of the future buyers. This was followed by Maruti and Honda, who come next in line.

However, the preferences seem to vary across the genders. While Maruti is the top brand considered by men while making a purchase, followed by Toyota and Honda; for women Hyundai is the strongest brand, followed by Honda and Maruti.

Looking further into the attitudes of these people shows that these consumers are brand and quality conscious. As compared to general population, a significantly higher proportion of these people agree with the statements- ‘I have expensive tastes’ (28% vs 21%), ‘I tend to choose premium products’ (32% vs 24%) and ‘I don’t mind spending extra for good quality products’ (42% vs 34%). Brands looking to target them can make a note that they engage quite a lot with TV and Internet adverts and interestingly, their children play an important part in their purchase decisions, with 24% agreeing to the statement that they let their children influence what they buy.

Commenting on this, Deepa Bhatia, General Manager, YouGov India, said, “Contrary to popular belief in the market, our data actually shows that a considerable size of people are looking out to buy a car in the next 12 months. Although Maruti is the entry level preference of most of the first time buyers, our data shows that most people who are considering to buy a new car are looking at Hyundai instead. The attitudes of these people- be it buying premium products or spending extra for good quality, also indicate their likeliness to consider a more premium brand like Hyundai. Brands need to understand the needs and preferences of their consumers in order to make their offering more attractive to them.”

Data collected online by YouGov Omnibus among 1,056 respondents in India between 5th and 7th February, 2019 using YouGov’s panel of an online representation of India.

Additional data by YouGov Profiles, a segmentation and media planning tool that enables agencies and brands to rapidly build audience profiles from thousands of variables from our community database. The tool was launched in India in August 2018, and more than 5,000 responses have been collected so far.