Peroni vs Stella – who is winning the premium beer battle?

The lager market is crowded, with brands battling for market share while trying to differentiate themselves from the competition.

Shifting perceptions of a brand can be a difficult thing to do, as the public can be very wedded to what they associate with a particular company, and this is especially true in the lager market.

New YouGov research carried out as part of its Beer and Cider white paper has explored the premium end of the lager market, and has underlined why Peroni has been able to separate itself from the competition. This is especially true in comparison to one brand that has been able to alter its image over the years, the ‘reassuringly expensive’ Stella Artois.

Looking at the Quality metric among lager brands on YouGov BrandIndex, Peroni and Stella occupy the top two spots (Peroni has a score of +25, Stella has +19). However, the data hints at contrasting fortunes for the two brewing giants, with a warning for the future for Stella. For example, Peroni’s score in 2014 was +22, while Stella’s was higher that it is now (+21).

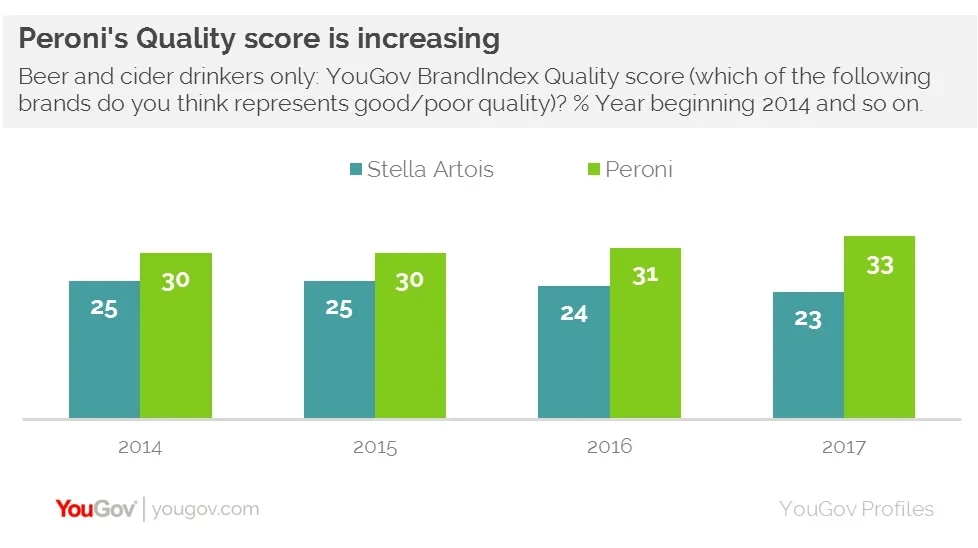

This difference is more pronounced among those that are actually beer drinkers. While in 2014 Stella Artois had a score of +25 and Peroni was on +30, now Peroni’s Quality score has improved to +33 while Stella Artois’s has fallen to +23, almost level-pegging with Kronenbourg (+22).

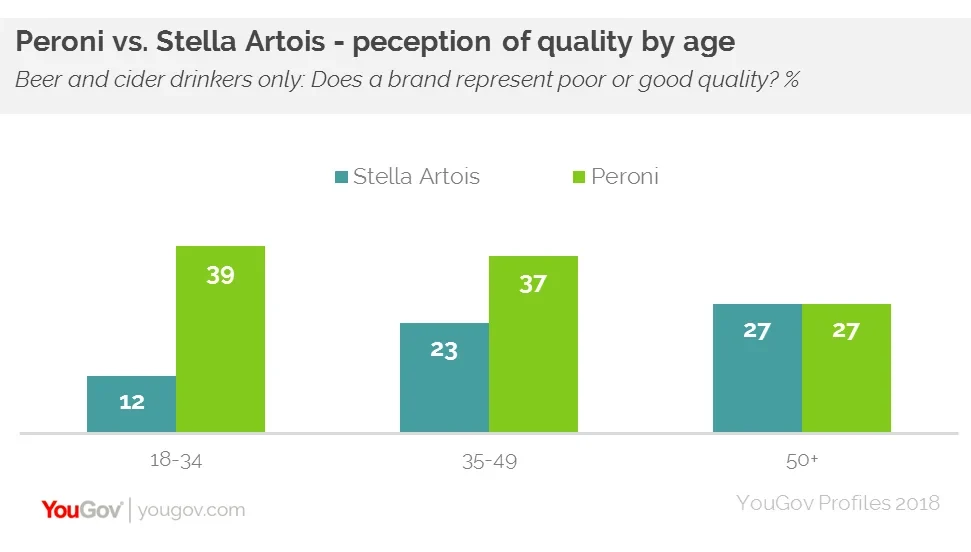

Age plays a major role here too. Peroni’s highest scores come from the youngest group (18-34 year-olds) and gets its lowest scores from the oldest group (those aged 50+). The opposite is true for Stella Artois, where it performs relatively poorly among younger drinkers but much better among the older group. For example, among 18-34s Stella’s Quality score is +39, against Stella’s 13%. Looking at those aged 50+, it’s a tie on +27.

It would be too simplistic to associate the disparity between the two brands with price points – clever marketing has obviously played its part too. While Peroni is more expensive, it has clearly managed to persuade those in the younger age group that it is more upmarket, and represents better quality. This may well be a problem for Stella as these consumers grow older – especially if their tastes, and perceptions, don’t change.

Image Getty